Treasury yields have been ticking higher after a volatile week in the stock market, making short duration and inflation protection a must for current or would-be fixed income investors.

“Bond yields have been on a mini-surge this week,” a Barron’s article said. “The current yield on the 10-year Treasury suggests it can rise even more in the short-term, making cyclical stocks look like good bets.”

“The 10-year yield rose to 1.46% on Friday from a low point of 1.3% this week,” the article added. “It passed 1.38% this week, a key level of support at which buyers had tended to step in for the past few months. Bond prices and yields move inversely.”

This means that ETFs can address future rate increases by the Federal Reserve via Treasury inflation-protected securities (TIPS). Vanguard has an option that not only includes TIPS, but also decreases duration in order to stave off interest rate risk.

Move With Inflation Using TIPs

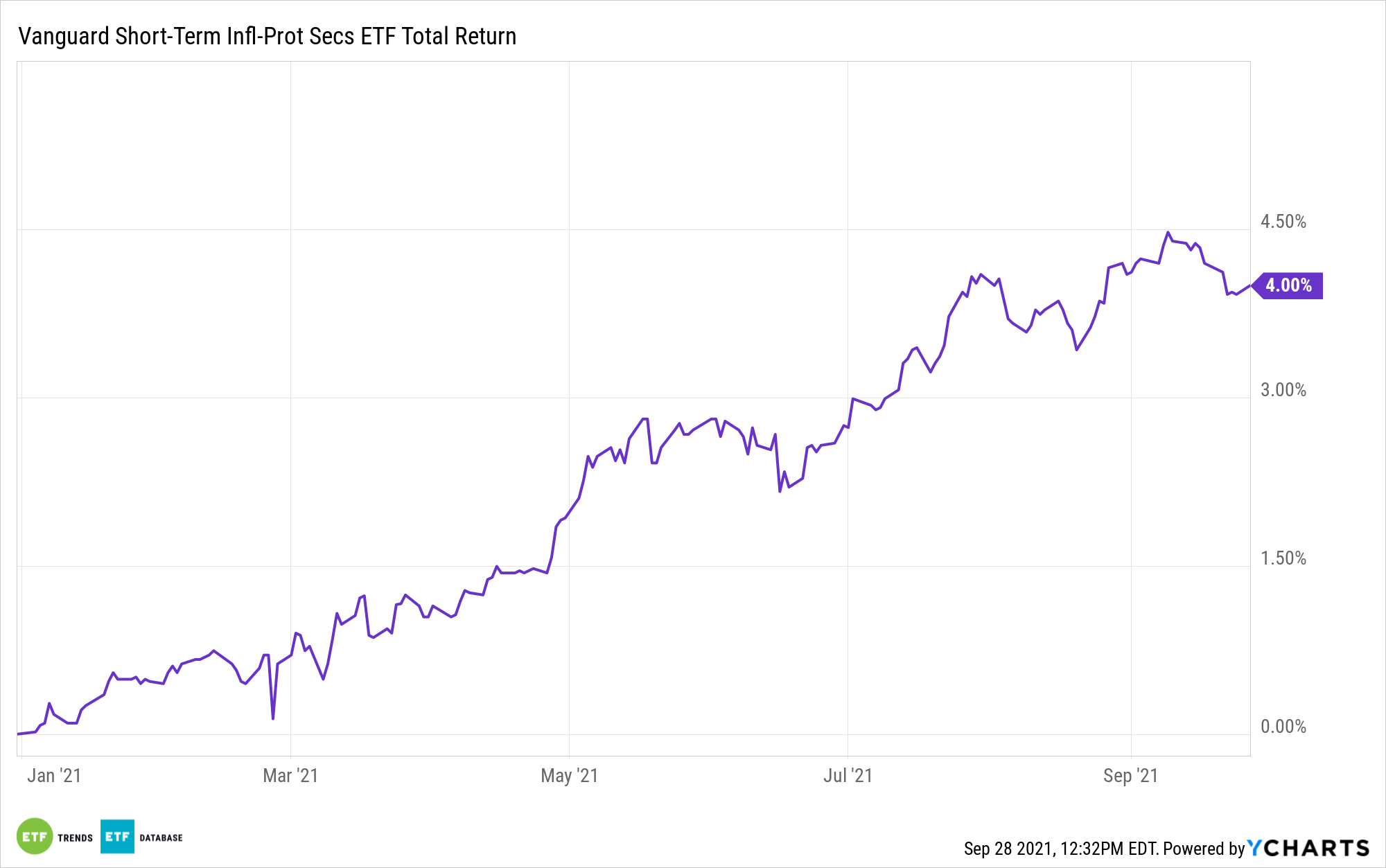

One way to protect bond income from rate increases is to move with them. This can be done using ETFs like the Vanguard Short-Term Inflation-Protected Securities Index Fund ETF Shares (VTIP).

VTIP seeks to track the Bloomberg U.S. Treasury Inflation-Protected Securities (TIPS) 0-5 Year Index performance. The index is a market capitalization-weighted index that includes all inflation-protected public obligations issued by the U.S. Treasury with remaining maturities of less than five years.

The manager attempts to replicate the target index by investing all, or substantially all, of its assets in the securities that make up the index, holding each security in approximately the same proportion as its weighting in the index.

- Seeks to track an index that measures the performance of inflation-protected public obligations of the U.S. Treasury that have a remaining maturity of less than five years.

- Is designed to generate returns more closely correlated with realized inflation over the near term and offer investors the potential for less volatility of returns relative to a longer-duration TIPS fund.

- Can have less real interest rate risk and lower total returns relative to a longer-duration TIPS fund, given its short duration.

- Invests in bonds backed by the full faith and credit of the federal government and whose principal is adjusted semi-annually based on inflation.

- Can provide protection from inflationary surprises or “unexpected inflation.”

For more news, information, and strategy, visit the Fixed Income Channel.