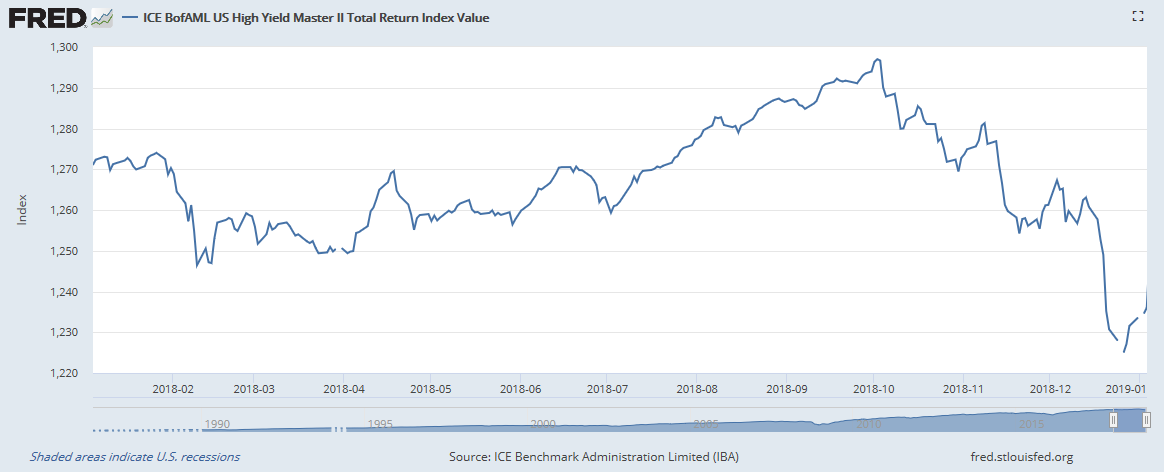

As stocks continue to build forward momentum after a tumultuous December, it’s been high-yield bonds going the opposite direction with the ICE BofAML US High Yield Master II Total Return Index resuming its downward trajectory. Investors looking to capitalize on the weakness in high yield can look to the ProShares Short High Yield (NYSEArca: SJB).

It’s a clear sign that the risk-off sentiment that started in October is affecting the high-yield sector that was flying high during the midst of the extended bull run in the capital markets–a time when investors were willing to forego the extra risk in order to achieve the higher yields.

With respect to their 200-day moving averages, SJB is tracking above this level while high-yield bond ETFs like the SPDR Bloomberg Barclays High Yield Bond ETF (NYSEArca: JNK), iShares iBoxx $ High Yield Corp Bd ETF (NYSEArca: HYG) and the Invesco Senior Loan ETF (NYSEArca: BKLN) are languishing in the current risk-off environment.

Tide Turning?

The tide could turn for high-yield bond ETFs, especially now that the Federal Reserve is sounding more accommodative with respect to interest rate policy. Following the fourth and final rate hike of 2018, the central bank mentioned paring down its rate hikes to two rather the its original forecast of three.