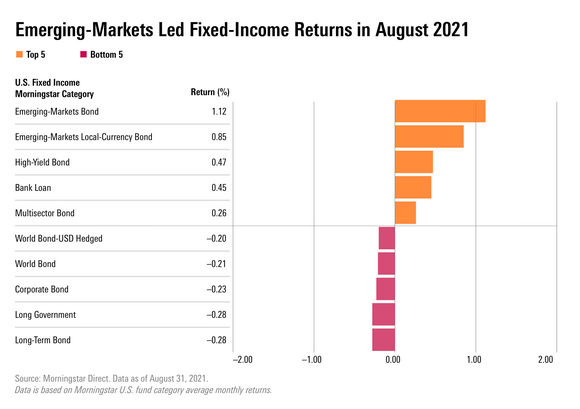

Extracting more yield in the current environment requires looking at other opportunities like emerging markets (EM), which outperformed their bond peers during the month of August.

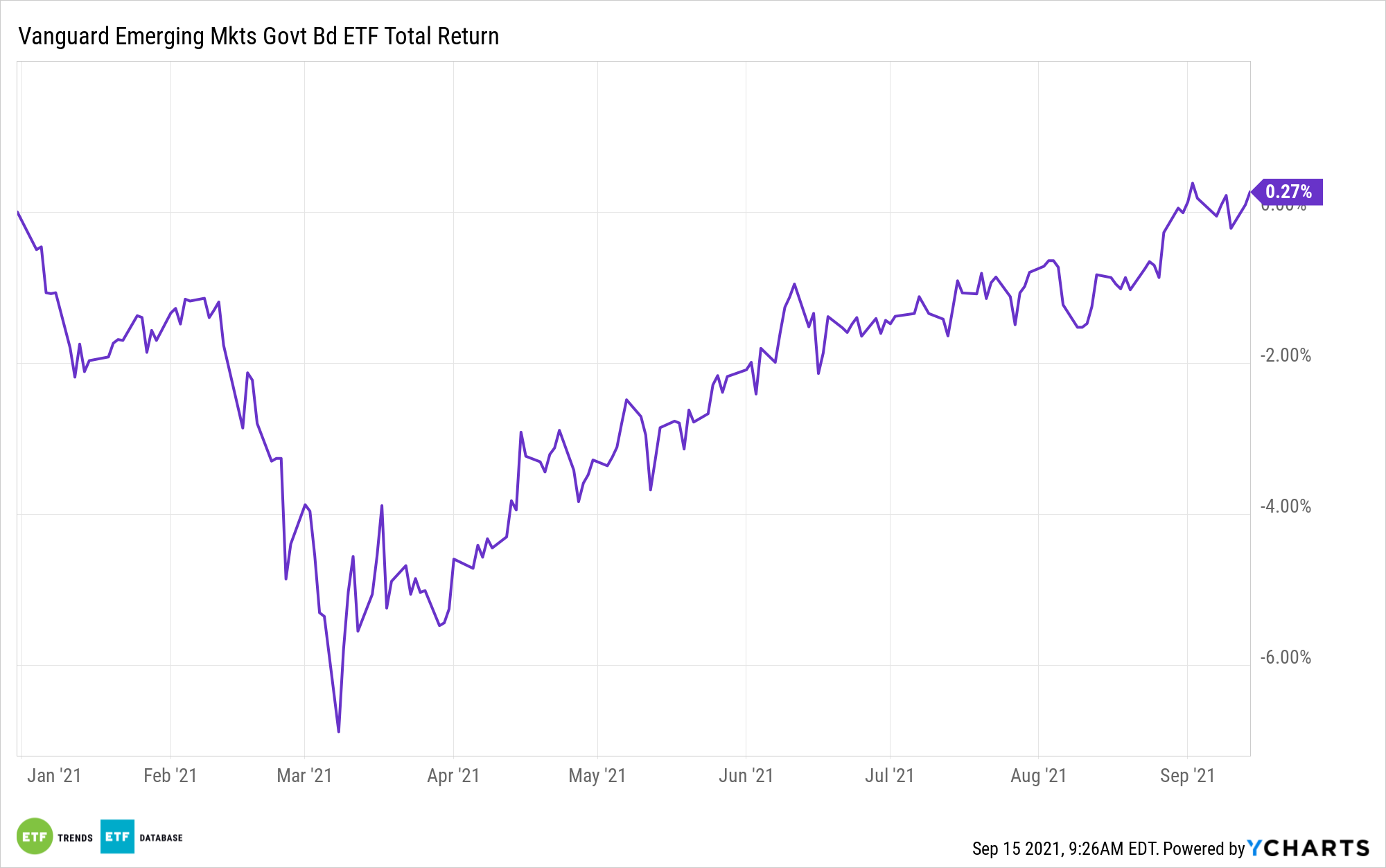

Given that outperformance, the time is right to look at ETFs like the Vanguard Emerging Markets Government Bond Index Fund ETF Shares (VWOB). Whether investors are looking for yield or diversification of their bond portfolios, VWOB is a prime option to consider.

“As interest rates reach new lows, U.S. government and even corporate bond yields look bleak,” wrote Lauren Solberg in a Morningstar article. “To compensate, income-seeking investors are moving their money into riskier, higher-yielding debt–such as emerging-markets bonds. Among Morningstar fixed-income categories for funds, the emerging-markets-bond category was the best-performing in August, making it the monthly leader for the first time since June 2020.”

VWOB seeks to track the performance of a benchmark index that measures the investment return of U.S. dollar-denominated bonds issued by governments and government-related issuers in emerging market countries. The fund employs an indexing investment approach designed to track the performance of the Bloomberg Barclays USD Emerging Markets Government RIC Capped Index.

All of the fund’s investments will be selected through the sampling process, and under normal circumstances at least 80% of the fund’s assets will be invested in bonds included in the index. The fund comes with a 0.28% expense ratio.

While emerging markets have been hit especially hard during the pandemic, their recovery is well underway. So far this year, EM bonds are also making a vaunted comeback.

“After a stretch of losses, emerging-markets bonds edged into positive territory for the year to date,” Solberg wrote. “The Morningstar Emerging Markets Bond Index has been steadily picking up speed since hitting a low point in April 2021, outpacing the Morningstar Global Core Bond Index (made up of developed markets and investment-grade debt) by an increasingly wide margin.”

Be Wary of the Risk

Greater reward in the form of higher yield doesn’t come without risks. Emerging markets in particular can bring their own unique set of risks that investors should be wary of prior to simply diving into EM debt.

“Geopolitics, changing regulations, and macroeconomic factors can all play into this risk, adding volatility to both corporate and sovereign bonds from issuers in emerging markets,” Solberg wrote. “During the coronavirus pandemic, a stressful time for markets across the world, five emerging-markets countries defaulted on their debt payments (more defaults in one year than any other single year in history). And when emerging-markets bonds are denominated in their local currencies as opposed to hard currencies, additional currency risk is layered on top.”

For more news, information, and strategy, visit the Fixed Income Channel.