Investors looking to inject stability into their fixed-income portfolios, particularly as Treasury yields continue to rise and depress prices, may want to consider adding municipal bonds especially when volatility has been racking both the stock and bond markets as of late.

Moody’s Investors Service’s released an annual report, US Municipal Bond Defaults and Recoveries, 1970-2017, highlighting the municipal bond market through 2017. One notable to extrapolate from the 100-page report was that stability is prevalent in the municipal bond market since the propensity for these debt issues to default is rare.

Based on the report’s findings, the five-year all-rated cumulative default rate (CDR) on municipal bonds from 1970 to 2017 was a scant 0.09%. Compare this to a CDR of 6.7% for global corporate bonds within the same timeframe and it shows just how stable municipal bonds can be.

Furthermore, defaults on municipal bonds were rare even during time periods of dire financial straits. The reason is state and local governments have delinked revenues and expenditures, which allow municipalities to defer debt and delay a crisis.

In some instances, municipal bond debtors can even obtain additional financing whereas corporate bond debtors must foot the bill when the debt is due.

Related: J.P. Morgan Launches First Ultra-Short Muni Bond ETF

$3.8 Trillion Muni Bond Market Pie

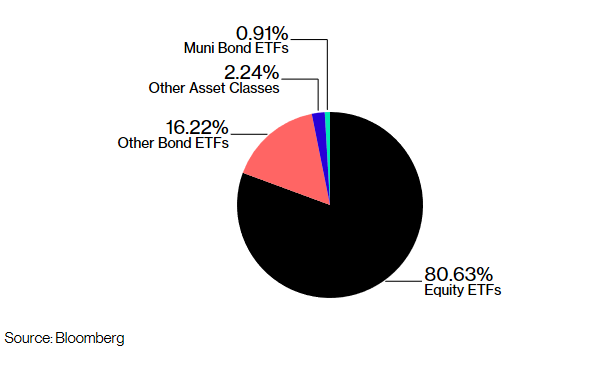

The U.S. municipal bond market represents a $3.8 trillion pie and smart beta exchange-traded fund (ETF) strategies are looking for a slice, such as Columbia Threadneedle Investments’ Multi-Sector Municipal Income ETF (NYSEArca: MUST). Columbia already boasts an ETF roster that utilizes smart beta strategies for emerging markets, equity income and fixed income. However, as shown in the pie chart below, the municipal bond market has been relatively untouched.

![]()

“Today’s municipal market is comprised of nearly $4 trillion in assets spread out among more than one million debt offerings from 80,000 issuers,” Catherine Stienstra, head of municipal bond investments at Columbia Threadneedle Investments and serves as Lead Portfolio Manager of MUST, said in a note. “In the muni space, buying individual bonds or purchasing a debt-weighted benchmarked product doesn’t give investors the diversification they need, nor the ability to manage credit risk transparently and efficiently. We created MUST with the goal of simplifying investors’ municipal bond exposure without compromising their investment objectives.”