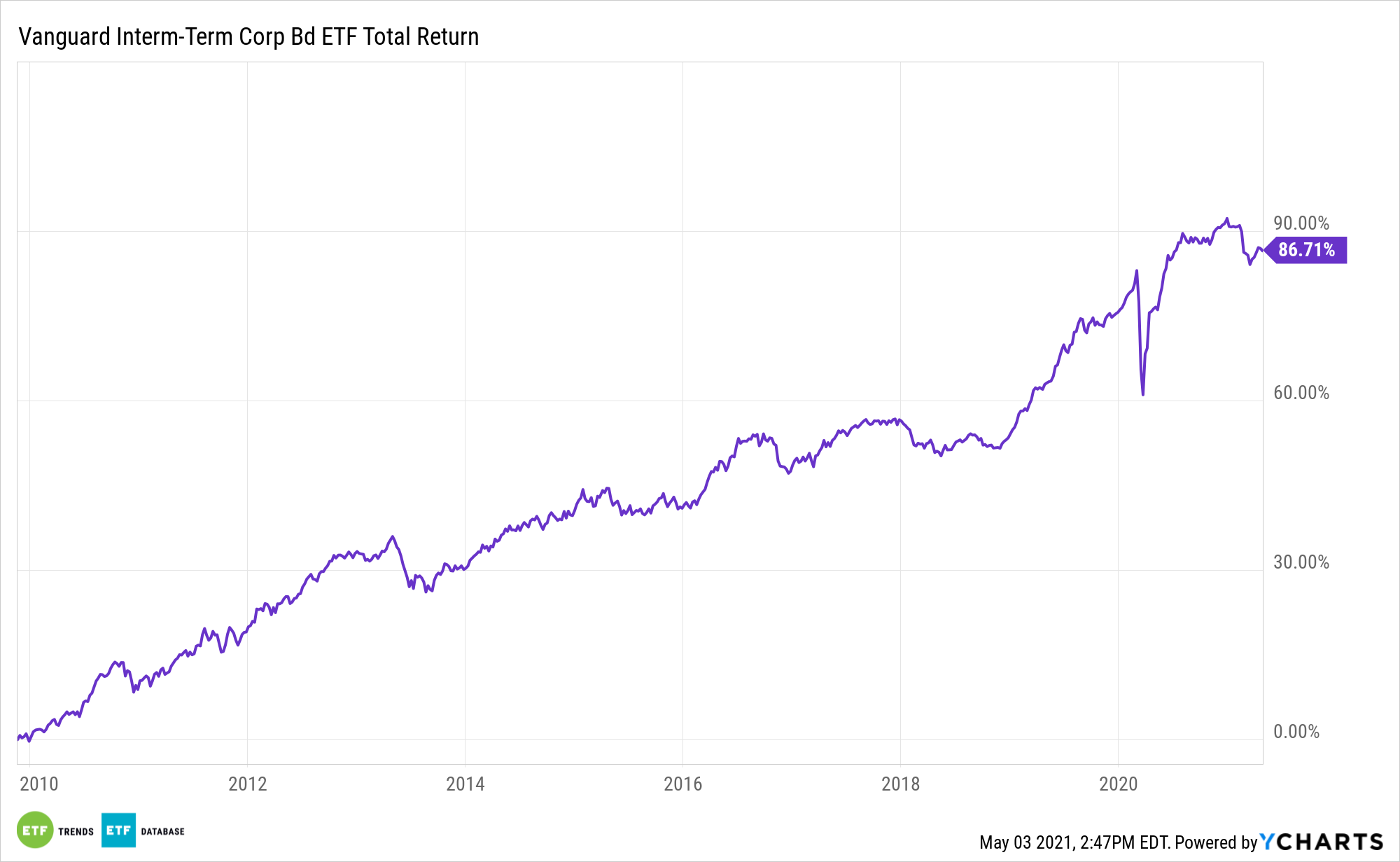

Five Vanguard bond funds have enjoyed significant 2021 inflows. The five funds give fixed income investors a smorgasbord of options, including exposure to aggregate bonds, international fare, and the short side of the yield curve.

U.S. and International Exposure

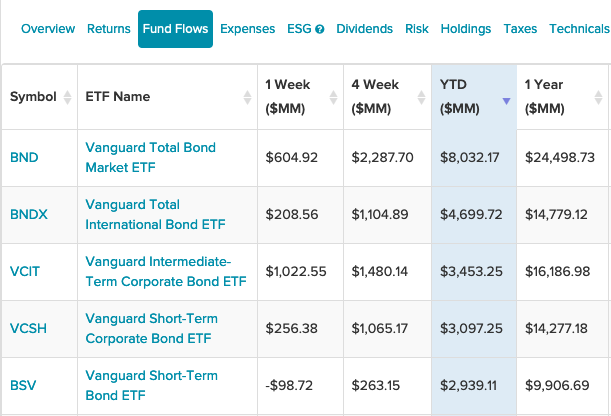

To get complete bond exposure domestically, investors can opt for the Vanguard Total Bond Market Index Fund ETF Shares (BND). BND seeks the performance of Bloomberg Barclays U.S. Aggregate Float Adjusted Index. The Bloomberg Barclays U.S. Aggregate Float Adjusted Index represents a wide spectrum of public, investment-grade, taxable, fixed income securities in the United States, including government, corporate, and international dollar-denominated bonds, as well as mortgage-backed and asset-backed securities, all with maturities of more than 1 year.

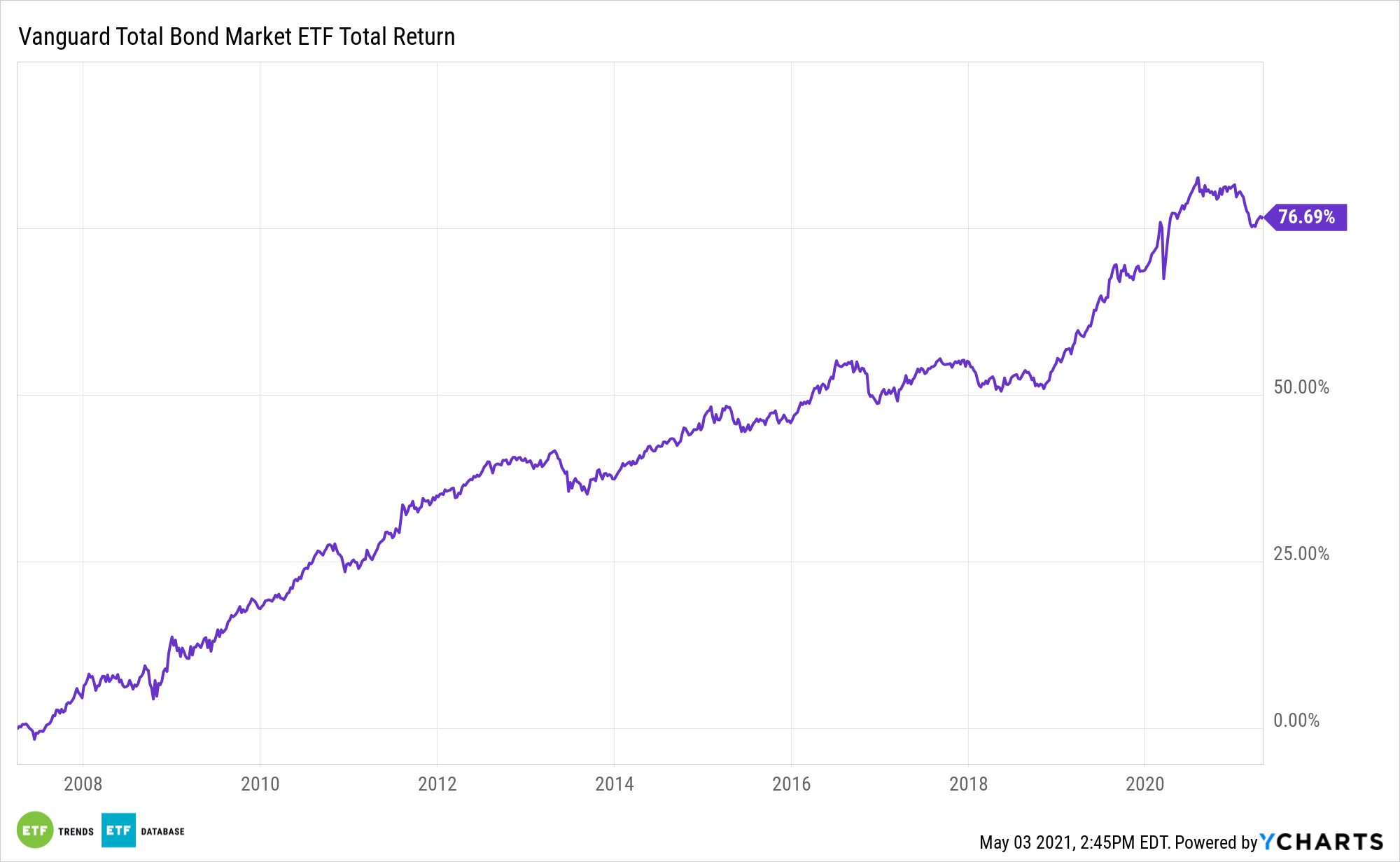

Fixed income investors willing to venture abroad can opt for the Vanguard Total International Bond Index Fund ETF Shares (BNDX). BNDX seeks to track the performance of a benchmark index that measures the investment return of non-U.S. dollar-denominated investment-grade bonds.

BNDX employs an indexing investment approach designed to track the performance of the Bloomberg Barclays Global Aggregate ex-USD Float Adjusted RIC Capped Index (USD Hedged). This index provides a broad-based measure of the global, investment-grade, fixed-rate debt markets.

Corporate and Short-Term Exposure

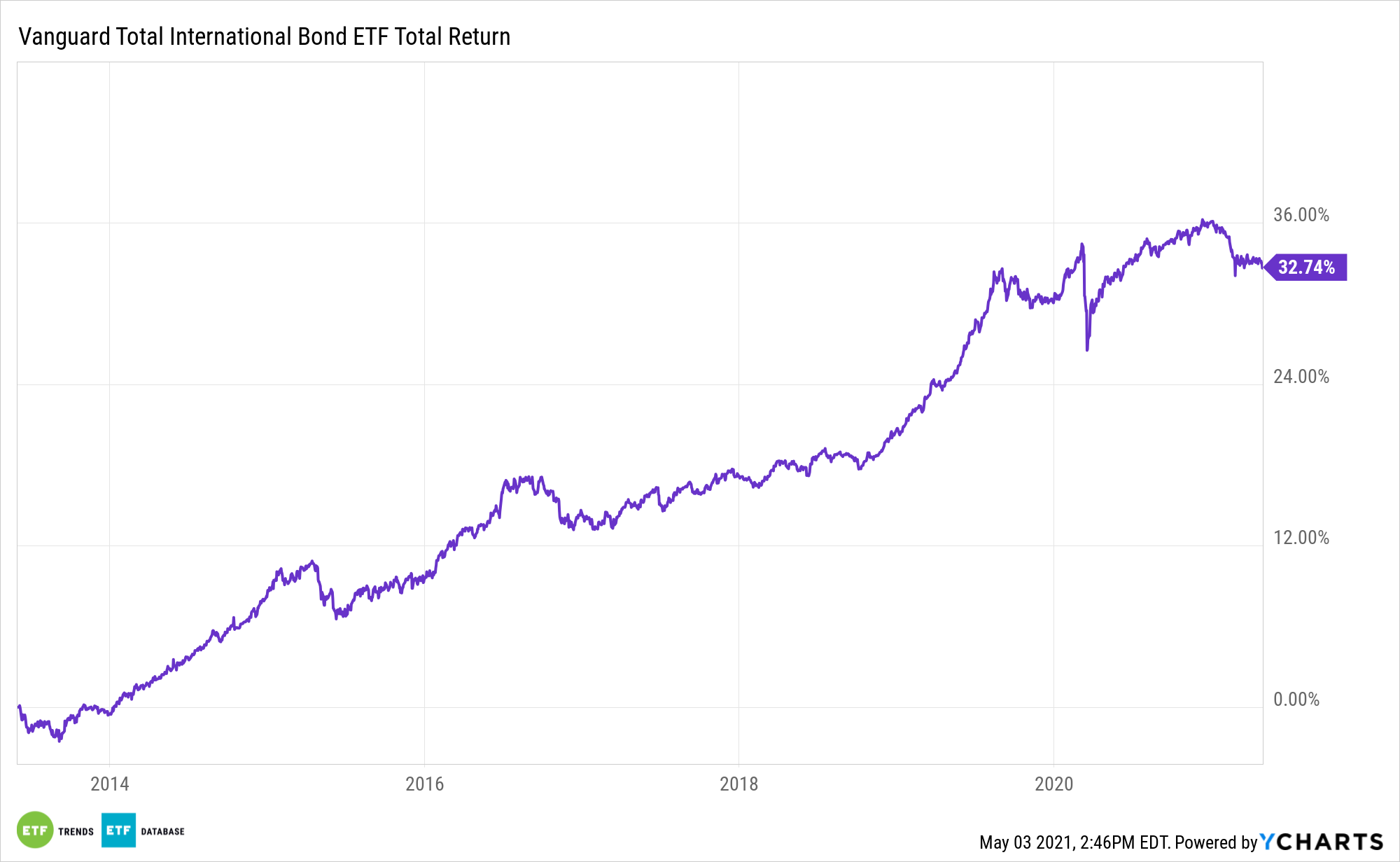

For corporate bond options, there’s the Vanguard Interim-Term Corporate Bond ETF (VCIT) for investors willing to take on more duration risk. VCIT seeks to track the performance of a market-weighted corporate bond index with an intermediate-term dollar-weighted average maturity.

The fund employs an indexing investment approach designed to track the performance of the Bloomberg Barclays U.S. 5-10 Year Corporate Bond Index. This index includes U.S. dollar-denominated, investment-grade, fixed-rate, taxable securities issued by industrial, utility, and financial companies, with maturities between 5 and 10 years.

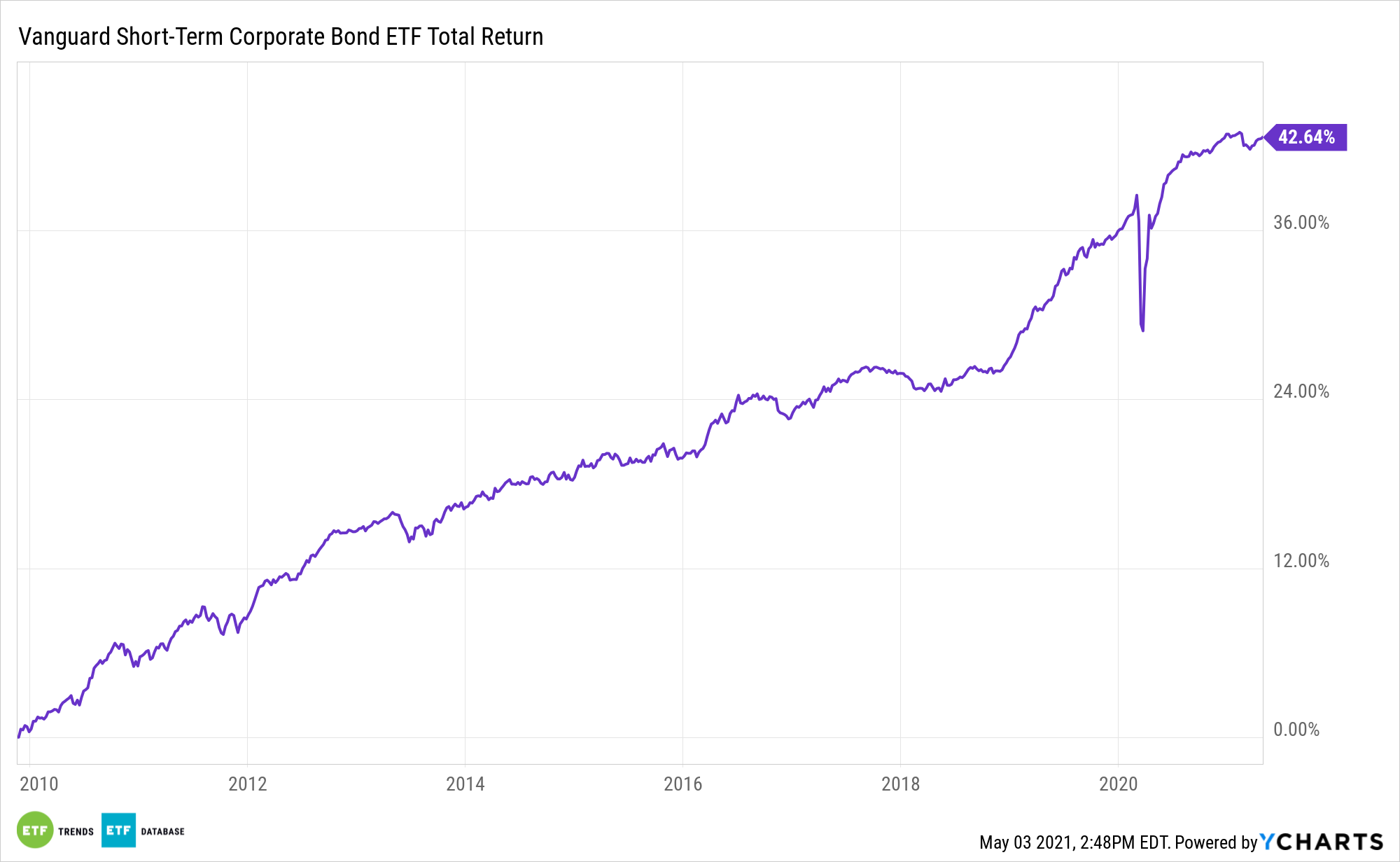

Investors looking to limit their duration in corporate bonds can opt for the Vanguard Short-Term Corporate Bond Index Fund ETF Shares (VCSH). VCSH seeks to track the performance of a market-weighted corporate bond index with a short-term dollar-weighted average maturity, and also employs an indexing investment approach designed to track the performance of the Bloomberg Barclays U.S. 1-5 Year Corporate Bond Index.

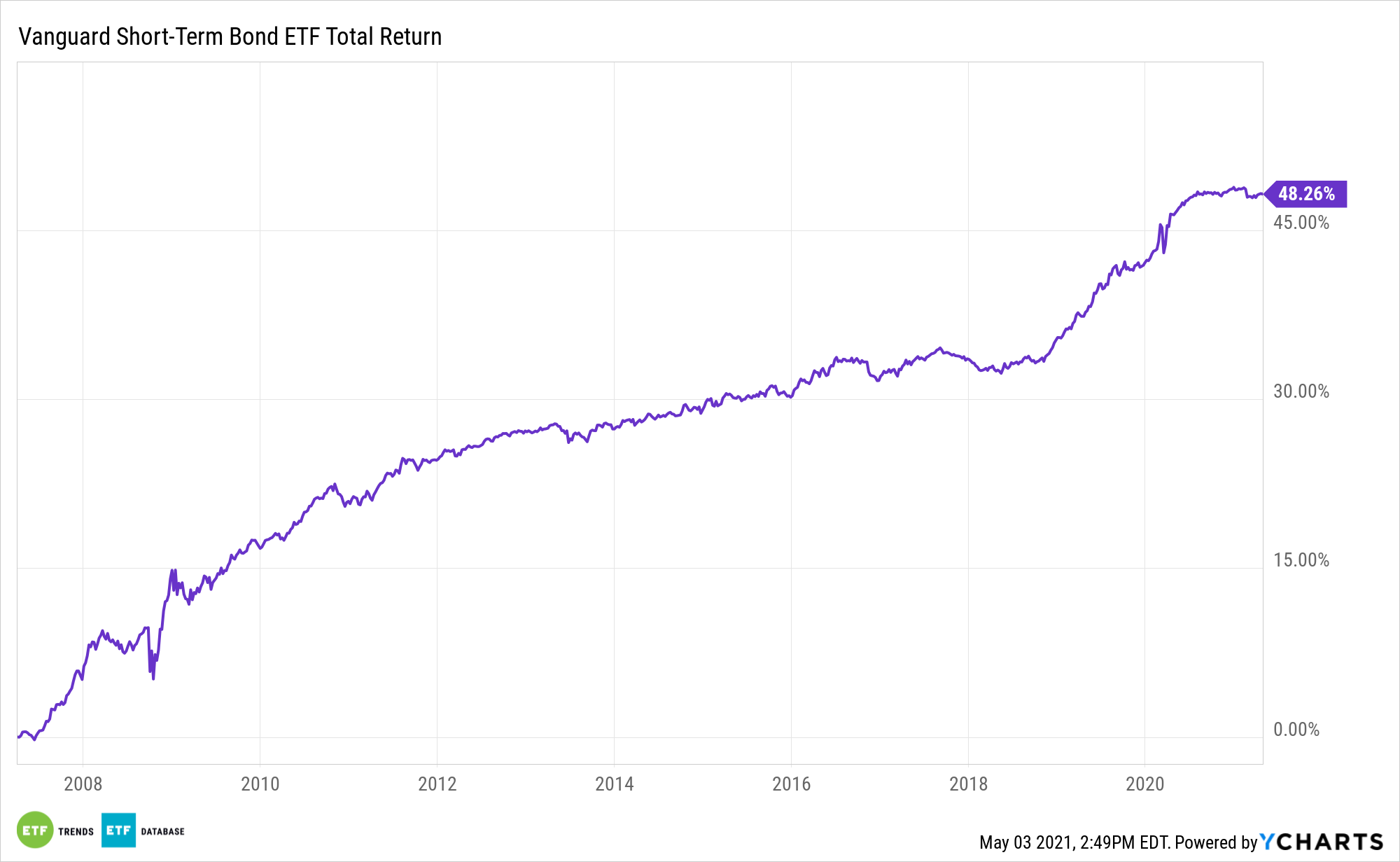

For a similar short-term strategy that doesn’t strictly focus on corporate debt, there’s the Vanguard Short-Term Bond Index Fund ETF Shares (BSV). The fund seeks to track the performance of Bloomberg Barclays U.S. 1-5 Year Government/Credit Float Adjusted Index, which is more comprehensive than VCSH, and includes all medium and larger issues of U.S. government, investment-grade corporate, and investment-grade international dollar-denominated bonds that have maturities between 1 and 5 years and are publicly issued—all selected via a sampling process.

For more news, information, and strategy, visit the Fixed Income Channel.