Alight Solutions 401k Index showed that 401k participants piled into fixed income as fears of a global economic slowdown could be stoking investors to head for the exits when it comes to equities. That same fretting could be eased by a central bank rate cut, but will it be enough to stem the tide of outflows from equities?

“The data we need is not Q2. What’s at risk is the growth and magnitude of the Fed rate cut. I don’t think Q2 is going to have much impact on the Fed’s thinking,” said Marc Chandler, chief market strategist at Bannockburn Global Forex. “It’s really how Q3 is progressing. It seems to me the economy softened in April and May and picked up in June with jobs data, retail sales and manufacturing sector.”

According to an article in 401K Specialist, “June saw, on average, 0.017% of 401k balances traded daily and 17 of 20 days favored fixed-income funds.” Furthermore, the article went on to state that 401k participants tended to favor bonds, stable value, and money market funds.

Fixed Income ETFs See Massive Inflows in June

According to the latest report on ETF flow data from State Street Global Advisors, fixed income inflows were out of this world in the month of June, garnering over $25 billion.

“Even with a 6% rally in global equities, investors allocated a record amount to fixed income ETFs,” wrote Matthew Bartolini, CFA Head of SPDR Americas Research State Street Global Advisors, in the report. “Equity ETFs did garner $20 billion of inflows. However, inflows to bonds were truly out of this world with over $25 billion –a more than 45% increase over the prior record from October of 2014.”

The record number of inflows into bond ETFs allowed for record capital allocations into the fixed income space.

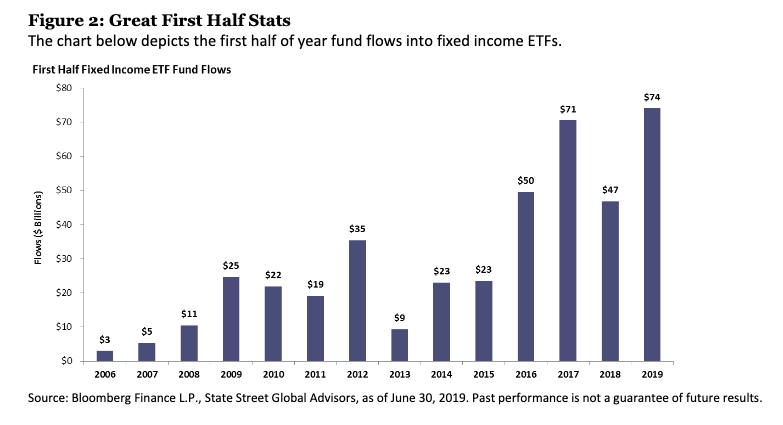

“Bonds’ record June haul pushed the first-half figure to $74 billion, which is also a record amount for a first half,” Bartolini noted. “This surpassed the $70 billion bond ETFs amassed in 2017, a time period that was aided by regulatory tailwinds emanating from the fiduciary rule that led to all ETFs having a record amount of fund flows once the year was over.”

This latest data could provide insight on a repeat performance of fixed income’s first quarter. It’s no doubt that the volatility-laden fourth quarter of 2018 spurred an investor move to bonds, but that trend persisted in the first quarter of 2019 with $34.5 billion going into fixed income exchange-traded funds (ETFs), according to a US-Listed Flash Flows Report from State Street Global Advisors.

As opposed to simply adding a broad-based fund like the iShares Core US Aggregate Bond ETF (NYSEArca: AGG), it will take more of a strategic bent, such as looking into actively-managed funds or other corners of the bond market like municipal debt. This is especially so since the Federal Reserve said during its fourth and final rate hike in December 2018 that it will do more reassessing–the central bank already lowered its forecast to no rate hikes in 2019 as opposed to the initial two forecasted.

For more market trends, visit ETF Trends and to access up-to-date data on ETFs, visit ETFdb.com.