Tim Urbanowicz, Invesco’s Senior Fixed Income ETF Strategist, discussed with ETF Trends a few key drivers showing why BulletShares ETFs is a great space to look into from a macro perspective.

One aspect is seeing how global yields have forced a lot of demand from overseas investors to take on more credit duration and currency risk.

The first half of the year showed the bid from non-US investors was firm with investment-grade corporates, which has allowed for a very nice tailwind for investment-grade credit. However, things have gotten worse overseas, so there are more buyers on a hedge and non-hedge basis, creating a steady stream of demand for investment-grades.

“So, the yield squeeze should be all-in-all supportive for US investment-grade,” Urbanowicz says.

A Supportive Fundamental Backdrop

Additionally, there’s a supportive fundamental backdrop. A significant concern over the past few quarters has been the amount of debt that’s been added to corporate balance sheets in recent years.

That in mind, as Urbanowicz explains, there’s been some deleveraging taking place. Q2’s earnings season, in particular, showed an unexpected growth of about 2.1%.

“For us, looking at the investment-grade story, that remains supported because we do believe now that if you see that earnings growth, a lot of these companies will have the ability to de-lever before the economy does turn in a more meaningful way,” adds Urbanowicz.

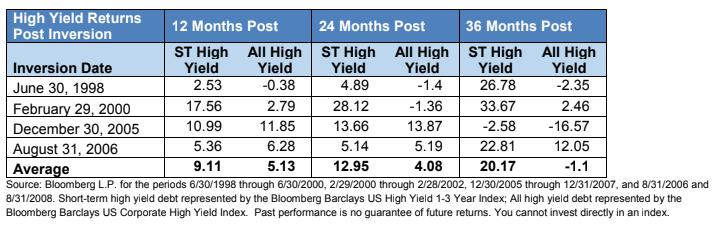

Another driver is what has been seen historically in the investment-grade credit landscape. A big concern is the 2 and 10-year inversion; what that could be indicative of, and what that’s been predictive of in the past.

Looking back at from the late 90s through the mid-00s, these are the last four times the curve has inverted similarly. That in mind, looking at the 12 months following that inversion, every single period has shown investment-grade post positive total returns, many of which have been entirely meaningful.

“All that to say, when you look at the historical data and the fundamentals, as well as the technicals from overseas buyers, we think that really makes a strong case. So, for investors that are looking for that basic quality, when we talk about being targeted in picking your spots on the curve, that one-to-three maturity, you’re still getting a nice pick-up over Treasuries, but you have a lot less default and even mark-to-market risk in those defined or target maturity funds.”

Related: 3 Rally Treasury ETFs as Safety Bets Send Yields Reeling

It’s a good look. With a lot of uncertainty around rates and the large movement that’s been seen, the defined maturity BulletShares allow investors to put these factors aside and stay focused on the predictable outcome.

Another vital thing to keep in mind is how holding 2020, 2021, and 2022 High Yield BulletShares maturities will allow investors to maintain high yield exposure, while potentially limiting some of the volatility associated with broad-based high yield investments.

For more market trends, visit ETF Trends.