The idea of socially responsible investments is not relatively new, but the concept is still struggling to break into the mainstream, particularly at time when the markets are at fever pitch and the major indexes like the S&P 500 are hitting record highs.

The focus on environmental, social and governance (ESG) investing has made headway in the form of equities, but investors are also looking at opportunities within the fixed-income space where funds can make innovations to meet this demand.

Three areas of fixed income that are currently experiencing innovations to fulfill investors’ needs for social responsibility include green bonds, development bank debt and portfolio ratings that include ESG.

Green Bonds

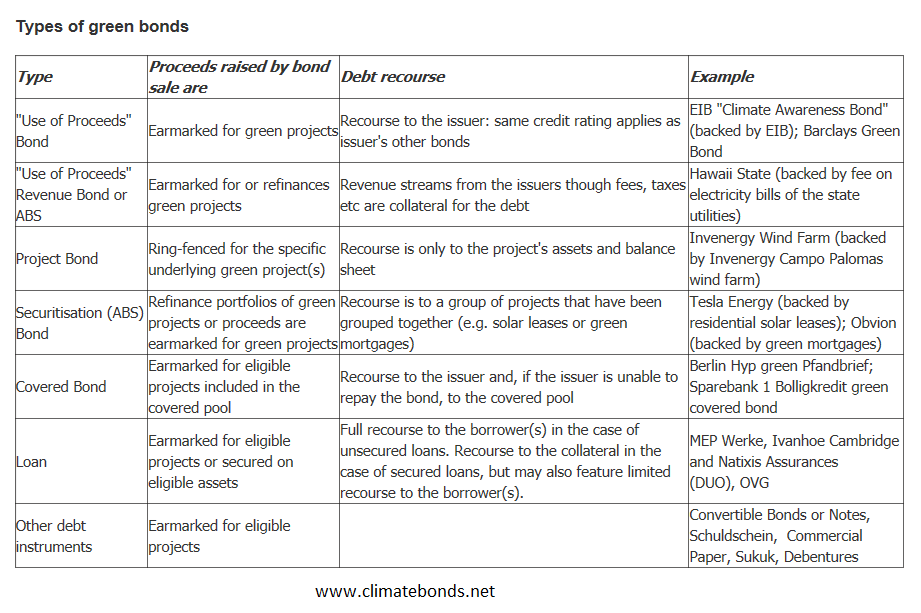

Green bonds are debt issues used to fund projects with a focus on positively impacting the environment. The proceeds from green bonds are allocated towards green initiatives and projects–backed by the debt issuer’s balance sheet. The chart below specifies the types of green bonds available for investors.

Development Bank Debt

According to UBS Group AG, development bank debt offers investment-grade type debt with a penchant for strong returns generated for socially conscious private bank clients. The New Development Bank (NAB), an infrastructure-focused lender established by the BRICS emerging nations, completed the sale of its first worldwide bond in China’s interbank bond market two years ago.

The bond itself was the first yuan-denominated green bond sold in mainland China by a multinational financial institution. The five-year, 3 billion yuan ($447.87 million) bond was used to fund eligible projects in sustainability areas, such as renewable energy, pollution prevention and sustainable water management.

ESG Portfolio Ratings

Investment firms like Pimco and Fidelity Investments are in the forefront of building their sustainable fixed-income funds through the selection of debt issues of companies with excellent ESG ratings. In addition to selecting fixed income investments based on credit quality, investors can now filter debt issues via their contributions towards social responsibility.