Fixed income investors have more than a handful of fears to worry about in the bond markets, such as inverted yield curves, global economic slowdowns and a central bank that is cautious on the prospects of further economic growth domestically. Given these concerns, investors can take refuge in opportunities through defined-maturity exchange-traded funds from Invesco.

It’s no doubt that the volatility-laden fourth quarter of 2018 spurred an investor move to bonds, but that trend persisted in the first quarter of 2019 with $34.5 billion going into fixed income exchange-traded funds (ETFs), according to a US-Listed Flash Flows Report from State Street Global Advisors.

It provided more evidence that investors are picking themselves up in 2019 after a tumultuous way to end 2018. The Dow Jones Industrial Average fell 5.6 percent, while the S&P 500 was down 6.2 percent and the Nasdaq Composite declined 4 percent.

2018 marked the worst year for stocks since 2008 and only the second year the Dow and S&P 500 fell in the past decade. In 2019, investors are no doubt reassessing their strategies for how to distribute their capital through the rest of the year.

However, less-than-stellar returns may have investors thinking twice about their fixed income exposure. Combine that with the aforementioned fears and the taste for the bond markets begin to sour, especially given the way equities have performed thus far in 2019.

“Credit investors faced many headwinds in 2018 as financial conditions tightened, foreign demand faded, and spreads widened,” wrote Timothy Urbanowicz, CFA®, Senior Fixed Income ETF Strategist at Invesco. “Despite tailwinds from a booming economy and strong earnings growth, most credit sectors saw negative total returns. Today, many challenges remain, and the growth tailwind may be fading. But there is a certain type of fixed income strategy that can help mitigate the effects of market noise and may help investors pinpoint more attractive opportunities — defined maturity bond funds.”

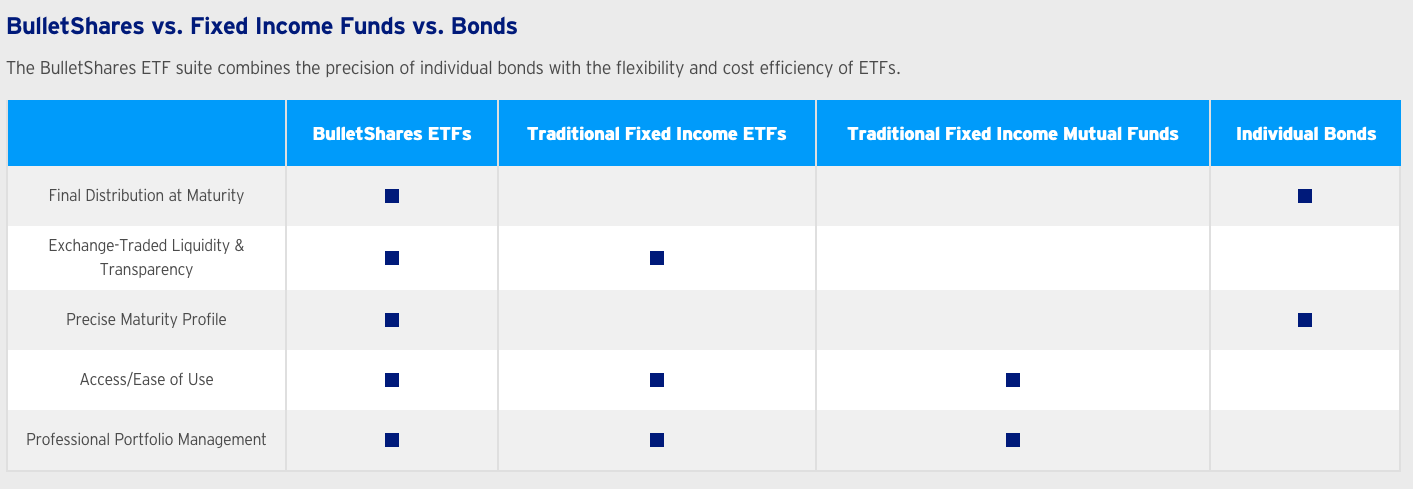

Compared to other fixed income options, defined-maturity funds tick all the boxes–mainly final distribution at maturity, ETF liquidity/transparency, precise maturity profile, access/ease of use, and professional portfolio management.

Invesco’s suite of defined-maturity ETFs give investors more flexibility, especially at a time when tailwinds for fixed income could be easing, as Urbanwicz mentioned. With the ability to provide cash flow, the BulletShares ETFs give fixed income investors more confidence in an uncertain market environment.

“With uncertainty around rates, credit spreads and growth, investors may be inclined to look to defined-maturity bond funds,” noted Urbanowicz. “Unlike traditional fixed income funds that tend to sell bonds before their maturity date, defined-maturity funds seek to hold securities through final maturity—at that time, investors can take the proceeds from the maturing bonds, or reinvest the proceeds in a different ETF with a new maturity date.”

Furthermore, defined-maturity ETFs can also be used strategically via bond laddering, which is necessary in today’s credit markets.

As BulletShares defined-maturity ETFs are available across the yield curve, investors can efficiently ladder a portfolio,” Urbanowicz wrote. “A ladder is a portfolio of bonds that mature at staggered intervals across a range of maturities.”

To see how investors can use defined-maturity ETFs in various scenarios, such as investment-grade debt or high yield given various maturity dates, click here.

BulletShares Corporate Bond ETFs – each with a designated year of maturity ranging from 2019 through 2028 – seek investment results that correspond generally to the performance, before the funds’ fees and expenses, of the corresponding Nasdaq BulletShares ® USD Corporate Bond indices:

| BulletShares Corporate Bond ETFs | |

| Total Expense Ratio: 0.10% / Distribution Frequency: Monthly (if any) | NYSE Arca Ticker |

| Invesco BulletShares 2019 Corporate Bond ETF | BSCJ |

| Invesco BulletShares 2020 Corporate Bond ETF | BSCK |

| Invesco BulletShares 2021 Corporate Bond ETF | BSCL |

| Invesco BulletShares 2022 Corporate Bond ETF | BSCM |

| Invesco BulletShares 2023 Corporate Bond ETF | BSCN |

| Invesco BulletShares 2024 Corporate Bond ETF | BSCO |

| Invesco BulletShares 2025 Corporate Bond ETF | BSCP |

| Invesco BulletShares 2026 Corporate Bond ETF | BSCQ |

| Invesco BulletShares 2027 Corporate Bond ETF | BSCR |

| Invesco BulletShares 2028 Corporate Bond ETF | BSCS |

BulletShares High Yield Corporate Bond ETFs – each with a designated year of maturity ranging from 2019 through 2026 – seek investment results that correspond generally to the performance, before the funds’ fees and expenses, of the corresponding Nasdaq BulletShares® USD High YieldCorporate Bond indices:

| BulletShares High Yield Corporate Bond ETFs | |

| Total Expense Ratio: 0.42% / Distribution Frequency: Monthly (if any) | NYSE Arca Ticker |

| Invesco BulletShares 2019 High Yield Corporate Bond ETF | BSJJ |

| Invesco BulletShares 2020 High Yield Corporate Bond ETF | BSJK |

| Invesco BulletShares 2021 High Yield Corporate Bond ETF | BSJL |

| Invesco BulletShares 2022 High Yield Corporate Bond ETF | BSJM |

| Invesco BulletShares 2023 High Yield Corporate Bond ETF | BSJN |

| Invesco BulletShares 2024 High Yield Corporate Bond ETF | BSJO |

| Invesco BulletShares 2025 High Yield Corporate Bond ETF | BSJP |

| Invesco BulletShares 2026 High Yield Corporate Bond ETF | BSJQ |

BulletShares Emerging Markets Debt ETFs — each with a designated year of maturity ranging from 2021 through 2024 — seek investment results that correspond generally to the performance, before the funds’ fees and expenses, of the corresponding Nasdaq BulletShares® USD Emerging Markets Debt Indexes: