By Jack Forehand via Validea Guru’s Blog

There is probably nothing that hurts our investment returns more than our behavior. We spend a lot of time debating things like whether we should invest in active or passive funds or whether value or momentum is a better investing factor, but in doing that we often lose sight of the thing that studies have shown detracts from our returns more than all of that.

The way we are wired as human beings has been very helpful for our survival as a species, but it is a significant hindrance for our investment portfolios.

For this week’s interview, we are going to take an in depth look at behavior in investing, how it hurts us, and what can potentially be done about it. My guest is psychologist Dr. Daniel Crosby. Daniel is the author of three books on Behavioral Finance, including the recent best seller The Behavioral Investor. He also recently became the Chief Behavior Officer at Brinker Capital.

Behavioral Finance can be a complex topic and many experts in the area tend to explain it with a level of complexity that is difficult for your average investor to comprehend, but Daniel is the opposite of that. He is able to take very difficult concepts and explain them in a way that not only is easy to understand, but also focuses on practical solutions rather than complicated theory.

Jack: Thank you for taking the time to talk to us and congratulations on the new position.

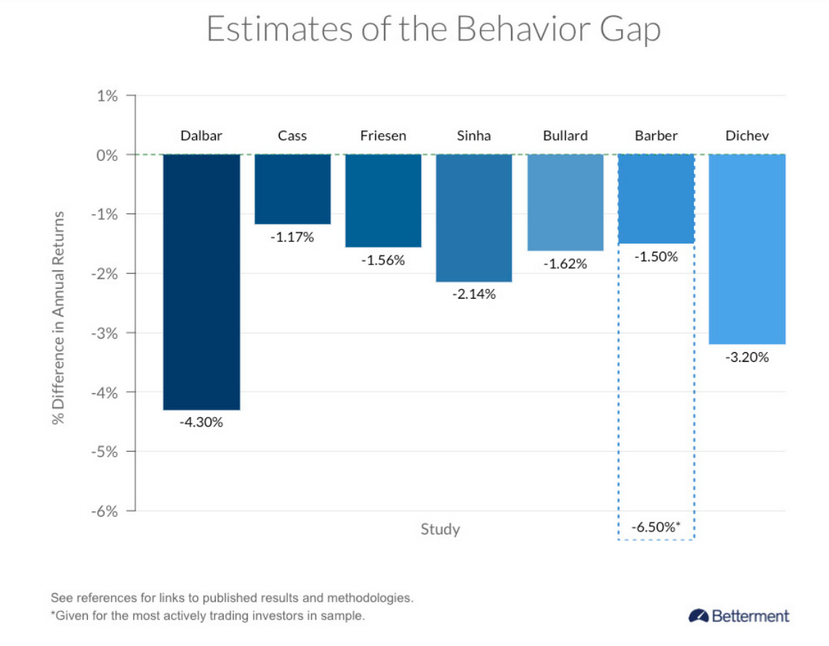

Everyone seems to agree that our behavior has a significant negative impact on our investment returns. As investors, we tend to buy high and sell low, which is the exact opposite of what we should be doing. The actual impact can be difficult to measure, though, and the research seems to vary with respect to how significant of an issue this is. I have seen studies that estimate that behavior impacts returns less than one percent per year and others with estimates of four or five percent. The methods that are used to calculate this impact have also been subject to significant debate. Common methods used to calculate the effect like asset weighted mutual fund returns have been subject to scrutiny since there are a myriad of reasons investors add money to or withdraw money from mutual funds other than bad behavior. What is the best research you have seen on the impact of behavior on investment returns and what are the best methods you have seen to calculate the effect?

Daniel: While there’s a fair bit of disagreement about how best to measure the behavior gap, there is very little doubt about whether or not it exists and what causes it. The most conservative estimates put the behavior gap at just over 1% and the most dramatic (and most widely cited) estimate has it at over 4%. But whether you think it’s 1% or 4% (and I tend to think it’s somewhere in the middle), we can all agree that fees, poor timing and improper product selection are at the heart of investor performance. The lessons of the behavior gap for me are watch your fees, do less than you think you should and diversify within and between asset classes. To the first point, Morningstar found that the best predictor of fund performance is fees, simply because paying too much directly erodes your performance and directly contributes to the behavior gap. It’s wholly possible for an uneducated investor to overpay by 1% or more for a product, which would get you all the way to the most conservative estimates of the gap. In terms of activity, Meir Statman and others have found that in each of the 19 countries they examined, that performance decreases with increased account activity. Bearing this in mind, a big part of managing the behavior gap becomes getting investors to do as little as possible. Finally, there’s diversification which makes the ride more palatable for the average investor and is low ego made flesh. A diversified portfolio that owns the world is a concrete way of saying, “I have no idea what’s going to happen and I’m cool with that.”

Here is an excellent chart from Betterment with estimates of the behavior gap:

Source: https://www.betterment.com/resources/betterments-quest-behavior-gap-zero/

Jack: Despite the fact that we continue to learn more about the effect of behavior in investing, the problem continues to persist. Given the way human beings are wired, that may be inevitable, but there is the potential that continued research in this area combined with technological innovations could improve things over time, and may have done so already. Do you think the problem is getting better or do you think that our nature as human beings will always limit our ability to solve this?

Daniel: Advances in behavioral finance can improve significantly, but will never fully eradicate, the tendency of investors to make poor decisions. The reason this is so is that there’s a profound “knowing-doing gap” that owes to the difficulty of implementing things that are psychologically tough, even if we know them to be true. Smoking is a great example. For a long time, the dangers of smoking were not fully understood and so in the 1960s, 42% of adults in the US smoked. As time went on, science began to tell us in great detail about the dangers of smoking, and while that has improved the ability of the public to make better decisions about their health, millions of people still smoke. Currently, 14% of Americans smoke and I’d wager that not a single one of those 16 million people believes that it’s a good idea. Likewise, as investors get more and more information about the impact of their behavior, many will make better decisions, but there will always be a significant minority of the population that makes ill-advised decisions about their wealth, simply because it’s emotionally expedient.