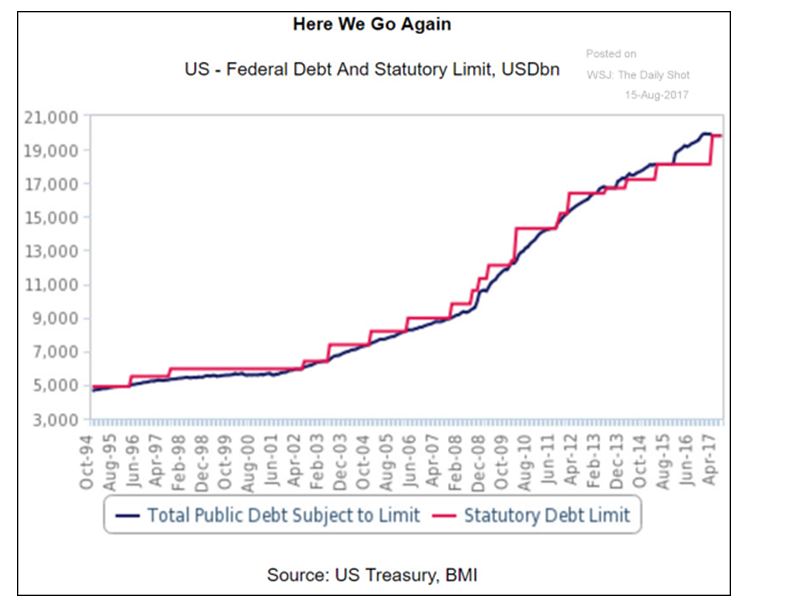

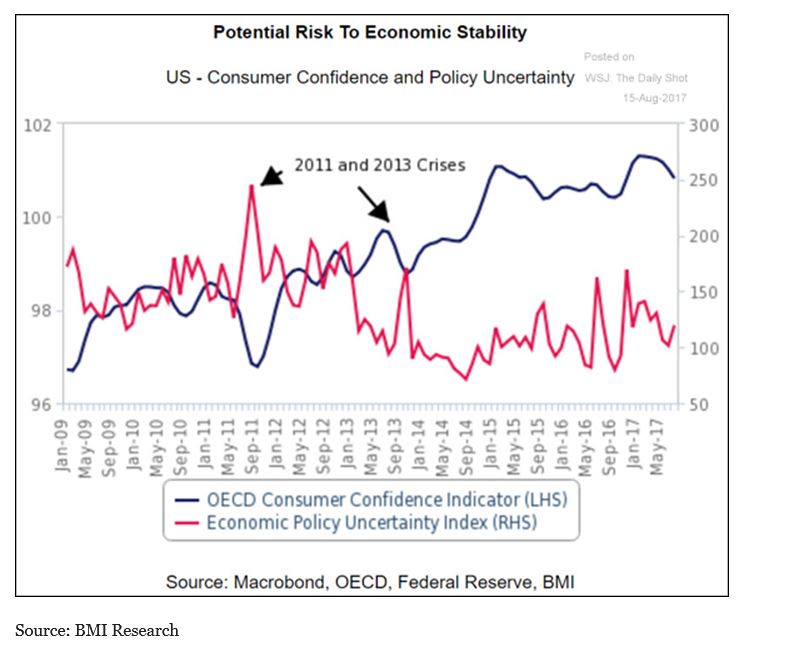

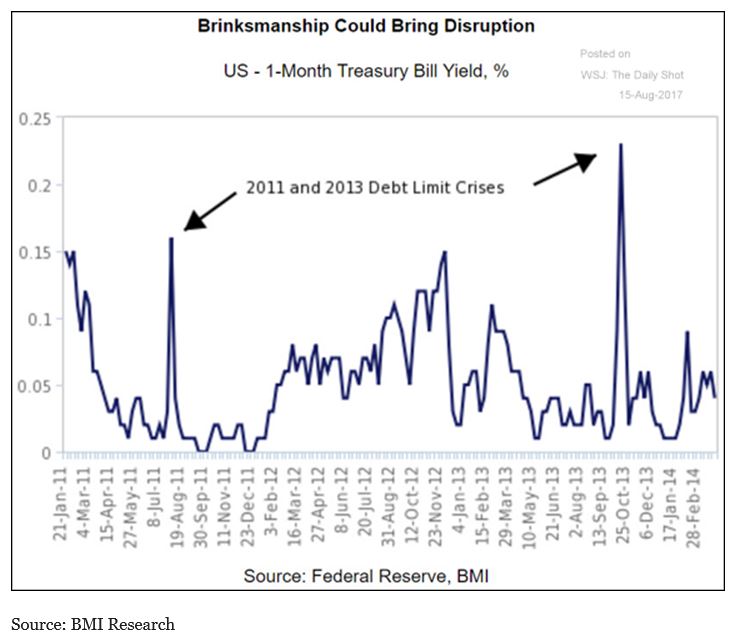

The US is expected to reach the debt limit in the next month or two. Will politicians in Washington use it as a weapon again? We hope not! The next two charts show why it is massively disruptive to business, the stock and bond markets, as well as our confidence.

If you hear Washington start to use the debt limit as a political tool, remember what happened the last two times this occurred. It got ugly. While we do not know what Washington will do, or how the markets will react this time, now is a good time to review your portfolios. Has the bull market driven your equity holdings to inappropriate levels? Do your portfolios have enough defensive capabilities? Are expectations aligned with your portfolio’s construct and expected returns? Indexing is great until markets enter a correction or worse. Now is a great time to review, realign and prepare for whatever comes next.

David Haviland is a Managing Partner and Portfolio Manager at Beaumont Capital Management, a participant in the ETF Strategist Channel.