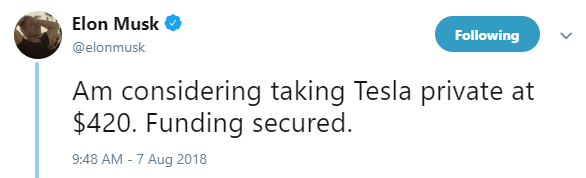

As in most cases when you mix social media and market influencers, it took just one tweet to send the capital markets spinning yesterday when Tesla co-founder and CEO Elon Musk announced he was mulling the idea of taking the Palo Alto, California-based company private–a move that would affect exchange-traded funds with the heaviest weightings of its stock, leaving them in limbo as they await Musk’s next move.

ETFs affected include VanEck Vectors Global Alt Energy ETF (NYSEArca: GEX), ARK Industrial Innovation ETF (NYSEArca: ARKQ) and First Trust NASDAQ Cln Edge GrnEngyETF (NASDAQ: QCLN). Of the three, only QCLN was a smidgen down at .05%, while GEX and ARKQ were both up slightly at 0.04% and 0.57%, respectively.

Related: Elon Musk: Tesla Going Private is ‘Best Path Forward’

![]()

With a price of $420 per share, it would effectively bring Tesla’s market value to $71 billion. In an email, Musk expressed to employees that he believes going private would be the “best path forward.”