With this ratio, the larger the number the better, and a comparison to peers is necessary to determine whether a number is “good” or “bad.”

K-Ratio Addresses a Standard Deviation Flaw

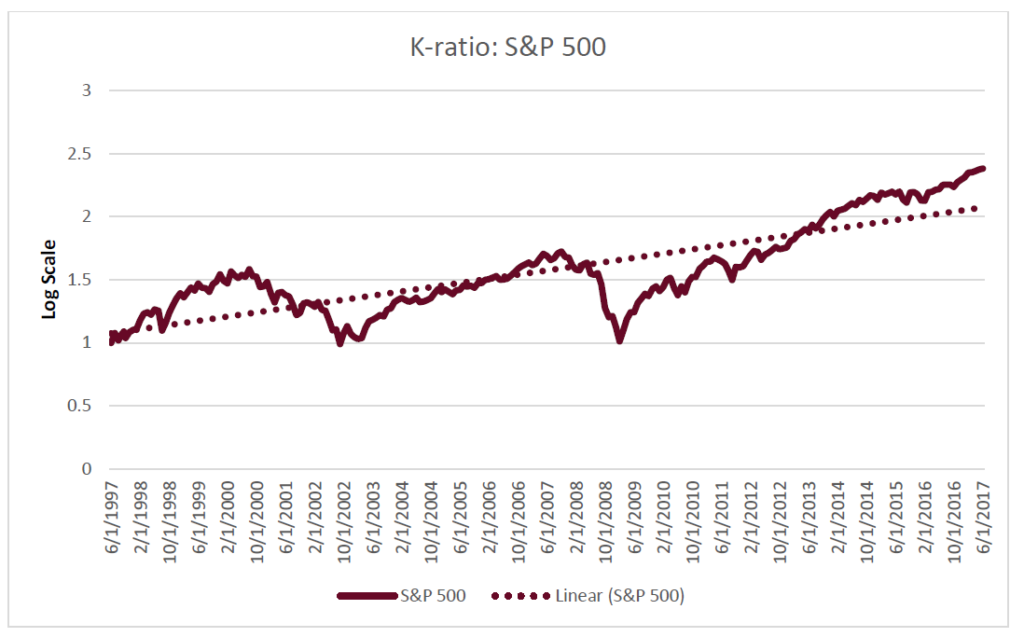

As an added benefit, the K-ratio addresses one of the long-standing complaints regarding the use of standard deviation as a risk measure: it does not and cannot take into account the timing of bad returns. If there are a dozen very bad monthly returns over the span of ten years, standard deviation cannot tell whether those bad months were randomly scattered throughout a decade or if they were all clustered in a small period of time. Anyone who remembers the dark days of late 2008/early 2009 can recall that some of the worst months in memory were tightly clustered within a few quarters.

The standard error of the mean and the K-ratio remedy this. A financial crisis pushes the investment from the idealized straight line, so you can clearly see where that cluster of bad months happened.

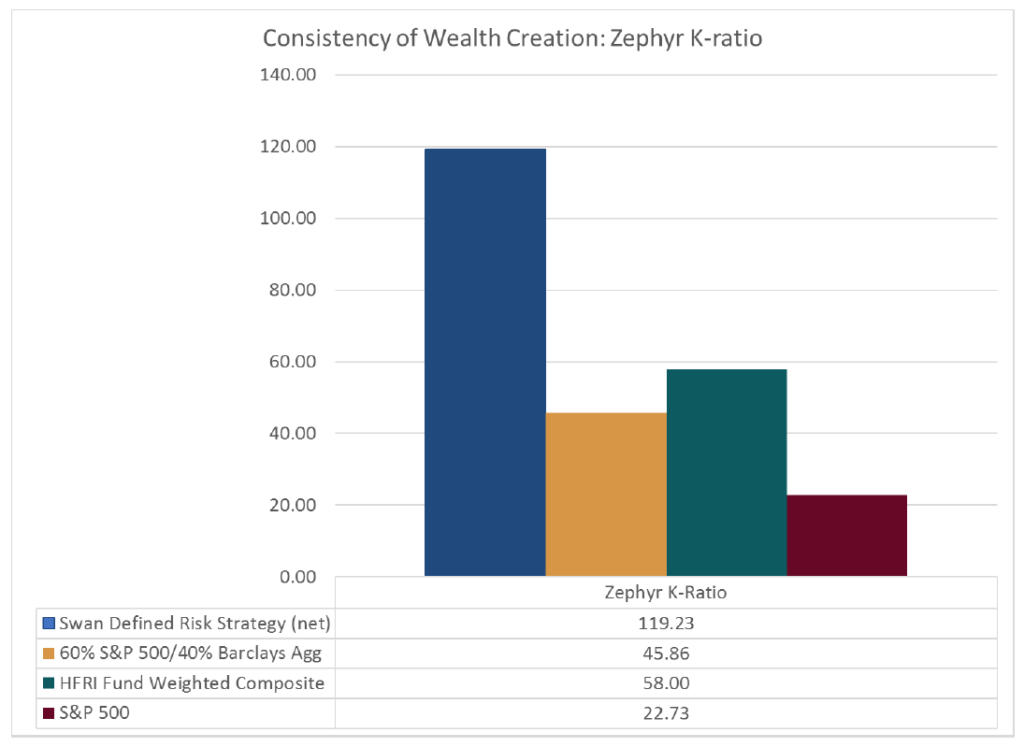

The Zephyr K-Ratio in Action: A Comparison

For the K-ratio to have meaning, it must be compared to other investments’ K-Ratios. Using the Defined Risk Strategy (DRS) as an example, we compare the K-Ratio for the DRS Select Composite to the S&P 500.

The DRS Select Composite looks strong when analyzed in terms of consistency of wealth creation in contrast to the S&P 500. First of all, the slope of the best-fit line is steeper than that of the S>&P 500, meaning the DRSSelect Composite does a better job of creating wealth.

![]()

Source: Zephyr StyleADVISOR, Swan Global Investments. All S&P 500 data based on historical performance of the S&P Total Return Index. All historical performance of the Swan. Select Composite is net of fees. Prior performance is not a guarantee of future results.

Secondly, and more importantly, the actual data line tends to hug the idealized best-fit line much more closely than the S&P 500 fits its ideal line. This is the consistency part of the equation.

A strong return metric divided by a smaller risk metric will certainly lead to better overall ratios. That is what we see with the K-ratio metric—the DRS winning on both the wealth creation and consistency fronts.

Defined Risk Strategy: Smooth & Consistent Wealth Creation

The DRS was devised with this goal in mind: to provide a nice, smooth, constant rate of wealth creation. The K-ratio illustrates how well the strategy was able to achieve that goal.

Source: Zephyr StyleADVISOR, Swan Global Investments. The Barclays U.S. Aggregate Bond Index and the S&P 500 Index are unmanaged indices and cannot be invested into directly.

DRS results are from the DRS Select Composite, net of all fees, from July 7, 1997 to June 30, 2017. Past performance is no guarantee of future results. Structures mentioned may not be available within your Broker/Dealer.

The DRS Select Composite’s K-ratio is 119.23, much better than the S&P 500’s 22.73. The S&P 500’s K-ratio shows that the two big bear markets in 2000-02 and 2007-09 had a big impact on an investor’s path of wealth creation. The balanced 60/40 mix and the hedge fund index did better than the S&P 500 with K-ratios of 45.86 and 58.00, respectively, but are well short of the DRS Select Composite’s K-ratio of 119.23.

An investment made solely in a S&P 500 product would have been knocked severely off course by those crises. Of course, anyone who had been through those periods remembers those events, but the K-ratio allows us to quantify the impact of those events on one’s wealth creation.

Marc Odo is the Director of Investment Solutions at Swan Global Investments, a participant in the ETF Strategist Channel.