By Gary Stringer, Kim Escue, and Chad Keller, Stringer Asset Management

We hear a lot of concern about proposed increases in federal tax rates. At the broadest level, tax rate adjustments can be very impactful for an individual and corporation. As a result, changes to tax rates often require careful and effective planning to navigate. However, we do not think that the proposed changes in tax law will have significant economic impact.

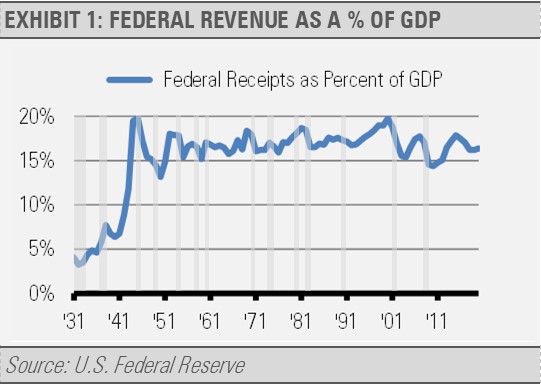

Despite much concern over federal policy, federal tax revenue relative to the size of the U.S. economy has not change much since the second World War. As the following graph illustrates, federal tax revenue as a percentage of the U.S. economy changed dramatically with the advent of WWII and the larger government that has been in place ever since. However, overall tax revenue compared to the size of the economy has not changed much since the 1950s. This is especially true once we adjust for the business cycle. Over the last 70 years, federal tax revenue has been in a range of roughly 14% to 20% of gross domestic product (GDP). Tax revenue normally bottoms out during a recession and tops out with a business cycle peak. Federal tax revenue fell just below the midpoint range on October 25th, 2020, last year at 16.37% of GDP. It would require significant changes to the tax code to move much higher in overall federal tax revenue, and we just do not see that happening.

With the slim democratic majority in Congress and moderate democrats pushing back against large tax increases, we doubt that we will see significant changes in overall policy rates. Even the proposed levels of corporate tax rates are below what we had in the 1990s when the effective corporate tax rate was approximately 35% and the economy was booming. Proposed changes in individual tax law are similar and will require individual planning once the adjustments are known. In summary, the proposed tax changes would be a big deal at the individual level and may require tax planning once the rules are known, but not a big issue for the overall economy.

For more news, information, and strategy, visit the ETF Strategist Channel.

DISCLOSURES

Any forecasts, figures, opinions or investment techniques and strategies explained are Stringer Asset Management, LLC’s as of the date of publication. They are considered to be accurate at the time of writing, but no warranty of accuracy is given and no liability in respect to error or omission is accepted. They are subject to change without reference or notification. The views contained herein are not be taken as an advice or a recommendation to buy or sell any investment and the material should not be relied upon as containing sufficient information to support an investment decision. It should be noted that the value of investments and the income from them may fluctuate in accordance with market conditions and taxation agreements and investors may not get back the full amount invested.

Past performance and yield may not be a reliable guide to future performance. Current performance may be higher or lower than the performance quoted.

Data is provided by various sources and prepared by Stringer Asset Management, LLC and has not been verified or audited by an independent accountant.

Stringer Asset Management, LLC

Email: [email protected]

Phone: 901-800-2956