By Marc Odo, Swan Global Investments

Portfolio protection is now top of mind right for many investors.

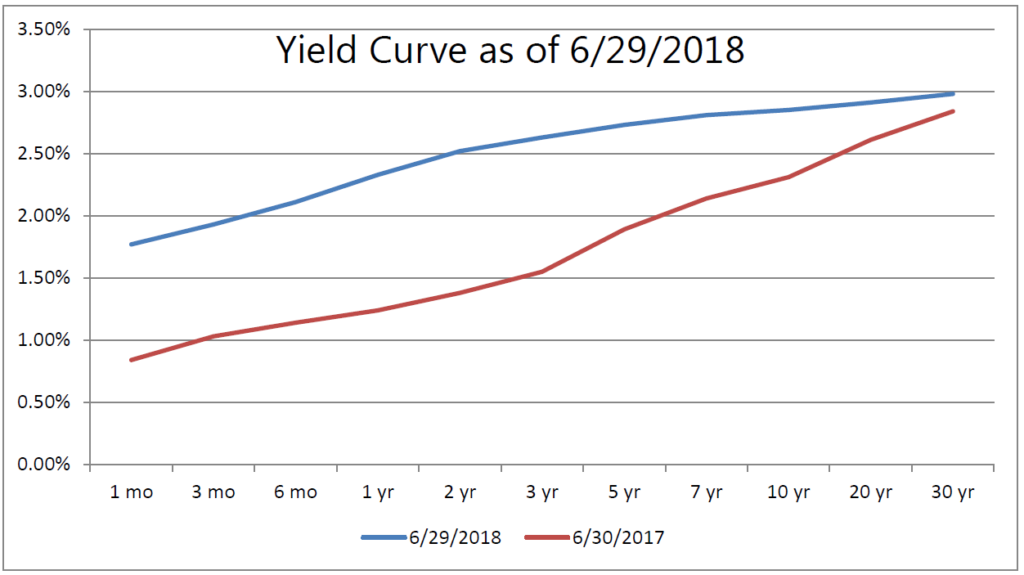

With U.S. equities pushing all-time highs, a flattening of the yield curve, and the unknown impact of potential trade wars, many investors are justifiably concerned.

Advisors usually recommended significant bond allocations to hedge their clients’ portfolios, and historically, it has worked. For example, during the most recent bear market from November 2007 until March of 2009, the Barclay’s Bond Index rose 6% while the S&P 500 Index fell 50%. Thus, a balanced portfolio of 60% stock / 40% bonds fell around 27%, and a 40/60 portfolio fell only 15%.

But the landscape has changed.

The environment of low but rising rates presents a challenge to those investors seeking protection and capital preservation from bonds.

How Low Can You Go?

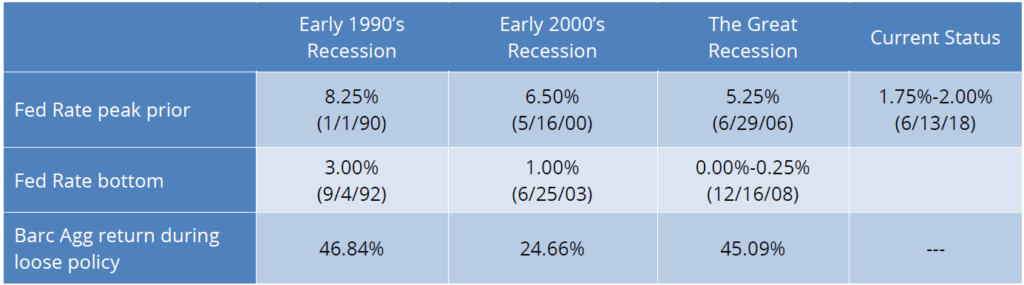

Over the last 30 years there have been three times in which the Fed entered an extended period of loose, accommodative monetary policy in order to help ease the economy through a recession. In all three cases bonds performed admirably well. As rates fell, bond values increased, helping offset losses associated with the equity markets. If the standard, balanced portfolio contained 60% in equities and 40% in fixed income, that 40% allocation to bonds was vindicated.

![]()

Source: U.S. Treasury, Zephyr StyleADVISOR

The previous three recessions started with the Federal Fund rate over 5%. In each case the Fed was able to cut over 500 basis points from short term lending in order to help boost the economy during a recession. The Barclays Aggregate U.S. Bond Index performed quite well during these periods, providing positive returns that offset losses in the equity markets.

Were a recession to start today with short term rates in the 1.75%-2.00% range, the Federal Reserve would have much less scope to implement a loose monetary policy. They might push rates back to 0.00%, but the gains to bonds will likely be less due to the lower starting point. With less of a value increase, the protection role of bonds is much weaker than before.

Keeping an Eye on the Yield Curve

Is a recession imminent? No one knows for sure. Debating the relative strength or weakness of the economy keeps thousands of people occupied and gainfully employed. But one yellow flag is the recent flattening of the yield curve.

Source: U.S Treasury