Over the last year the short end of the curve has moved up significantly, while the long-end has barely budged. While the yield curve hasn’t yet inverted, long time market watchers know this is a bad omen. For those needing a refresher on the importance of flat or inverted yield curves, the New York Times recently ran this piece in June: “What’s the Yield Curve? ‘A Powerful Signal of Recessions’ Has Wall Street’s Attention.”

Rising Rates Hurt Capital Preservation

Maybe you’re of the opinion that the economic expansion has room to grow, and you don’t see a recession on the horizon. Assuming the Fed continues on its path of tightening under healthy market conditions, the impact on bond prices will be negative. As prices and yields are inversely related, bond holders could feel a lot of pain as rates increased by 3% to their historic average levels. While this may mean good things for those who want income, it’s a problem for those who are seeking capital preservation.

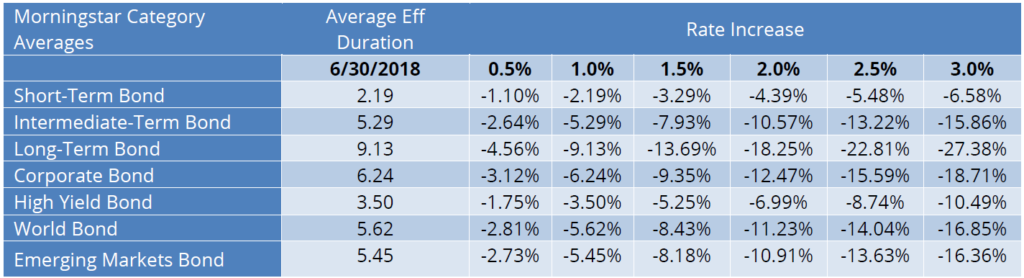

The table below shows the average durations of different types of fixed income managers and how susceptible they are to losses in the face of rising interest rates.

![]()

Source: Morningstar Direct, Swan Global Investments

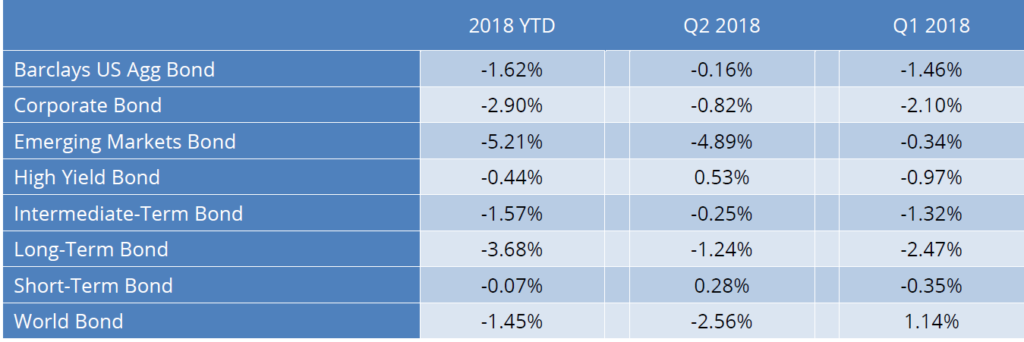

We’ve already seen this bear out a bit in 2018, as many bonds have lost money in the first half of the year.

Source: Morningstar Direct

If rates continue to rise in a healthy economy, bond holders can expect more losses.

Rethinking Capital Preservation and the Traditional Portfolio

The capital preservation role hasn’t been truly tested in almost a decade, as the market has not witnessed a 20% sell-off since 2007-09. The current low rates leave little room for a loose policy during a possible future recession, and rising rates hurt the principal of bond holders now.

Those depending on bonds to fulfill the conservative portion of the portfolio may be facing some tough times ahead. Luckily, there are many money managers employing various strategies and techniques that don’t depend on bonds for capital preservation. Investors have more options than before.

Shifting allocations from bonds to strategies that directly hedge market risk may feel risky. But it may be a riskier move to stay with the familiar that isn’t working than to try something new that might provide the protection many need.

Marc Odo is the Director of Investment Solutions at Swan Global Investments, a participant in the ETF Strategist Channel.