By Nicholas Porter, Astor Investment Management

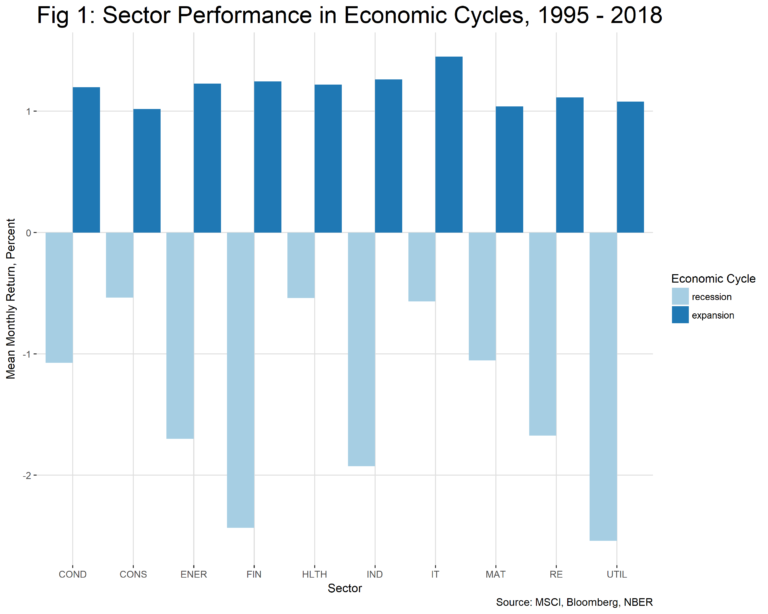

As the current recovery ages and trade tensions garner headlines, a money manager’s thoughts turn to defensive sectors. But how have the defensive sectors actually done in recent recessions? We examine the record in this post.

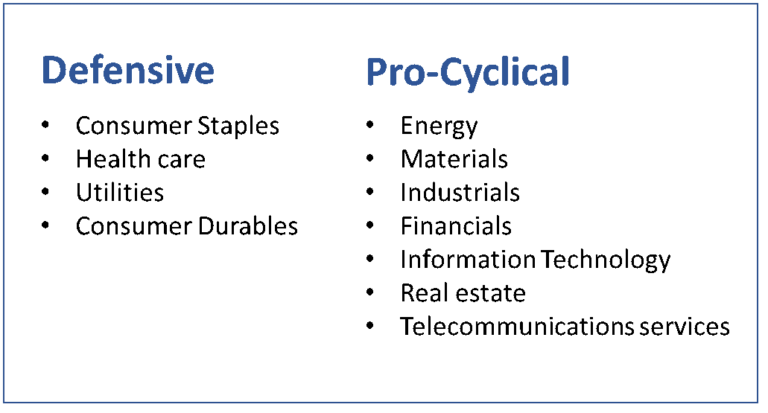

For an investment manager, there is obvious appeal in knowing how sectors of the economy perform in recessions and expansions. During recessions, investors could shift exposure into sectors that perform better than the market (i.e. defensive or anti-cyclical sectors), and underweight sectors that perform worse (pro-cyclical sectors), with the opposite process occurring during expansions.

![]()

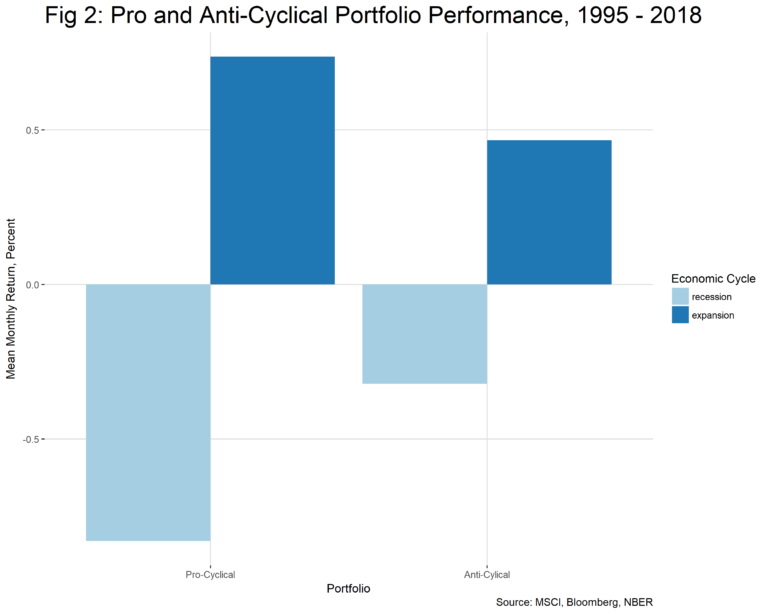

Except for a few outliers, it looks like the Street wisdom holds true. We at Astor have also constructed market-cap weighted pro and anti-cyclical portfolios of equities based on the classification in the table above. How do our portfolios perform in recession and non-recessionary periods over two recession periods?