Our analysis lends some support to the existence of defensive sectors, and at first glance, the results are encouraging. As Figure 2 shows, our anti-cyclical portfolio handily outperforms our pro-cyclical portfolio during recessions, and lags during expansions as we would expect. Of course, it bears noting that these portfolios still generate negative returns during recessions. Moreover, a glance at the underlying data highlights the risk in expecting industries to comport with economic theory.

![]()

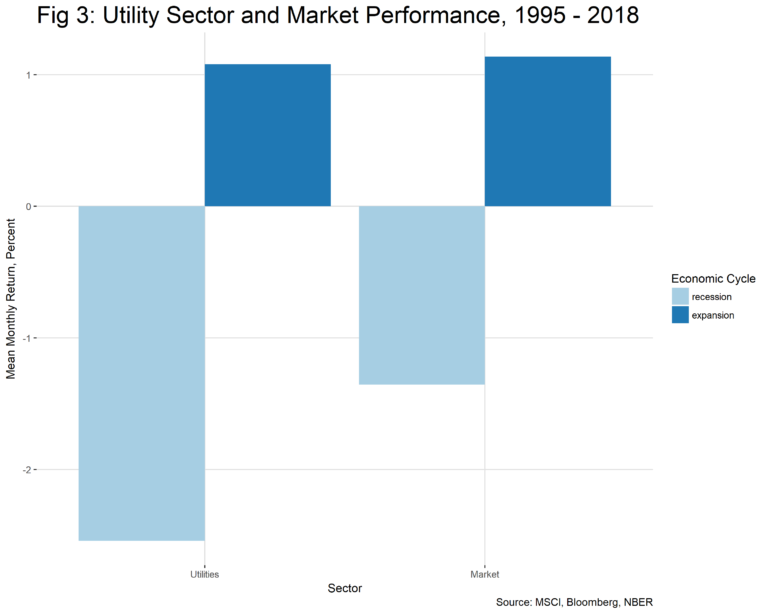

As Figure 3 depicts, the “classic” defensive sector, utilities, is anything but, and indeed has had worse returns than the broader market during recessions. We can extend this research back to the early sixties with a slightly different data set and find that utilities do indeed outperform the market in some recessions, but under performs in others.

Of course, much of this reinforces what common sense tells us: stocks are not billiard balls which will always behave the same given the same force and angle of shot. This emphasizes the first rule of portfolio construction: diversification. It also highlights the potential we at Astor see in understanding the relationship between the top-down fundamentals underlying each economic sector’s growth and corresponding asset valuation. Astor’s Sector Allocation Fund does just that by weighting sector exposure appropriately based on multiple economic data points.

This article was written by Nicholas Porter of Astor Investment Management, a participant in the ETF Strategist Channel.

Disclosure Information

All information contained herein is for informational purposes only. This is not a solicitation to offer investment advice or services in any state where to do so would be unlawful. Analysis and research are provided for informational purposes only, not for trading or investing purposes. All opinions expressed are as of the date of publication and subject to change. Astor and its affiliates are not liable for the accuracy, usefulness or availability of any such information or liable for any trading or investing based on such information. 2018-181