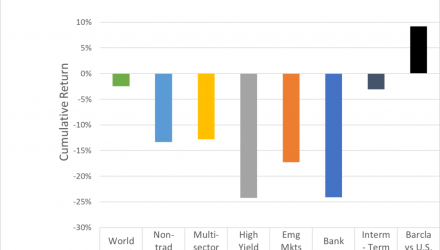

Based on these numbers, these types of bonds should be viewed as a “risk” asset, not a “protection” asset. Those chasing yield in High Yield Bonds would have suffered losses in the neighborhood of 24.25% during the crisis.

Another subtler but perhaps even more worrisome point to note is regarding investment grade bonds. The two columns on the far right display the Morningstar category average for Intermediate Term Bonds and the Barclays U.S. Aggregate Bond Index, respectively. In theory, both are meant to represent safe, investment grade bonds.

However, the performance gap between the two is quite large—over 12%. During the Global Financial Crisis the Barclays Aggregate Index was indeed up 9.17%, offsetting equity losses if used in a balanced portfolio. However, the average Intermediate Term Bond fund fared much worse during this period, losing over 3%. it is fair to assume a lot of active managers went chasing after yield, even though their mandate might have been investment grade bonds.

Barron’s recently ran a thorough and worrying article called “Where the Bond Market’s Next Big Problem Could Start” by Vito Racanelli. The author explores the large “bulge” of corporate debt sitting right on the investment grade/speculative grade cusp and wonders what might happen if this BBB-rated debt tips over into BB-range. For those looking for icebergs on the horizon, it is a good read.

How will such assets fare in another downturn when spreads have been squeezed to razor-thin margins? Time will tell, but the forecast is not favorable.

Low Yields and Limited Options

These ultra-low yields for the past 10 years limit advisors’ and investors’ options. They can either take on more risk going after yield and set themselves up in a precarious position for a future downturn or they can remain conservative and sacrifice income.

But there are other ways to get income.

An Alternative to Yield: Total Return & Systematic Withdrawals

With bonds failing to provide the necessary income many require, it’s time to redefine how we think about income. Bonds aren’t the only way.

We argue the focus should be on total return on an investment. Too many investors focus just on the yield component of total return and miss the importance of capital gains. Instead of reaching for yield and risking principal, advisors and investors can widen their options and limit the amount of risk they take.

At the end of the day, a dollar gained is a dollar gained and one shouldn’t care how that dollar is generated. Moreover, by leaving gains invested one could reap the benefits of compounding returns.

And when it comes to taking out income, you will just need to implement a systematic withdrawal plan.

Redefining the Concept of ‘Income’ with an Alternate Retirement Cash Flow Source

In a way, a systematic withdrawal plan is similar to the dollar-cost averaging and regular 401(k) purchases many savers are familiar with during their working years when they were building up their nest eggs. The systematic withdrawal can be explained as the reverse of that. During the accumulation stage, investors saved what they could every paycheck period. In retirement, a systematic withdrawal plan simply reverses that flow.

When it comes to taxation, a systematic withdrawal plan may actually be preferable to a pure income-based plan. After all, income is taxed at regular income rates, whereas systematic withdrawals out of a long-term holding would likely be taxed at a long-term capital gains rate. Although many different variables come in to play when calculating after-tax returns, a systematic withdrawal plan does have its advantages.

In the wake of this extraordinary, post-crisis environment, it does seem unlikely that fixed income can fulfill its traditional role of capital preservation and income within a portfolio. It is important to remain focused on the big picture: wealth and the preservation of it, not investment yield, will determine whether or not an investor will be able to meet their retirement goals.

Marc Odo is the Client Portfolio Manager at Swan Global Investments, a participant in the ETF Strategist Channel.