Rational Diversification

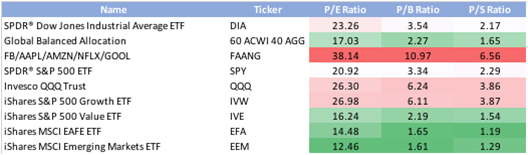

It is not terribly surprising that the indexes that have done the best have the most expensive valuations. The magnitude is the true surprise, since the P/E, P/B, and P/S of the Dow are consistently twice as expensive as the Emerging Markets. The fundamentals categorically support maintaining a diversified portfolio. That said, what is the role of the ETF industry within this phenomenon? First, let’s see if ETF asset flows are chasing these index returns.

Source ETF.com

The Role of ETFs

The chart above shows that although significant flows have gone into US large cap ETFs like VOO, IVV, and VTI, seven of the top ten flows have been into ETFs with negative or relatively muted returns. The flows suggest ETF investors continue to embrace the client alignment factor of diversification. But do ETFs share some of the blame for the performance and valuation discrepancies of the Dow? According to our ETFthinktank.com ownership influence application, ETFs on average own about 8% of the market cap of all US companies. When the same formula is applied to the Dow, we see that ETFs own on average 5.73%. Therefore, ETFs substantially under own the equities in the Dow relative to the overall market.

Go Ahead and Hate the Dow, but Love the Market

From an academic perspective, it easy to hate the Dow; the index is really surviving to market the Dow Jones brand. From the perspective of Wealth Advisors, the headlines surrounding the all-time highs of US large caps at the expense of all other geographies and assets has put the value of diversification into question. This is the right time for Wealth Advisors to embrace the diversification and innovation growth factors of the ETF industry and prepare for the market to return to a position of rationality.

This article was written by the team at Toroso Asset Management, a participant in the ETF Strategist Channel.

Click here to see disclosures.