As mentioned at the outset, only five months remain before the November election. As a guide to what the expected unemployment rate will be, we assume that the Civilian Labor Force continues to grow as it has in the recent past (the median gain over the past 24 months has been 177,000 per month). Armed with this data, we then can estimate the hypothetical civilian labor force at the time of the election by adding five months growth at 177,000 per month to the current totals. From there, the numerator of the calculation is a function of jobs added per month to arrive at the unemployment rate on election day.

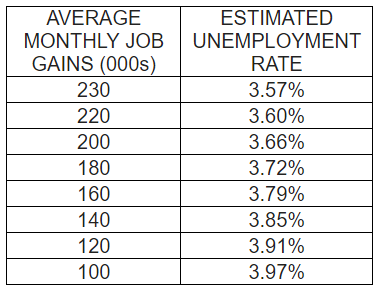

While one can argue that the recent jobs gains have been outsized for this late point in the economic cycle, the table below indicates that the average monthly employment gains would have to drop all the way down to around 140,000 per month, or 30% less than the average job gains over the past 6 months, to witness a reversal of the current 3.8% unemployment rate. On the other hand, maintenance of the levels achieved in the past month of 230,000 or more, would drop the unemployment rate below 3.6%. Better results than that (say a posted rate of 3.5% or lower) would push the unemployment rate down to levels not seen since mid- 1969.

![]()

When it comes down to areas important to voters, it is always economic issues that carry the day. As mentioned, concerns over the outlook of the economy have dissipated but that does not mean they have lost their importance. We have always felt that the NFIB Index of Small Business Optimism (see here) represented a terrific survey of how the country is doing. The NFIB has generated their monthly Index since 1986 (Quarterly data goes back to 1973) and we believe their answers are broader than polls as they regularly sample more than 20,000 businesses, as opposed a Pew or Gallup poll, which would typically question around 1,000 participants. Additionally, the NFIB data has the added benefit as their answers are usually devoid of political bias.

The last release of the NFIB Index in May witnessed a jump of 3.0 points to 107.8, which is the second highest reading in its 45-year history.

We believe the NFIB capsulizes the strength of small business very well as they noted in their published data that:

- Reports of compensation increases hit a 45-year record high

- Views about expansion are the most optimistic in survey history

- Reports of positive earnings trends at a survey record high

- Reports of positive sales trends are the highest since 1995

- Concerns about labor quality the second highest in survey history

- Reports of price hikes the highest since 2008 when oil was $140/barrel

- Plans of price hikes are the highest since 2008

Accordingly, there appears to be clear economic sailing through the November elections.

J. Richard Fredericks is founding partner at Main Management, a participant in the ETF Strategist Channel.

A pioneer in managing all-ETF portfolios, Main Management LLC is committed to delivering liquid, transparent and cost-effective investment solutions. By combining asset allocation insights with smart implementation vehicles, Main Management offers a unique approach that translates into distinct advantages for our clients, including diversification, cost efficiency, tax awareness and transparency. http://www.mainmgt.com