By Kimberly Woody

Senior Portfolio Manager

The markets seem distorted by forces for which we have no history. We are navigating pandemic(s), unprecedented fiscal and monetary intervention, worldwide inflation spurred by supply chain disruptions and general market volatility. That said, investors might have made that same quip – arguably driven by innovation rather than a global pandemic – at any time since at least World War I. The 20th century experienced repeated waves of modernization and economic evolution that likely knocked investors off their staid axioms. Despite decades of innovation, in looking back, we inexplicably find remarkably consistent market cycles.

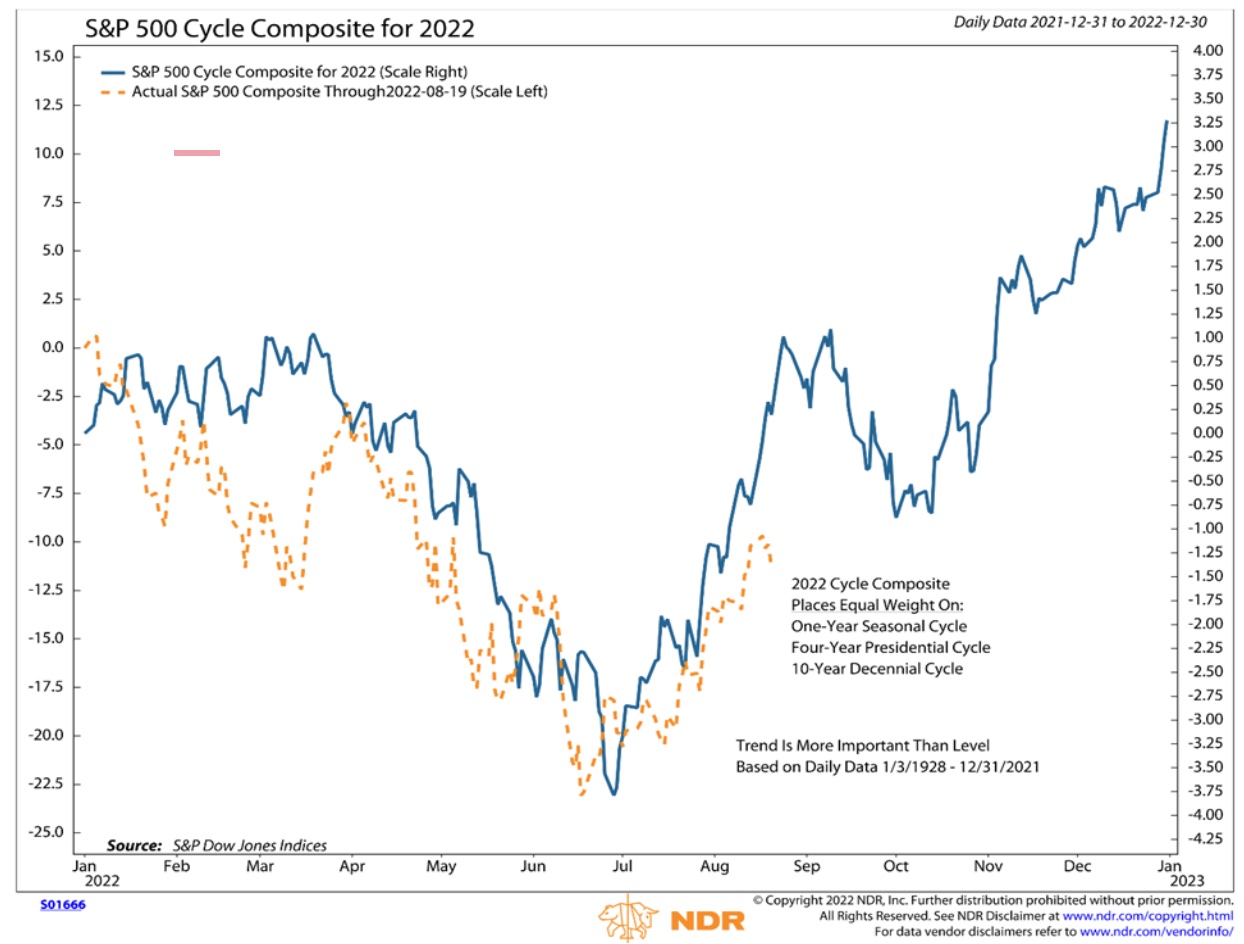

A cycle composite (in this case a one-year cycle) is calculated by finding the average percent change in the S&P 500 Index for each day of a calendar year, based on all years from 1928 to the present. Similar cycle composites are constructed for the four-year presidential cycle as well as the decennial cycle which typically bookend economic cycles. Much like technical analysis, cycle composite analysis suggests markets exhibit seasonality (the tendency for stock prices to behave differently during different times within a calendar year) and multi-year cycles have patterns that tend to repeat over time. These can be instructive as they offer insight into the potential direction of the market over the course of a year. It is important to note that the cycle composite is not structured to be accurate with regard to magnitude but is meant to be suggestive of directional bias.

The chart above paints a picture not dissimilar from what we’ve described in past Spotlights. The bad news appears to be digested, sentiment remains extremely negative, especially among individual investors, valuations have broadly corrected to more historically reasonable levels, corporate earnings have held up well, and the prevailing consensus is that the US is headed for recession. It is our belief that consensus often does not get it right. For the most part, recessions are not confirmed until the economy is on its way out of it and on to recovery. In our July newsletter, we viewed market participants as overly bearish.

Much like the overly bullish environment in which we ended 2021, we feel things are so extreme that the risks are potentially to the upside. With sentiment so negative, it would take little in the way of “less bad” news to provide some life to severely damaged markets.

While we’ve had a bit of a rally off the bottom from July levels, and we consider a pullback to be consistent with this sort of bear market rally, it’s not a stretch to make the case for a more sustained rally fueled by less bad economic news, short covering, and basic cycle behavior as shown in the cycle composite chart above.

For more news, information, and strategy, visit the ETF Strategist Channel.

GLOBALT is an SEC Registered Investment Adviser since 1991 and, effective July 10, 2013, remains a Registered Investment Adviser through a separately identifiable division of Synovus Trust N.A., a nationally chartered trust company. This information has been prepared for educational purposes only, as general information and should not be considered a solicitation for the purchase or sale of any security. This does not constitute legal or professional advice, and is not tailored to the investment needs of any specific investor. Registration of an investment adviser does not imply any certain level of skill or training. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information may be required to make informed investment decisions, based on your individual investment objectives and suitability specifications. Investors should seek tailored advice and should understand that statements regarding future prospects of the financial market may not be realized, as past performance does not guarantee and/or is not indicative of future results. Content may not be reproduced, distributed, or transmitted in whole or in part by any means without written permission from GLOBALT. Regarding permission, as well as to receive a copy of GLOBALT’s Form ADV Part 2 and Part 3, contact GLOBALT’s Chief Compliance Officer, 3400 Overton Park Drive, Suite 200, Atlanta GA 30339. You can obtain more information about GLOBALT Investments and its advisers via the Internet at adviserinfo.sec.gov, sponsored by the U.S. Securities and Exchange Commission. The opinions and some comments contained herein reflect the judgment of the author, as of the date noted. Investment products and services provided are offered through Synovus Securities, Inc. (SSI), a registered Broker-Dealer, member FINRA/SIPC and SEC Registered Investment Adviser, Synovus Trust Company, N.A. (STC), Creative Financial Group, a division of SSI. Trust services for Synovus are provided by STC. Regarding the products and services provided by GLOBALT: NOT A DEPOSIT. NOT FDIC INSURED. NOT GUARANTEED BY THE BANK. MAY LOSE VALUE. NOT INSURED BY ANY FEDERAL AGENCY