The Federal Reserve has started QE4 with huge injections into repo markets. Regardless of what you call it, upwards of 2 trillion dollars of bonds are due on their balance sheet over the next few years. They will either let their balance sheet unwind significantly or purchase more Treasury debt in some form. This is by no means a “don’t fight the fed” moment.

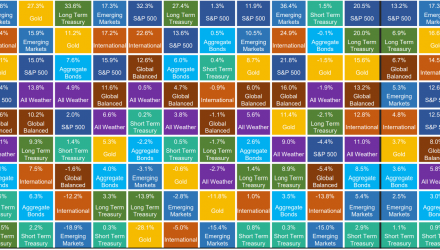

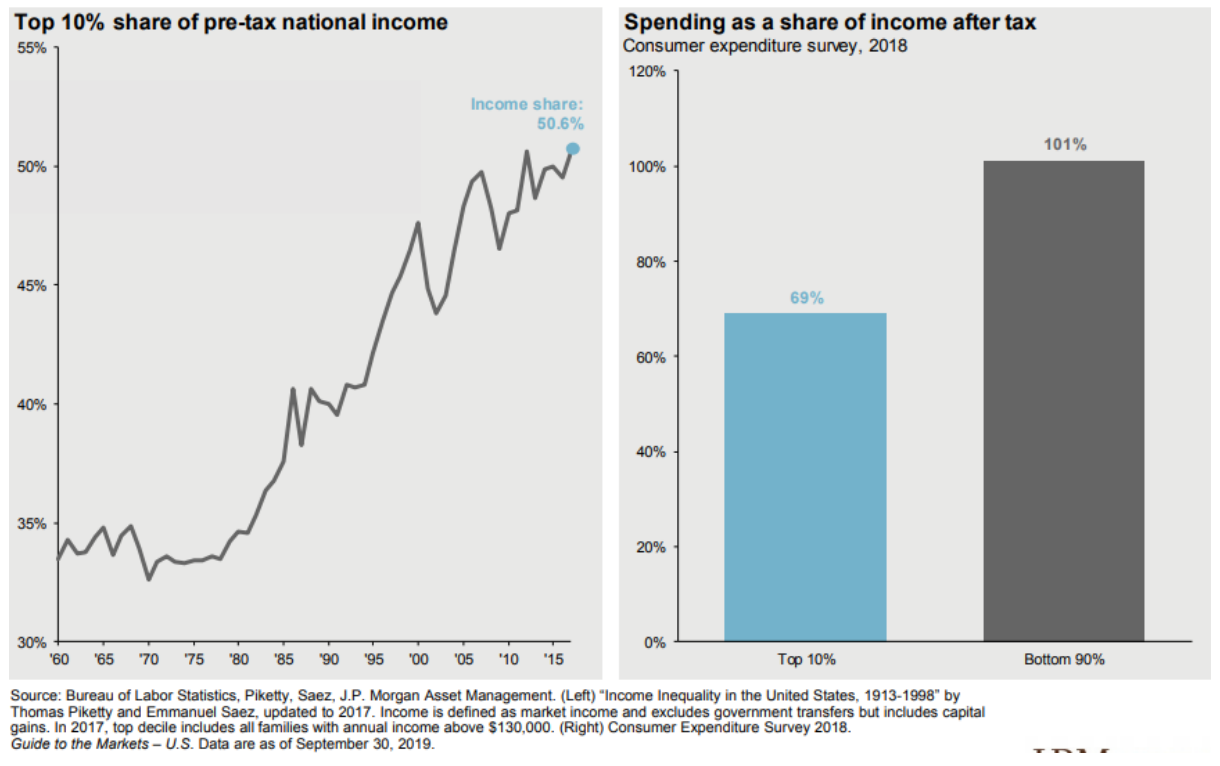

Global QE infusions, if thought of as a boxer throwing punches, are punching with much less force these days. The next important topic is politics. Toroso does not have a political perspective but, as with the Fed, politics drives markets, and will continue to do so for the foreseeable future in the US and globally. The story today is one of uncertainty. There has never been more policy uncertainty in the markets. Making economic judgements based on traditional market data is hard with so much uncertainty, which is why so many current commentaries are talking politics.

Global Economic Policy Uncertainty Index

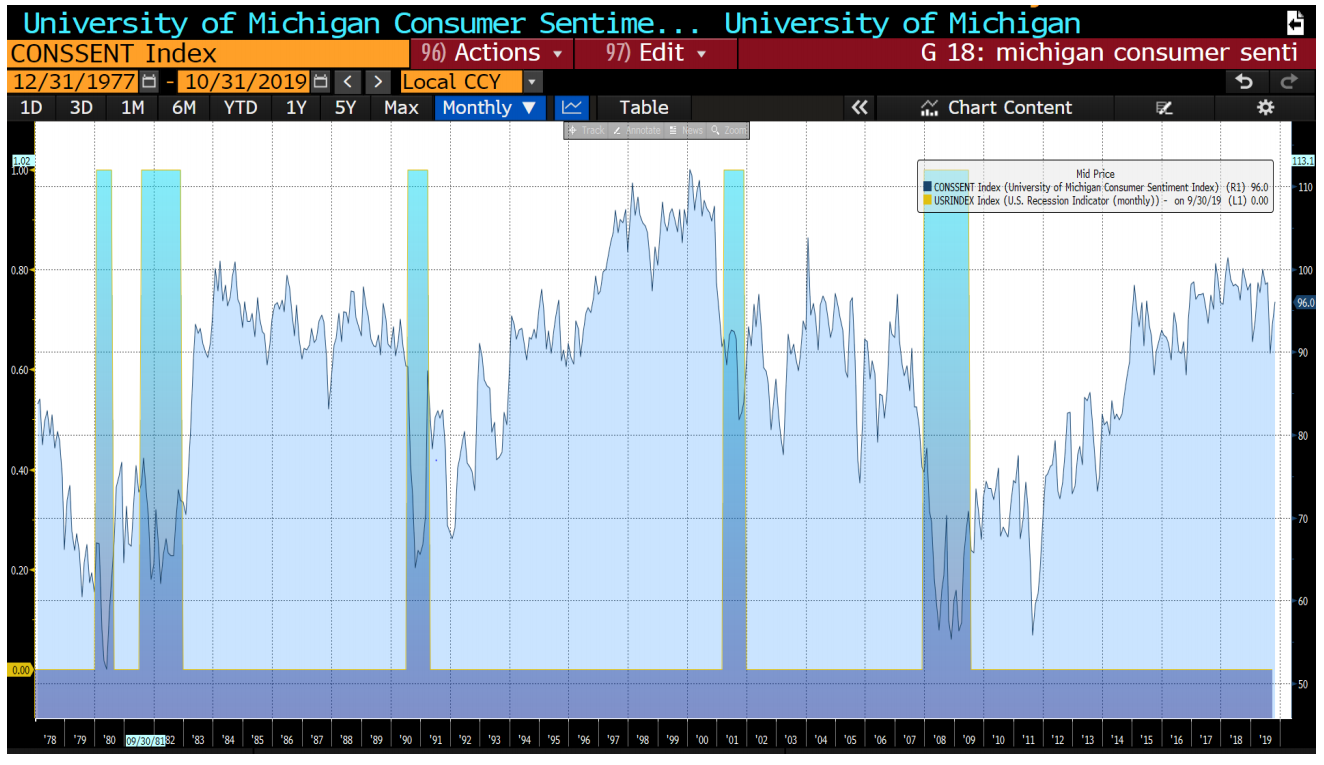

In our last few commentaries, we have discussed what recessionary signals we are watching, and the dangers of consensus. Primary indicators of an upcoming recession typically include an inverted yield curve (which exists now), and widening high yield credit spreads (not yet occurred in magnitude). We discuss the fiscal position of governments now levered up with massive balance sheets of their own debt, sometimes debt of high yielding companies in their region, and even outright equity ownership (Japan). We also discussed the exhausted state of the US consumer.

It seems like market pundits are always tying the day’s market movements to whatever economic release occurred with almost certainty. They speak almost as if it’s fact. The truth is much muddier. We can see how much the story matters in terms of trade talks. Just a hint of what’s to come one way or the other can send the market on a rollercoaster. A tweet by an executive of an NBA team caused tension between the US and China to rise even further (google Daryl Morey tweet), causing a huge economic cost for their league.

Some question the validity of QE and its actual effects on generating market stimulus. When the US began its QE cycle, the cycle’s actual long-term lasting effects were irrelevant (at least in the short run) – if people believed it would work, it would at least work for a period. Why? Because if a large enough percentage of the population believes the economy is due to grow and individuals expect to have future earnings growth, businesses invest and consumers purchase. When hope for the future declines and economic uncertainty exists, businesses invest less, and consumers spend less. Fiscal currency follows a similar need for belief, which some believe crypto-assets are trying to topple. At the end of the day it’s just paper, but enough of us believe its worth is beyond its cost of production.

We’d like to discuss 3 books on the Toroso investment team’s reading list. Sapiens, Homo Deus (both books by Yuval Noah Harari), and Talking to Strangers (by Malcom Gladwell). We won’t do a full review of course, just comment on some relevant information for the purposes of this commentary.

Sapiens & Homo Deus

According to Harari, homo sapiens conquered the world because of their unique language and ability to communicate.

Homo sapiens are the only creatures capable of discussing things never seen, touched or smelled (think religions, myths, fantasies and legends). These stories allow large scale collaboration in extremely flexible ways. Many species (including other sapiens) can’t live in social circles larger than 50 because of the difficulty communicating and coordinating in such large numbers. An imagined reality is not a lie if enough people believe it. Since the beginning of the cognitive revolution between 30 and 70,000 years ago, humans have been able to live in dual reality: the physical reality and the imagined reality. Homo sapiens would adapt their behavior as soon as their communal belief had shifted, without needing evolutionary genetic changes. Shared narratives are what allowed homo sapiens to collaborate at large scale. In the middle ages, the story of Catholicism brought together many European nations. Recently there has been a shift towards humanism. While there are many variants of humanism the most common is Liberalism. Liberalism allows us to express humanism but translating ideas into moral codes, laws, and political aspirations. Campaigns for climate awareness & less waste are coming into favor. This also ties into modern day business trends, ESG movements, and the creation of the LLC, which shifts theoretical responsibility off of an individual or family (“ruling class”) to the company itself.

Talking to Strangers

Thankfully, no one has yet issued debt with a negative coupon (could be a good way for the US to refill social security?). So what is negative yielding debt then? A bond priced so high, that even after a series of coupon payments and return of principal, the bond holder will receive less than they paid for the bond. If you expect us to now outline why this makes sense for anyone other than a central bank to hold you we apologize for disappointing you. Odds are one of your bond issuance cap index funds may hold some. There is a whole lot of it (see bloomberg chart below).

You might expect that evolution has given us the ability to tell when someone is lying, but it turns out evolutionary need for communal belief was more important than assessing the validity of one’s story, all the time. In Talking to Strangers, Gladwell reviews the deceptions of many characters, arguing that the way in which we go about making sense of people is flawed; especially for those hard to understand, from Sandra Bland to Bernie Madoff.

Whether it’s a Federal Reserve announcement, quarterly guidance from a company, or never-ending tariff talks, market movements are much more tied to how we interpret stories than most are willing to let on. Freakonomics Radio, a popular non-traditional economics podcast, has gone as far as claiming Brexit may have occurred due to poor marketing. How can that be? The two messages delivered to citizens of the UK were “remain” and “independence.” With the decision coming down to such a small margin, they speculate that if the slogans were “unite” and “independence,” it would have been enough of a marketing push (because “unite” spurs more enthusiasm and action than “remain”) to avoid Brexit all together. Some claim Trump’s victory was won in the marketing department as well. But it shows how markets, economies, and humans can often be random. In the day of social media, anyone has a voice, as evidenced by Daryl Morey, and their words have implications far greater than probably any one can fully interpret. Trying to pinpoint where or when the next market ripple will

occur is irrational.

Unicorns

Depending on which source, an investment bank or news outlet, is fueled by expensive PR, WeWork’s potential valuations ranged from $47 to $60 billion. At this point, WeWork appears to soon be mostly owned by SoftBank with valuations discussed in the $8-10 billion dollar range. Google raised $400 million in private markets, Facebook $1.4 billion. WeWork raised $14 billion (and going). Quantitative Easing has absolutely played a role in this.

WeWork lost upwards of 50 billion dollars of value because the story changed, as did the story teller. For years, the story of WeWork or its value was dictated by basically two individuals, Adam Neuman (co-founder of WeWork), and Masayoshi Son (SoftBank), and the help of a massive PR team (telling stories). The effects alone of having a $100 billion fund were felt far beyond WeWork. When a check minimum might be as high as $100 million (because below this is less than 0.1% of the overall portfolio), and you are buying shares from employees left and right, you are single handedly boosting sky-high San Francisco real estate markets even higher. The market impacts of WeWork have yet to be seen, as it will likely affect how future startups approach growth stages and how investors value them. But the story changed (and we can’t always trust our story tellers!).

We fear too much value is placed on the backs of individuals deemed visionaries. This is a difficult statement for us to say, as our firm has often believed owner-operator businesses are the ones most likely to achieve significant growth bypassing needs for quarterly validation in exchange for true growth. In the age of social media, these visionaries need to be spokesmen as well. How would Amazon have fared if Jeff Bezos was 15 years younger, started his empire 15 years later, and needed the twitter persona of Elon Musk to continue burning piles of cash in the name of growth in the early years?

How would Elon Musk do today if he didn’t have hair plugs? The story and images we craft matter.

How private markets fund and attempt to exit their Unicorns is shifting. For quite some time Kathy Woods of ARK Investments has commented on how inflated private market valuations were relative to some smaller and microcap, unicornlike companies in public markets. We often discuss the irrationalities of market classifications such as traditional sectors and geographic breakdowns. We do believe the exceptional growth in the thematic ETF space has found unique ways to capture potential growth areas of the market, albeit with significantly increased Beta.

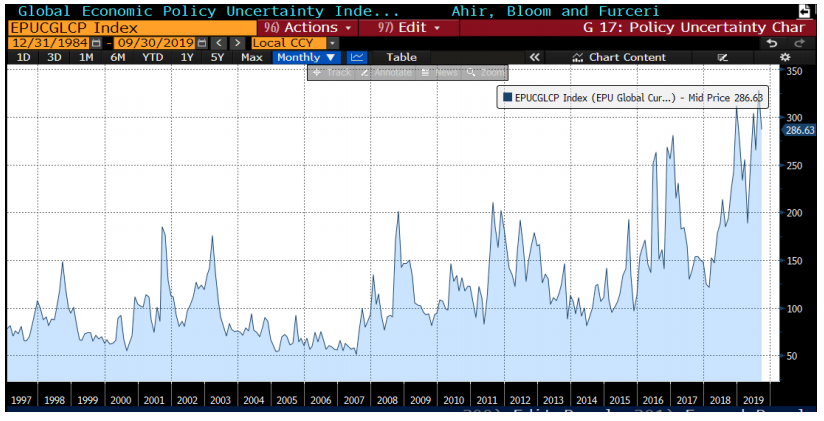

As we mentioned on the onset of this commentary, we are currently in a state of heightened global geopolitical & political uncertainty. Tensions between borders and within borders are high across the globe. This has led to a sharp downturn in business investment as year over year change in cash spending (capex, R&D, cash M&A, buybacks and dividends) fell by 13%, the most we’ve seen in over 2 years.

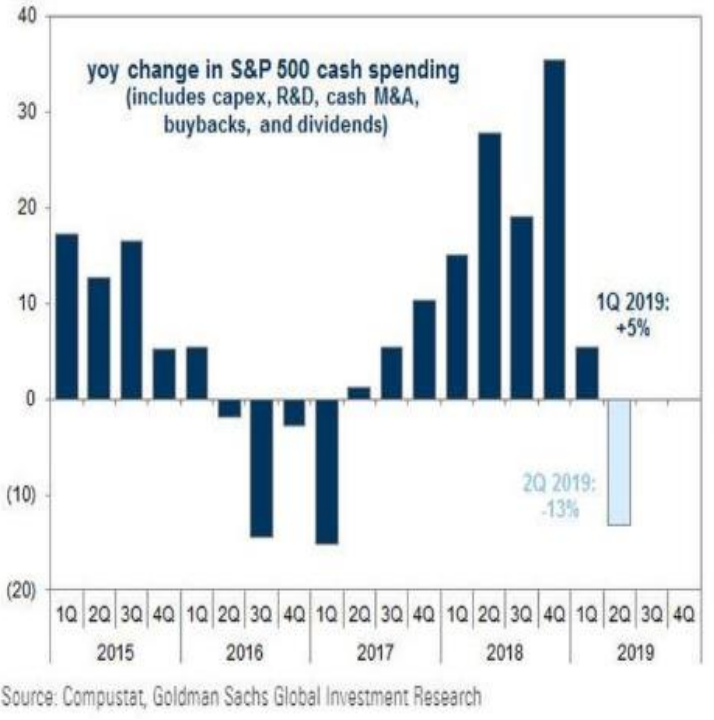

In their most recent economic release, JP Morgan shows just how stretched the average consumer is.

The bottom 90% of US consumers (based on pre-tax income) spent 101% of their income, and the only ones saving anything are the top 10%. They also equate this to asset bubbles seen in markets such as real estate and sports franchises. So where is the consumption growth going to come from? Consumer sentiment is still relatively high but we’ll be watching that closely to see if it starts to roll over as signs of trouble, especially heading into holiday spending season.

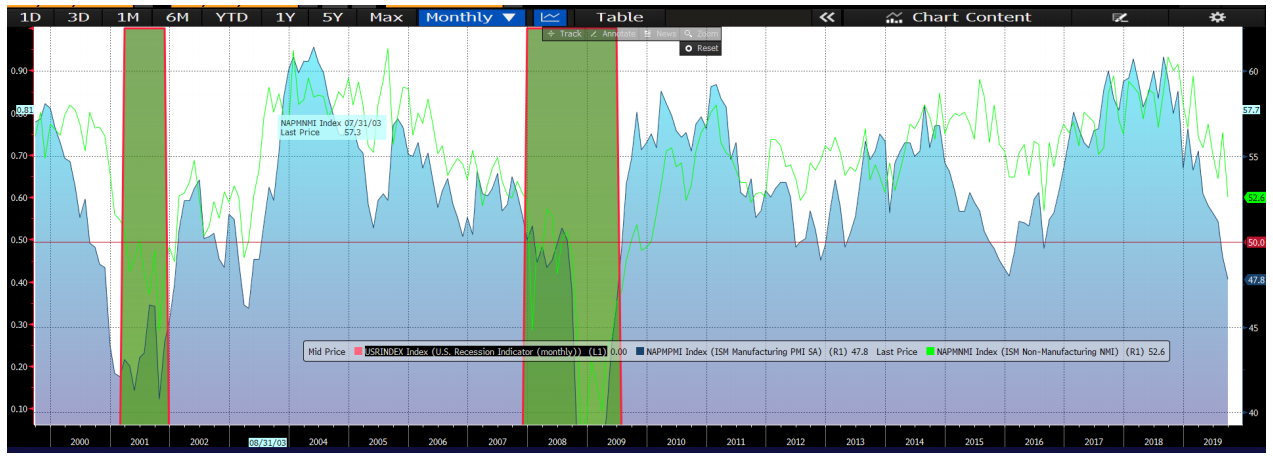

Because of all of the unknowns, businesses have invested less, and manufacturing is also beginning to slow. You can see below ISM Manufacturing, and non-manufacturing PMI. Below 50 is contractionary. ISM Manufacturing, at below 50, is at its lowest point since the last recession, while non-manufacturing is still above 50.

It’s important that we remember that the market is not the economy (and vice versa). One going up in today’s geared markets does not necessarily mean the other one will follow, and the same is true for the way down. The biggest buyers of US stocks are still their own companies (buybacks) fueled by debt made available at lower than normal rates due to quantitative easing. A run up in equity markets between now and the end of the year is not out of the question, as so many seem to be waiting for the “big one.” Until it occurs, markets may continue their upwards trajectory.

The market is top heavy and uncertainty is ripe. When looking at overlap between the iShares S&P 100 (OEF) and the iShares Total market S&P 1500 (ITOT), the two have 53% overlap. Of the 1500 names in ITOT, 53% are allocated to the top 100 names.. We continue to shift further away from traditional market-cap weighted equities and fixed income, in favor of portfolio wide barbell approaches of slightly lower risk on a portfolio level with unique, high active share exposure in both equities and fixed income. There are many ways to achieve this. High beta thematic, passively-active, or active ETFs can provide the necessary active share to add some upside to your portfolio in the coming months, especially if you are decreasing equity or increasing negatively correlated assets.

If you take anything from the non-traditional method of this commentary, just know the story is often more powerful than the economy itself. It appears as fact in the rear-view mirror but is truly random almost all of the time. The story today is very much tied to politics, and is one of uncertainty. Few have high hopes on the economic prospects of the coming 24 months. If we are wrong it may be due to the protectionism movement currently circling the globe being unwound, but similar to Brexit & US elections, we won’t be the pundits

displaying absolute certainty one way or the other, and instead we plan for both.

US Equities

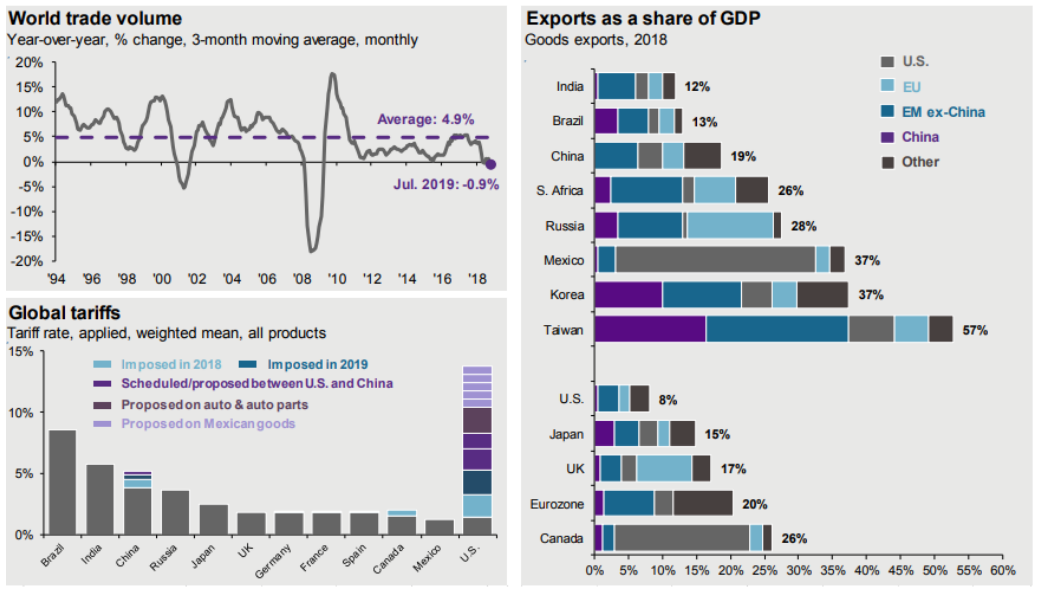

World Trading volume is negative for the first time since the recession, as shown above. Additionally, you can see why US equities may be faring better than most in the uncertainty. Exports as a share of GDP are only 8% for the US. The opposite would benefit if trade talks were actually ever concluded.

World Trading volume is negative for the first time since the recession, as shown above. Additionally, you can see why US equities may be faring better than most in the uncertainty. Exports as a share of GDP are only 8% for the US. The opposite would benefit if trade talks were actually ever concluded.