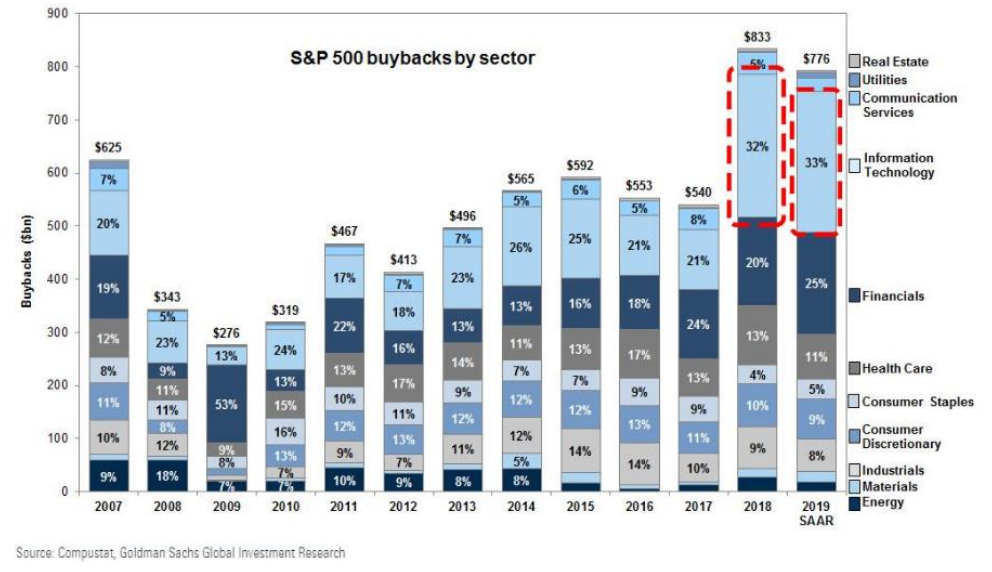

Technology has become the ultimate buyback king as of late, which is interesting in that it’s occurring at the later stages of such a significant tech rally. Value stocks outperformed growth over the third quarter, as the iShares S&P 500 Value ETF (IVE) outpaced iShares S&P 500 Growth ETF (IVW) by 2.10% for the quarter. iShares Total US ETF (ITOT) was up 1.4% for the quarter and 20.03% for the year. Value hunters are licking their chops in the small cap space as the only remaining inexpensive US market segment left from a fundamental perspective. We continue to favor non-traditional weighting methodologies such as Exponential Reverse Cap ETF (RVRS).

International Equities

International Developed Equities continue to appear cheap with minimal growth prospects. It’s hard to get excited about a fundamental play in Nestle. Brexit talks add uncertainty to the region and provide another barrier for longer-term business investment. We increasingly prefer to access this asset class through thematic ETFs with allocation in the region or active managers with high active-share. iShares MSCI EAFE ETF (EFA) returned -1.12% for the quarter and is up 12.8% for the year.

Emerging Markets

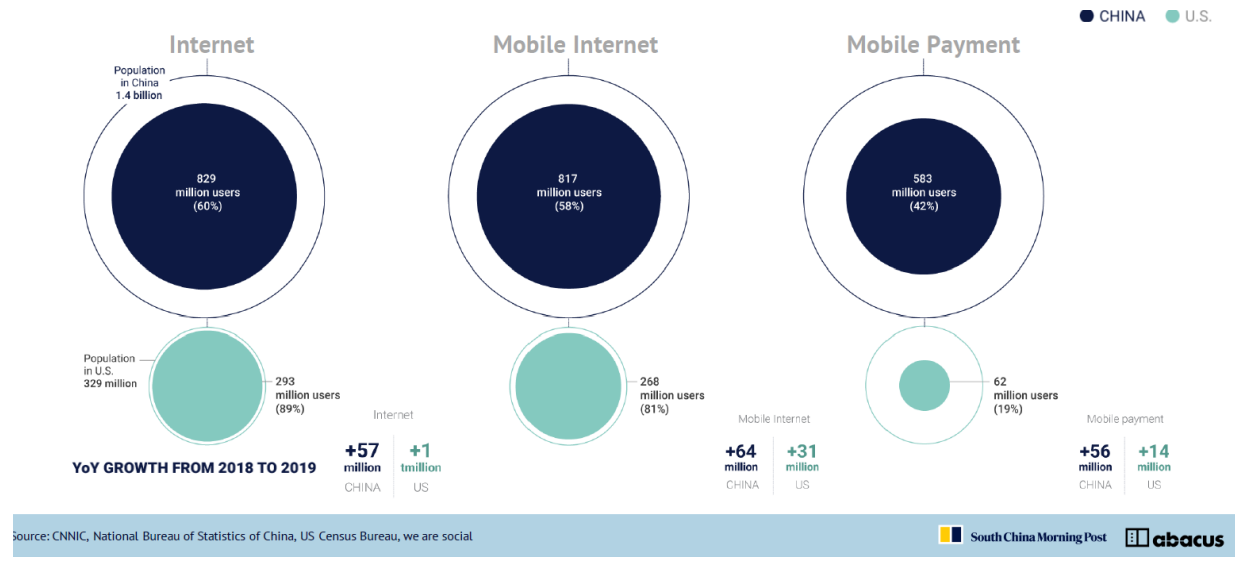

iShares Emerging Markets (EEM) was down -4.43% for the quarter, up 5.36% year to date. Emerging markets continue the seesaw of ongoing trade tariffs. Let’s look at the bigger picture. China had almost 60 million NEW internet users in the last year, and only 60% of their population is currently online. The US had 1 million new users, and 89% of our population is online. We have 293 million users vs their 829 million. We have a total population of 329 million, and they added 60 million internet users (18.24% of our population). Most agree that the intellectual property war is not likely to be solved anytime soon. Chinese companies will be servicing a massively growing user base, and those companies, while exceptionally volatile, will be some of the growth engines of the next decade.

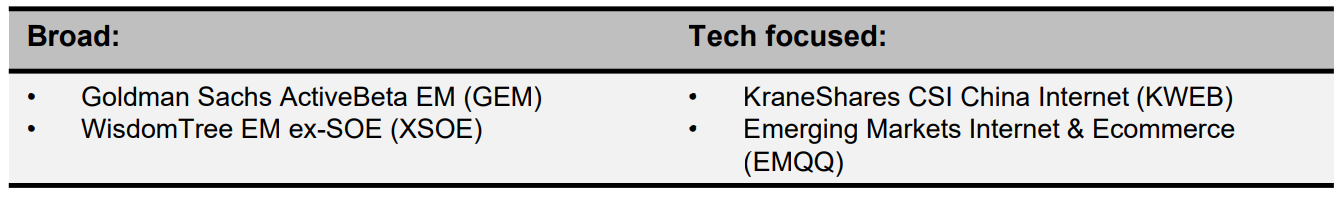

We recently built a tool for a client that shows the percentage of a portfolio associated with state-owned enterprise stocks, and often seek to minimize that exposure within the emerging market equity allocation in favor of some of their tech plays.

Here are a few ETFs we like in the space:

Fixed Income

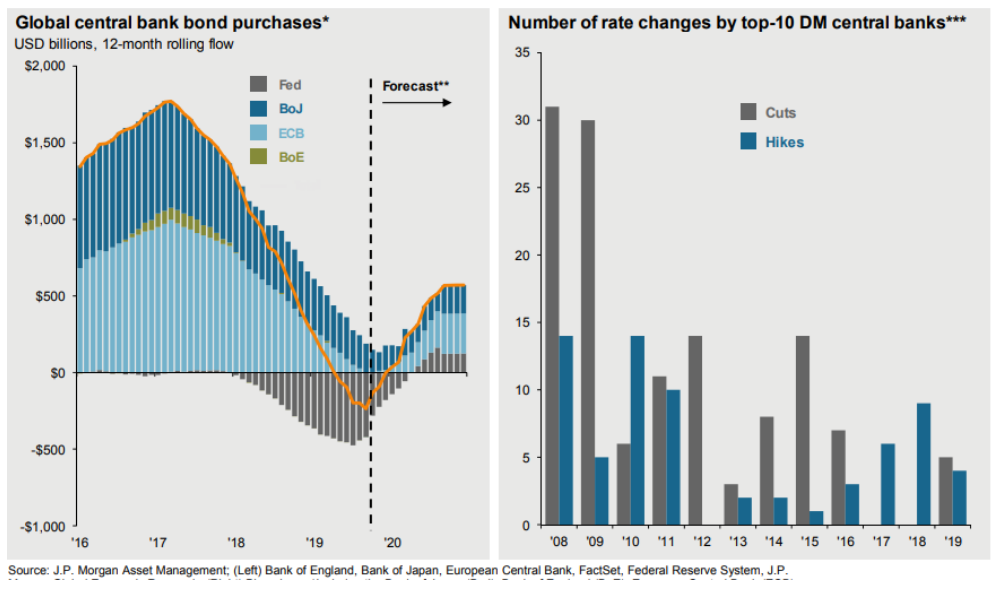

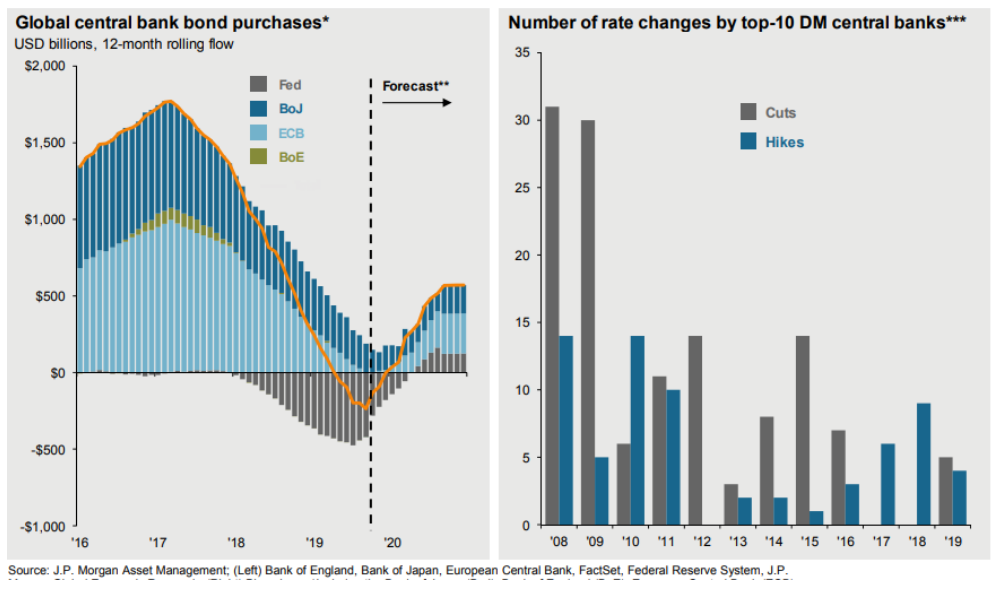

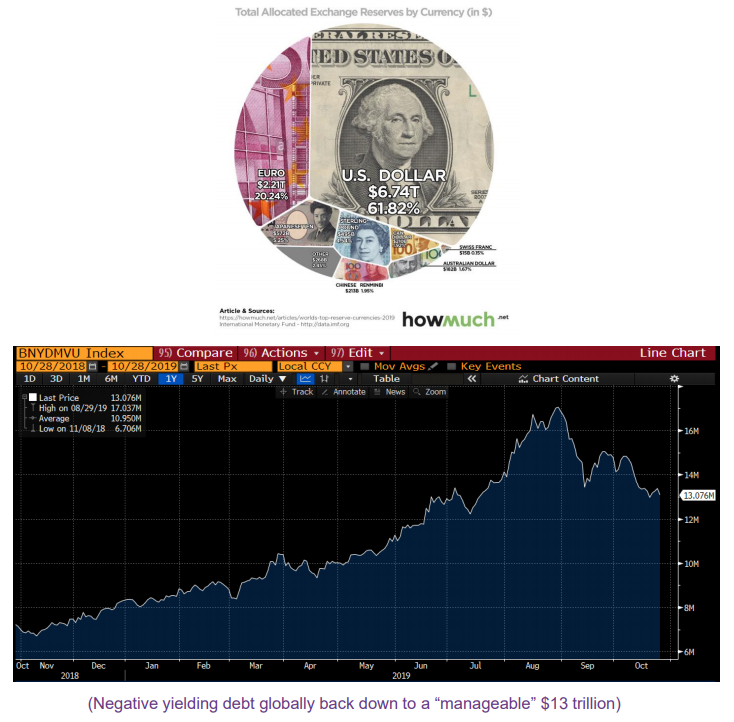

Global quantitative easing is back. Rate cuts have surpassed hikes in the top 10 DM Central Banks, and long-term US rates (for now) are en vogue as no European bond manager can rationalize allocating new capital to negative yielding debt (they’ll leave that to the ECB and the indexes). We have yet to see what new form of quantitative easing will be engineered coming out of the next recession. Credit spreads are still tight and we continue to recommend a barbell approach to this space.

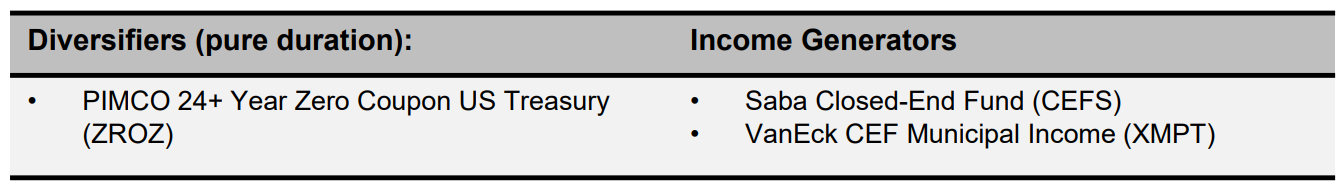

Broad fixed income has had a strong year lead by its ever-increasing duration as the iShares Barclays Agg ETF (AGG) returned 2.27% for the quarter, and is up 8.51% for the year. Here are a few ETFs we like in the space.

Alternatives

SPDR GoldShares ETF (GLD) returned 5.31% for the third quarter and is up 15.55%. Crypto assets have not fared as well.

We continue to see upside in nontraditional assets such as gold and crypto. The need for true portfolio diversifiers such as AGFiQ Market Neutral Anti-Beta ETF (BTAL) has never been greater (up 8.36% for the quarter, after being down a bit in the first half). If you seek more structural fixed income hedges, a look at Quadratic Interest Rate Volatility and Inflation ETF (IVOL) is definitely worthwhile.

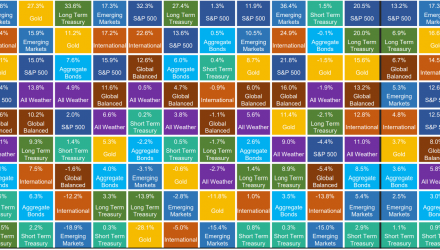

Source: Morningstar Direct. Data as of September 30, 2019

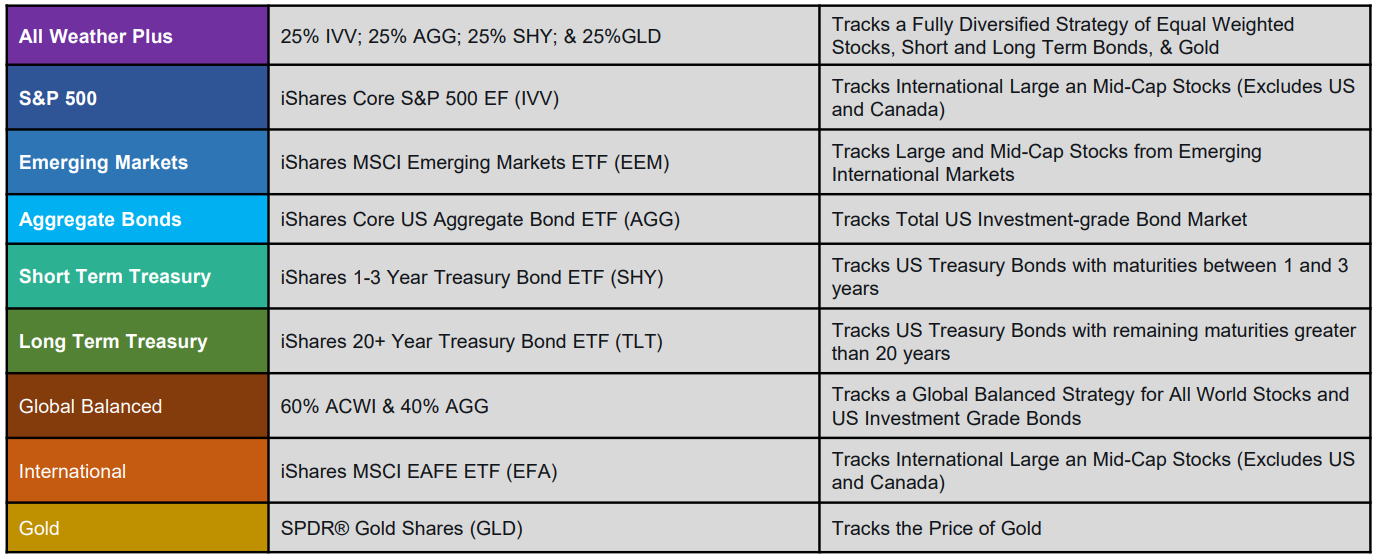

S&P 500’s performance is almost double that of the next category over the last decade. And emerging markets struggled for positive returns. We would bet on an unwind of that over the next 10 years. US equities have led all broad equity regions every year since 2012, with the exception of 2017.

S&P 500’s performance is almost double that of the next category over the last decade. And emerging markets struggled for positive returns. We would bet on an unwind of that over the next 10 years. US equities have led all broad equity regions every year since 2012, with the exception of 2017.

CONCLUSION

We continue to recommend a barbell approach to risks within asset classes (think equities and fixed income), and for the entire portfolio. The names below are definitely more volatile than traditional broad indexes, but we see more and more value in seeking the non-traditional in these markets.

High active Share ETFs to consider with a decrease in overall portfolio risk weighting:

• Davis Select Worldwide (DWLD)

• Robo Global Robotics & Automation (ROBO)

• Sofi Gig Economy (GIGE)

• ARK Genomic Revolution (ARKG)

• iShares Evolved Discretionary Spending (IEDI)

• iShares Evolved Financials (IEFN)

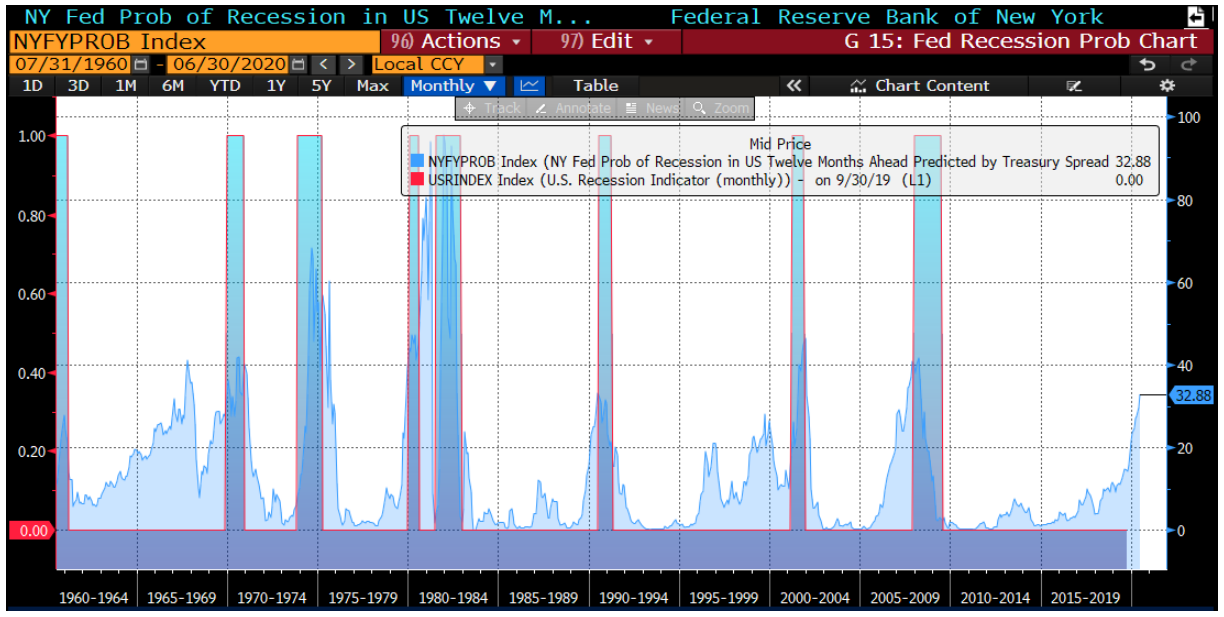

NY Fed Probability of Recession in US next twelve months overlaid with past recessions.

S&P 500’s performance is almost double that of the next category over the last decade. And emerging markets struggled for positive returns. We would bet on an unwind of that over the next 10 years. US equities have led all broad equity regions every year since 2012, with the exception of 2017.

This article was contributed by the team at Toroso Investments, creators of the ETF Think Tank and a participant in the ETF Strategist Channel.

Click here to see disclosures.

Disclaimer: This commentary is distributed for informational and educational purposes only and is not intended to constitute legal, tax, accounting or investment advice.

Nothing in this commentary constitutes an offer to sell or a solicitation of an offer to buy any security or service and any securities discussed are presented for illustration purposes only. It should not be assumed that any securities discussed herein were or will prove to be profitable, or that investment recommendations made by Toroso Investments, LLC will be profitable or will equal the investment performance of any securities discussed. Furthermore, investments or strategies discussed may not be suitable for all investors and nothing herein should be considered a recommendation to purchase or sell any particular security.

Investors should make their own investment decisions based on their specific investment objectives and financial circumstances and are encouraged to seek professional advice before making any decisions. While Toroso Investments, LLC has gathered the information presented from sources that it believes to be reliable, Toroso cannot guarantee the accuracy or completeness of the information presented and the information presented should not be relied upon as such. Any opinions expressed in this commentary are Toroso’s current opinions and do not reflect the opinions of any affiliates. Furthermore, all opinions are current only as of the time made and are subject to change without notice. Toroso does not have any obligation to provide revised opinions in the event of changed circumstances. All investment strategies and investments involve risk of loss and nothing within this commentary should be construed as a guarantee of any specific outcome or profit. Securities discussed in this commentary and the accompanying charts, if any, were selected for presentation because they serve as relevant examples of the respective points being made throughout the commentary. Some, but not all, of the securities presented are currently or were previously held in advisory client accounts of Toroso and the securities presented do not represent all of the securities previously or currently purchased, sold or recommended to Toroso’s advisory clients. Upon request, Toroso will furnish a list of all recommendations made by Toroso within the immediately preceding period of one year