As the markets sold-off in February with the steep rise in option volatility, there was an exceptional amount of VIX futures purchased, which potentially contributed to the sell-off in S&P futures during that time. The lack of liquidity for VIX futures in the after-market session highlighted the “fragility” of these types of strategies which suffered steep losses. In and of itself, shorting volatility is not a “bad” thing and there are numerous studies and strategies that employ risk premium harvesting to add incremental returns to portfolios. However, shorting volatility while using excessive leverage can quickly become challenging to manage under times of market duress.

A Regime Change?

And what about realized volatility? Well, realized volatility spiked as well. Risk premia harvesting strategies are based on the premise that over time implied volatility trades higher than what is actually realized in the underlying market. The early February move lower, by one metric, was one of the largest 5-day percent increases in history. The only other times that witnessed greater 5-day realized volatility percentage increases were May-1940, German blitz; May-1948, Israel independence declared; and October-1987, Black Monday crash (Source: Bank of America Merrill Lynch).

What does all this mean going forward? In previous writings, we’ve made the case that volatility tends to trade in “regimes”—i.e., low-vol, mid-vol, and high-vol environments. Undoubtedly, 2017 was a low-vol regime. However, a tremendous amount of short-gamma is now out of the market. The catalysts for another spike in the VIX of the likes just witnessed have been diminished, at least in the near-term. Market sell-offs from this point should be more “orderly” in keeping the VIX in its new volatility regime.

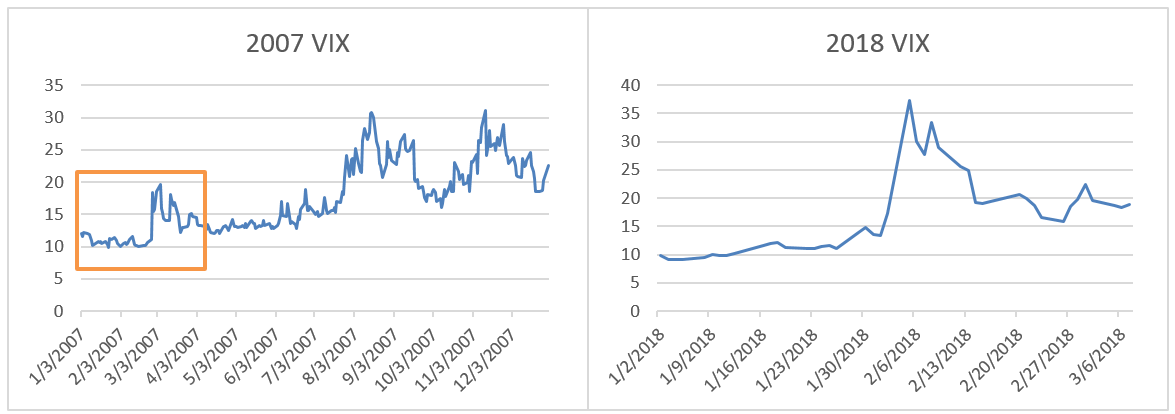

As we can see from the graphs below, the start of 2018 for the VIX looks quite similar to that of 2007 when the 2004–2006 low volatility period came to an end.

Throw in tax cuts, tariffs, and possible trade wars, don’t expect the VIX to see single digits anytime soon.

Chris Hausman, CMT, is Director of Risk Management and Chief Technical Strategist for Swan Global Investments, a participant in the ETF Strategist Channel.

Important Notes and Disclosures:

Swan Global Investments, LLC is a SEC registered Investment Advisor that specializes in managing money using the proprietary Defined Risk Strategy (“DRS”). SEC registration does not denote any special training or qualification conferred by the SEC. Swan offers and manages the DRS for investors including individuals, institutions and other investment advisor firms. Any historical numbers, awards and recognitions presented are based on the performance of a (GIPS®) composite, Swan’s DRS Select Composite, which includes non-qualified discretionary accounts invested in since inception, July 1997, and are net of fees and expenses. Swan claims compliance with the Global Investment Performance Standards (GIPS®).

All Swan products utilize the Defined Risk Strategy (“DRS”), but may vary by asset class, regulatory offering type, etc. Accordingly, all Swan DRS product offerings will have different performance results due to offering differences and comparing results among the Swan products and composites may be of limited use. All data used herein; including the statistical information, verification and performance reports are available upon request. The S&P 500 Index is a market cap weighted index of 500 widely held stocks often used as a proxy for the overall U.S. equity market. Indexes are unmanaged and have no fees or expenses. An investment cannot be made directly in an index. Swan’s investments may consist of securities which vary significantly from those in the benchmark indexes listed above and performance calculation methods may not be entirely comparable. Accordingly, comparing results shown to those of such indexes may be of limited use. The adviser’s dependence on its DRS process and judgments about the attractiveness, value and potential appreciation of particular ETFs and options in which the adviser invests or writes may prove to be incorrect and may not produce the desired results. There is no guarantee any investment or the DRS will meet its objectives. All investments involve the risk of potential investment losses as well as the potential for investment gains. Prior performance is not a guarantee of future results and there can be no assurance, and investors should not assume, that future performance will be comparable to past performance. All investment strategies have the potential for profit or loss. Further information is available upon request by contacting the company directly at 970–382-8901 or www.swanglobalinvestments.com.