By Gary Stringer, Kim Escue and Chad Keller, Stringer Asset Management

Executive summary

Traditional stock and bond market investing provides a solid foundation to an investment portfolio. However, the addition of another low correlated asset class that we call “alternative investments” can take your asset allocation to the next level. Using alternatives can increase diversification, dampen volatility, and provide access to non-traditional markets to enhance returns. Navigating the space can be daunting for individual investors, but ETFs have now made alternative investments more accessible, transparent, and liquid. As always, proper due diligence is important in order to sidestep potential landmines.

At Stringer Asset Management, we have been investing in the alternative investments space using ETFs for over a decade. Our expectations for the current market environment of relatively muted market returns with greater volatility makes this one of the best opportunities, in our opinion, to use alternative investment ETFs if done so properly. We focus on creating a basket of alternatives to provide liquidity and diversification to the other asset classes, along with the potential for risk reduction. When done correctly, this basket can help investors achieve an attractive rate of return with potentially less volatility than the traditional equity market and less interest rate risk than traditional bond investments. Even better, the evolution of the ETF universe allows investors to access alternative investment solutions through low-cost and liquid ETFs without the tax filing headaches associated with K-1s

WHY ALTERNATIVES IN THIS ENVIRONMENT?

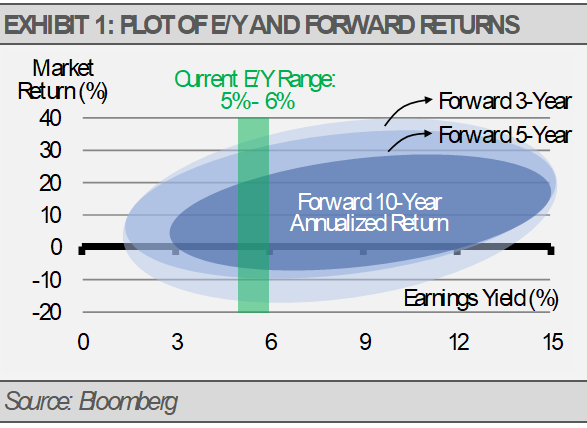

We expect slower corporate revenue and earnings growth ahead as the current business cycle evolves, which creates uncertainties in both the equity and bond markets. Furthermore, with equity market valuations stretched and interest rates low, our expectations for future investment returns have declined. In short, we think returns over the next 10-years returns are not likely to be as strong as the previous 10-years.

The earnings yield is one of the more impactful equity market valuation data points that we use in developing our expectations. The basic form of the earnings yield is defined as the earnings per share divided by the current stock price. It is also the inverse of the price-to-earnings ratio. We can compare the earnings yield of a broad index, such as the S&P 500 Index, to other yields and its own history, to get a sense of how we stack up today through relative valuations

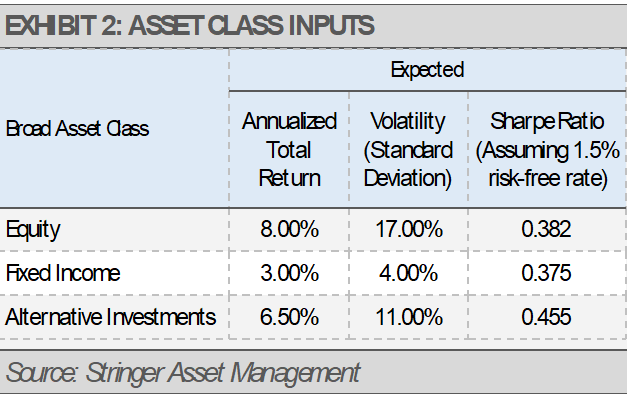

Slower revenue growth combined with increased wage pressure will likely squeeze corporate margins and put a ceiling on earnings growth. Because the rate of earnings growth may decline while equity market valuations are near the high end of their historical range, we expect that equity market gains will be harder to achieve. As a result, we expect an annualized total return for the global equity market in the years ahead of roughly 8%. However, we expect a significant level of volatility in the equity market as well, so we forecast a standard deviation of about 17%. Meanwhile, we expect a total return for the broad domestic investment grade bond market of 3% going forward. Since bonds tend to have some level of volatility associated with their prices, we think that a standard deviation of about 4% is reasonable for bonds.

Our work suggests that a well-diversified basket of alternative investments can earn a total return of approximately 6.5% over the long-term and we anticipate a standard deviation of approximately 11% around that return. With those inputs in mind, we can create a risk/return matrix across the three broad asset classes as follows.

Therefore, we expect the most attractive risk-adjusted returns, as measured by the Sharpe Ratio, from the alternative investments space. In addition to attractive risk-adjusted returns, alternative investments tend to have a relatively low correlation to the other two broad asset classes. This correlation benefit can also reduce overall portfolio risk. However, it is also important to think about exposures within an alternative investment basket.

WHAT TYPES OF ALTERNATIVE STRATEGIES WORK IN THIS ENVIRONMENT?

We view the alternatives universe as basically everything except traditional long-only equity securities and the core fixed income sectors as represented in the Bloomberg Barclays Aggregate Bond Index. Importantly, alternative strategies contain not only the risks associated with traditional equity and fixed income markets, but also many other types of unique risks that an investor should consider. For instance, we think that slower global economic growth reduces demand growth for commodities, such as industrial metals, natural gas, and oil. As a result, the prices of many commodities may stagnate, so investors may want to limit exposure to those areas of the alternative investments universe. Currently, we think investors should focus on the following U.S dollar-based assets that can thrive in an environment of heightened volatility while also offering relatively stable yields.

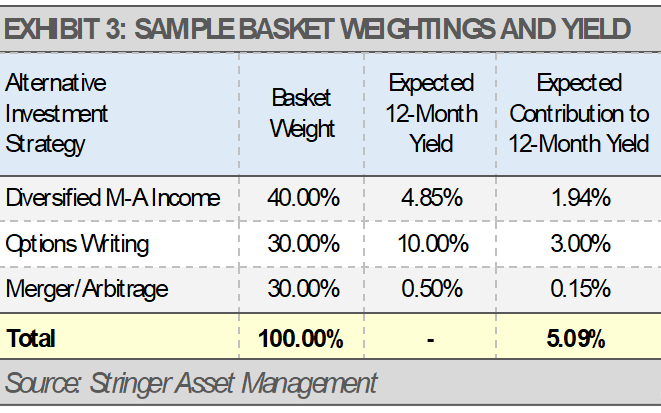

» Diversified Multi-Asset Income: These strategies can offer a blend of income producing assets, such as mortgage REITs, preferreds, MLPs, and high-yield bonds. They are diversified blends that offers relatively consistent returns, primarily through an attractive yield, and potentially low correlation to the traditional stock and bond markets.

» Options Writing: These strategies typically profit from a higher volatility regime by selling call options on an index. As volatility increases, so does the potential options premium. Additionally, many of these strategies reinvest the premium it receives to potentially increase the fund’s net asset value over time.

» Merger/Arbitrage: These strategies have a history of solid performance in volatile equity environments because of their ability to short equities. Merger/arbitrage investments generally make their returns based on the price differentials between companies being acquired and those doing the acquiring.

The following exhibit is an example of how an investor might allocate these strategies to create a basket of alternative investments. The expected current yield on this basket should get an investor a long way towards our long-term total return expectation of 6.5% for the basket with significantly less volatility than the equity market and less interest rate risk than the traditional bond market.

Importantly, because investors can use ETFs, these alternative strategies offer intra-day liquidity, rather than the longer holdings periods required by many alternative investment vehicles. Furthermore, many of the alternative ETFs are subject to 1099 tax reporting and not the more complicated K1s. Lastly, using ETFs should be less expensive than hedge funds or even the average alternative mutual fund. Combined, a well thought out allocation of alternative investment ETFs can offer an attractive risk-adjusted total return, a healthy income stream, less risk than the equity market, and efficient tax reporting in a low-cost product. This type of allocation may be a great solution in today’s shifting economic and market environment.

This article was written by Gary Stringer, CIO, Kim Escue, Senior Portfolio Manager, and Chad Keller, COO and CCO at Stringer Asset Management, a participant in the ETF Strategist Channel.

DISCLOSURES

Any forecasts, figures, opinions or investment techniques and strategies explained are Stringer Asset Management, LLC’s as of the date of publication. They are considered to be accurate at the time of writing, but no warranty of accuracy is given and no liability in respect to error or omission is accepted. They are subject to change without reference or notification. The views contained herein are not be taken as an advice or a recommendation to buy or sell any investment and the material should not be relied upon as containing sufficient information to support an investment decision. It should be noted that the value of investments and the income from them may fluctuate in accordance with market conditions and taxation agreements and investors may not get back the full amount invested.

Past performance and yield may not be a reliable guide to future performance. Current performance may be higher or lower than the performance quoted.

The securities identified and described may not represent all of the securities purchased, sold or recommended for client accounts. The reader should not assume that an investment in the securities identified was or will be profitable.

Data is provided by various sources and prepared by Stringer Asset Management, LLC and has not been verified or audited by an independent accountant.

Statistical Definitions:

Sharpe Ratio – This is a statistical measure of the average return earned in excess of the risk-free rate per unit of volatility or total risk. Subtracting the risk-free rate from the mean return, the performance associated with risk-taking activities can be isolated. Generally, the greater the value of the Sharpe ratio, the more attractive the risk-adjusted return

Index Definitions:

S&P 500 Index – This Index is a capitalization-weighted index of 500 stocks. The Index is designed to measure performance of a broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries.