4. Credit standards are much better today, resulting in very low delinquency rates compared to pre-crisis. Delinquency rates in the three years preceding the crisis were over 600 basis points. Last year, delinquency rates were 21 basis points.

5. Household debt service as a percentage of income is near multi-decade lows. Whereas wage growth hasn’t been off to the races, household balance sheets are strong.

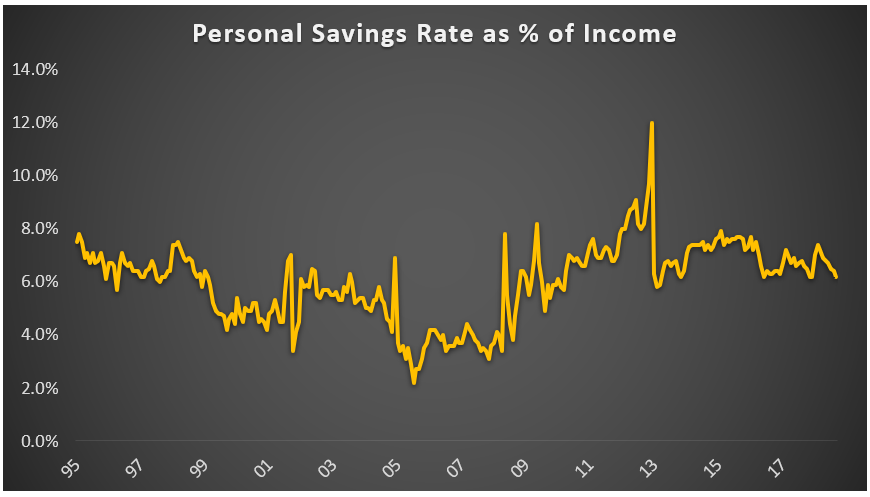

6. After the personal savings rate bottomed out in 2005 at 2.2%, consumers are tucking away more and more of their income for future consumption. The personal savings rate currently sits at 6.2%.

To gain more insight into how investors should be positioned in this market, listen to the Sage Advice Podcast.

This article was written by the team at Sage Advisory, a participant in the ETF Strategist Channel.