![]()

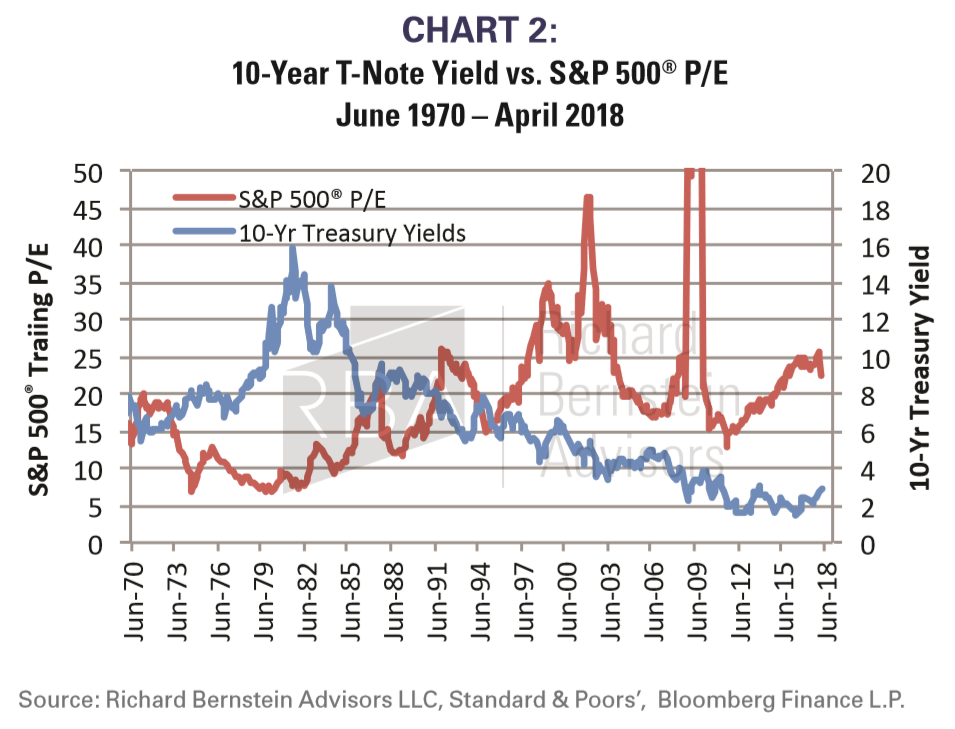

Time horizons shorten when interest rates rise Chart 2 demonstrates the inverse relationship between 10-year T-note rate and S&P 500 PE ratios. History clearly shows that PE ratios tend to contract when interest rates increase. Another way to think about this relationship is that investors shorten their time horizon when rates increase.

Investors seem to be in the process of once again shortening their investment time horizons when interest rates increase, and this is another challenge to unicorn companies. Promises of future growth can be very enticing when investor time horizons are long. However, such promises seem empty and immaterial when investors’ time horizons shorten.

The return of “boring” Free money allows one to dream the largest dreams about a wonderful future, like going to Mars. Rising interest rates bring investors back to earth. Our expectation is that interest rates are still at the beginning of an upward trend. If we are correct, then “boring” may win versus vision, positive cash flow may triumph over negative cash flow, and rational investing might kill the unicorns.

This article was written by Richard Bernstein, Chief Executive and Chief Investment Officer of Richard Bernstein Advisors, a participant in the ETF Strategist Channel.

To learn more about RBA’s disciplined approach to macro investing, please contact your local RBA representative or visit www.rbadvisors.com/images/pdfs/Portfolio_Specialist_Map.pdf.