By Clark Capital Management Group

A Bond Manager’s Worst Nightmare

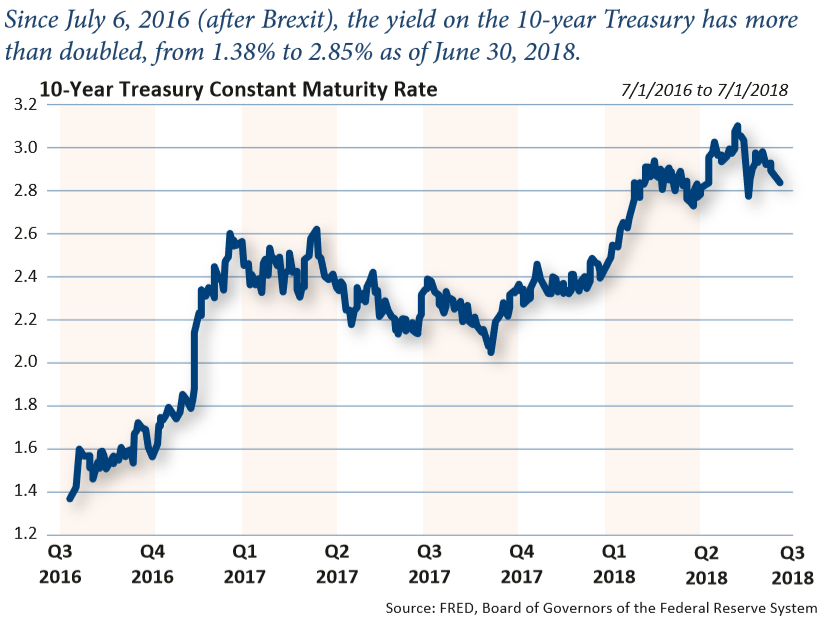

For the majority of bond managers, the most difficult environment to navigate is a market where rates rise significantly and rapidly with very little in the means of coupon payment to offset the negative impact of raising rates. The past two years have been just that — a bond manager’s worst nightmare — a doubling of interest rates with an extremely low coupon at the onset.

![]()

A Bond Bear Market Is Not Like a Stock Bear Market

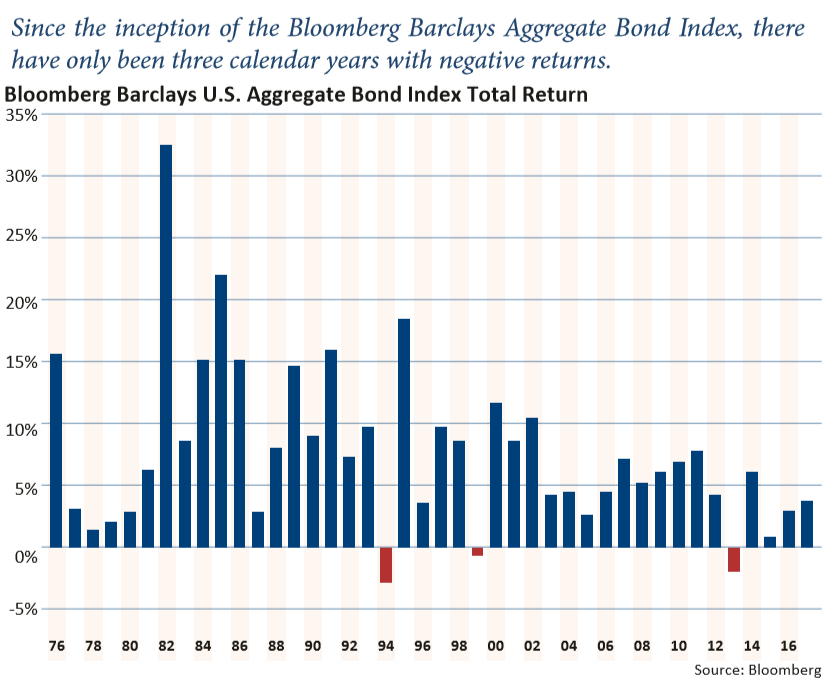

Since the inception of the Bloomberg Barclays Aggregate Bond Index on 1/1/1976, there have only been three calendar years with negative returns — 1994, 1999, and 2013. The worst of these years was 1994, a year in which the Fed raised the target on the Fed Funds rate six times for a total increase of 2.5%. Even in this environment, the Index was only down 2.92%. What many investors don’t take into consideration is that, even in difficult bond markets, bonds have historically not experienced the dramatic declines typical of an equity bear market. Stocks simply have greater volatility than bonds. What’s surprising to many, is that the Index had positive returns throughout the last half of the 1970s, a period when the yield on the 10-year Treasury went from 7.77% to 15.84%.

The coupon rate during that period was high enough to offset the principal decline associated with the increase in rates.

Not All Asset Classes React The Same to Rising Rates

Many investors ask, “Isn’t it difficult to make money in any asset class when interest rates are rising?” The answer is that not all asset classes react the same to rising rates. Over the past two years, equities have performed well, as have bonds that are more influenced by credit rather than interest rate risk. For example, high yield bonds were up 7.54% per year while Treasuries, which are only influenced by changes in interest rates, were down 1.49% per year.

We believe the best way to navigate these challenging markets is to take an active and tactical approach. Putting all of this together, we currently favor credit over interest rate risk and believe that these conditions should support a stable or narrowing credit spread and help corporates outperform treasuries. With interest rates doubling from a very low standing point, we believe the biggest challenges facing bonds are behind us.

This article was written by the team at Clark Capital Management, which is a participant in the ETF Strategist Channel

Disclosure Information

This information should not be considered to be an recommendation to buy or sell a security or to adopt a particular investment strategy. Clark Capital Management Group, Inc. is an investment adviser registered with the U.S. Securities and Exchange Commission. Registration does not imply a certain level of skill or training. More information about Clark Capital’s advisory services can be found in its Form ADV, which is available upon request.

Past performance is not indicative of future results. The opinions expressed are those of the Clark Capital Management Investment Team and are subject to change without notice. The opinions referenced are as of the date of publication and may not necessarily come to pass. This material is not financial advice or an offer to buy or sell any product. Clark Capital reserves the right to modify its current investment strategies based on changing market dynamics or client needs. The material in this report has been derived from sources considered to be reliable, but Clark Capital cannot guarantee its completeness or accuracy.

The S&P 500 measures the performance of the 500 leading companies in leading industries of the U.S. economy, capturing 75% of U.S. equities.