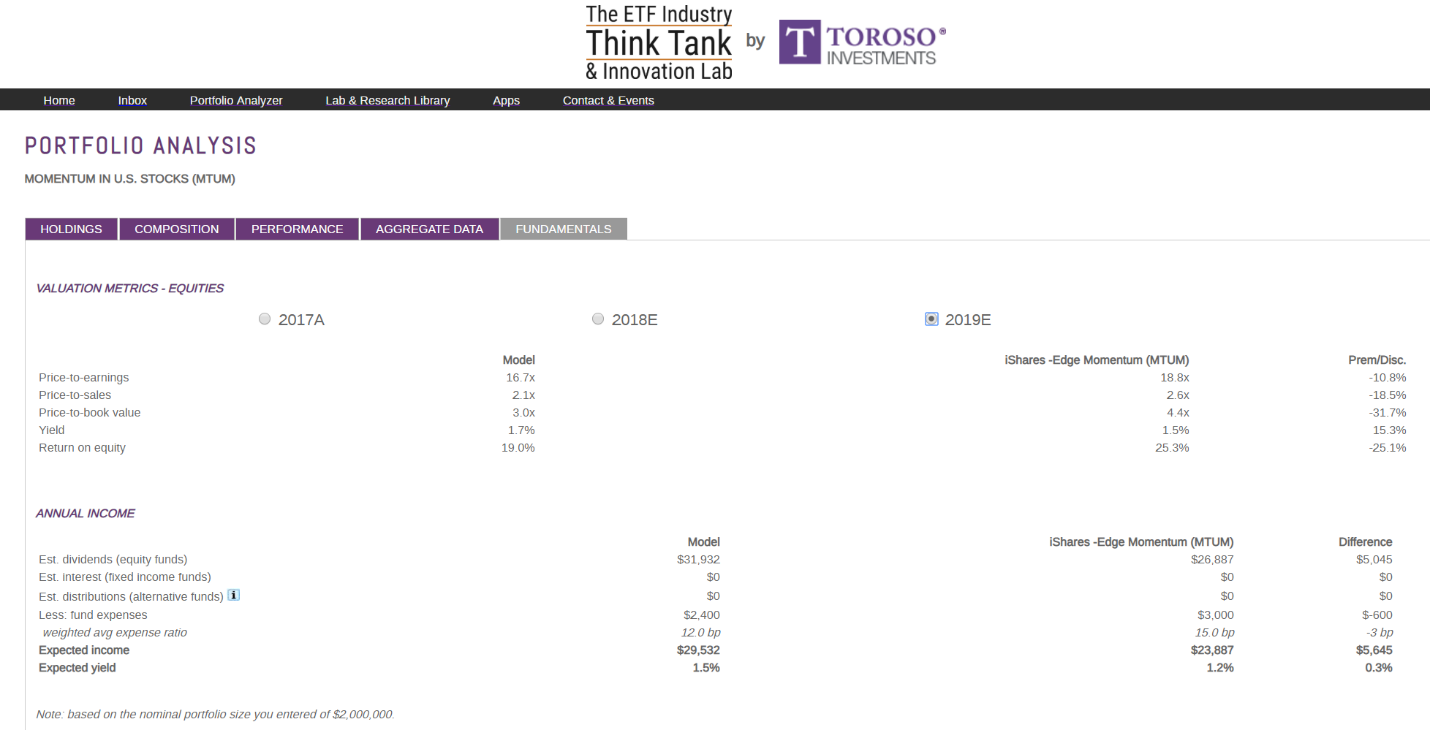

Good news! We think all this leads to a simple conclusion. Indiscriminating selling can also lead to opportunities for cool heads who are willing to be contrarian thinkers. If we can agree that value, growth, and quality are factors that have subjectivity, the next conclusion is to decide what investment themes should be core to a portfolio because their business opportunity remains intact for the long term:

How to capitalize on business momentum:

If the business opportunity today remains as strong as it did in September and has been validated by earnings reports arguably, this sets up as an opportunity that should offer a compelling risk/reward investment. The challenge of course is that advisors and their clients may now have to go back to doings securities analysis and think in a contrarian manner. Catching a falling knife is always hard, but arguably that is when you get the best value and potential upside. Long term, for growth, we think Robotics and Automation, through Global ROBO (ROBO) is such a theme. Earlier in the year, the index that drives ROBO traded at 22x forward EPS, but today it is at 17.5 times and earnings in the index are expected to grow by about 20%. High yield may be a very controversial idea. The track for U.S. interest rates is higher, but we see the InfraCapital MLP ETF (AMZA) a compelling value opportunity. The dividend yield is running at a 20% rate at 11 cents a month dividend payout. MLPs may remain out of favor, but the need for the infrastructure is irrefutable and the balance sheets of the companies in the industry are strong today. We also see the trend in online retail continuing and consolidation of the brands an inevitable cross selling opportunity. To capture the momentum of this growth theme we prefer the diversification provided by the Amplify Online Retail ETF (IBUY) over those ETFs that have concentration in Amazon.

We will find out in November soon whether October’s correction proved to be short lived and a classic opportunity. Certainly, the risks of headwinds may persist, but regardless advisors should not act as zombies. Stay focused on your due diligence. The importance of security selection is at the core of any client’s wealth management plan.

This article was written by the team at Toroso Asset Management, a participant in the ETF Strategist Channel.

Click here to see disclosures.