By Doug Sandler, Chris Konstantinos & Rod Smyth, RiverFront Investment Group

- We believe that the Administration’s desire to overhaul existing terms of trade, especially with China, has merit despite the uncertainty it is creating.

- We recognize that President Trump’s unconventional negotiating method could be effective in achieving the material concessions that the Administration believes are necessary to level the trading playing field, but his adversarial approach with our allies may be counterproductive.

- We regard the current ‘war of words’ between the U.S. and its trade partners as tactical gambits, not preludes to a 1930s-style protectionist trade war.

- We acknowledge that an unorthodox approach carries a higher risk of failure, and over the last several months have reduced the risk levels in our portfolios commensurately.

- In the end, we believe that the goal of ‘fairer trade’ is achievable and we anticipate raising our equity allocation if these disputes are resolved favorably.

WHY NEGOTIATE?

We believe that the Administration’s recent focus on trade is appropriate and its desire to overhaul existing trade arrangements, especially with China, is a cause worth championing. The primary problems with current trade agreements as we see it is that roughly 98% of global trade is governed by the World Trade Organization (WTO), which was established in 1995 and currently has 164 members.

The General Agreement on Tariffs and Trade (GATT) serves as the trading ‘rule-book’ for WTO members. GATT was designed in the 1940s and is a product of the Cold War. GATT helped strengthen economic cooperation among Western democracies by encouraging trade, and also provided an incentive for countries to align with the U.S. against its Cold War adversaries.

The rules and dispute resolution mechanisms with the WTO never anticipated an autocratic planned economy like China being a part of the system. China and Russia were admitted into the WTO under the assumption that they would reform to be more like the Western democracies. Instead, they have remained notorious trade protectionists. Their abuse of the WTO/GATT process may help explain disappointing wages gains over the past 20 years and diminishing political support for existing trade arrangements.

Why negotiate now?

- The playing field, particularly with respect to China, has become too uneven: Average bilateral Chinese tariffs are significantly higher (over 150%) than those in the U.S., Japan or the EU. While China was just developing, those tariffs provided protection for their nascent and fragile industries. As the world’s second largest economy, these protective tariffs no longer seem relevant.

- The unintended consequences of ‘free trade’ need to be addressed: The non-monetary costs of free trade, such as growing wealth inequality, have reached a tipping point. Public frustration with free trade/globalization is palpable and can be seen in the elections of non-traditional leaders across the globe. The cost of not dealing with the issues today may risk greater consequences in the future.

- The U.S. currently has negotiation leverage: Today, China is dependent on the U.S. for exports. Ten or twenty years from now, the U.S.’s negotiating position will be weaker if China successfully achieves its goal of developing its domestic economy and reduces its reliance on exports.

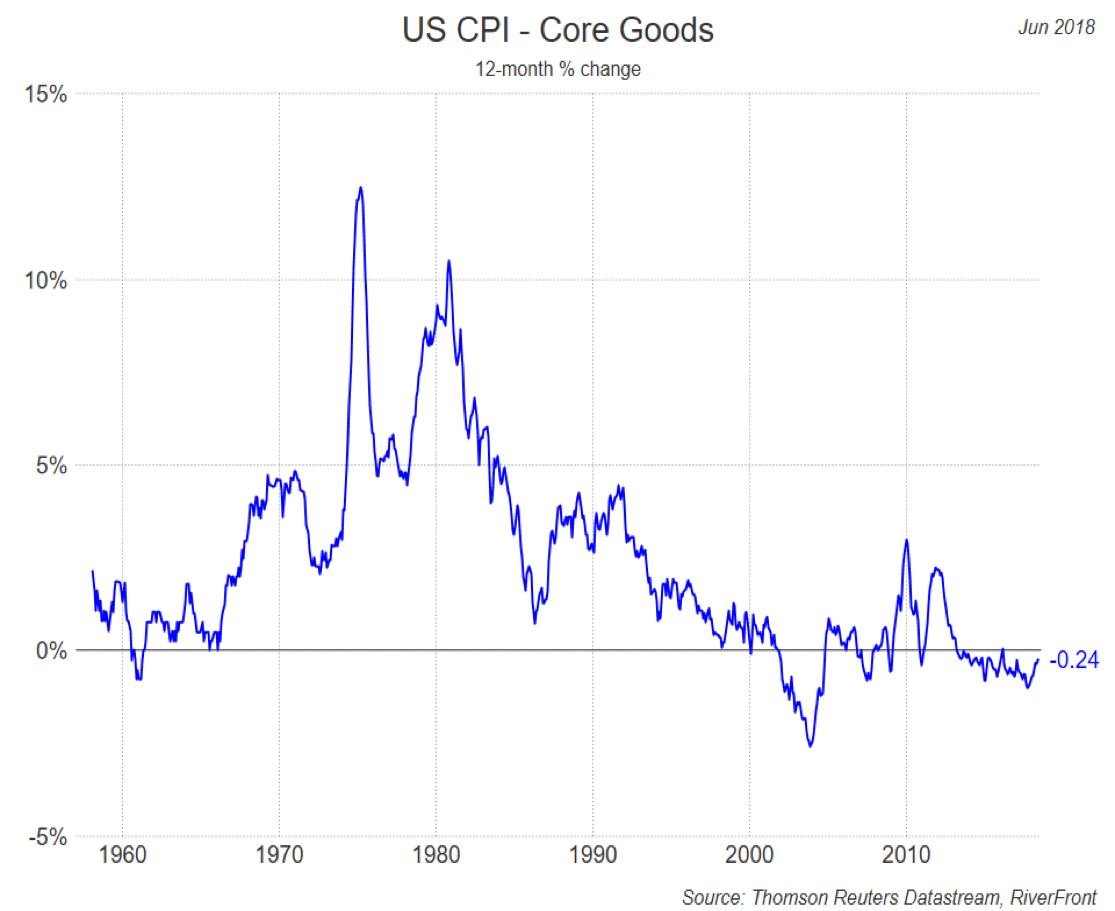

- The impact to U.S. consumers may be insulated: ‘Core goods’ prices have been stable/declining for many years, as can be seen in the chart on the right. While some of this can be explained by a rise in low-cost imports, we do not believe that imports deserve all the credit. Advances in factory automation, lower corporate taxes and stagnant wage growth have made U.S. manufacturers more competitive and lured foreign plants to U.S. shores. Costs are also being wrung out of other aspects of consumption including distribution (‘Amazon effect’) and financing (low interest rates). For these reasons, we do not foresee the entire impact of higher tariffs being borne by the American consumer.

![]()

Past performance is no guarantee of future results. Shown for illustrative purposes only.

How may it be resolved?

We recognize that an unconventional negotiating method is a risky but potentially effective way to achieve material concessions. We see two potential outcomes:

- Success:

-

- Divide: ‘Soften up’ all trade partners, including U.S. allies.

- Negotiate: Wring out the maximum number of concessions from our allies and harvest those ‘wins’ around mid-term elections.

- Unite: Align allies and amplify trade pressure on China, which will likely be a more drawn out fight.

- Result: Solid support for a continuing bull market is established, but markets remains volatile with the ebb and flow of U.S.-China trade negotiations.

- Failure:

- Divide: ‘Soften up’ all trade partners, including U.S. allies.

- Negotiate: The administration overplays its hand and alienates our allies.

- Unite: Alienated allies unite with each other and/or accept China’s recent partnership advances and cut the U.S. out of future trade deals.

- Result: Rising inflation and slowing economic growth leads to a bear market in anticipation of a pending recession.

Our strategy: Stay nimble and take action upon more conclusive evidence of success or failure:

- Stay nimble: We have reduced the risk in our balanced portfolios to be positioned ‘neutrally’ relative to benchmarks.

- Watch for more conclusive evidence of success or failure: Traditional trade negotiations that had previously occurred ‘behind closed doors’ are now on display for all to see. For this reason, it is critical to distinguish between ‘public haggling’ and ‘conclusive evidence’. We believe the progress of the following discussions will provide some of the conclusive evidence we are looking for:

- European discussions: Recent talks with European Commission President Jean-Claude Juncker were encouraging with both the U.S. and the EU agreeing in spirit to work toward zero-tariffs. Additional evidence that these talks are progressing would be welcomed, while a re-escalation of the negative rhetoric would be worrisome.

- NAFTA discussions: On July 26, U.S. trade representative Robert Lighthizer stated that he was ‘hopeful’ that a NAFTA agreement was in the ‘finishing stages’. An agreement, particularly with Mexico, would provide conclusive evidence that the Administration has no desire to fight a ‘three-front’ trade war.

Important Disclosure Information

The comments above refer generally to financial markets and not RiverFront portfolios or any related performance. Past results are no guarantee of future results and no representation is made that a client will or is likely to achieve positive returns, avoid losses, or experience returns similar to those shown or experienced in the past.

Information or data shown or used in this material is for illustrative purposes only and was received from sources believed to be reliable, but accuracy is not guaranteed.

GDP is the total value of goods produced and services provided in a country over one year. Past performance is no guarantee of future results. These views are current as of June 30, 2018 and are subject to change.

In a rising interest rate environment, the value of fixed-income securities generally declines.