A volatile week on Wall Street culminated with the Trump administration raising tariffs to 25% on $200 billion worth of Chinese goods at 12:01AM Friday, dashing investors’ hopes for an US-China trade deal in the near-term.

While we believe that the U.S. response is prudent given reports of unexpected changes to the agreement from China in the 11 th hour, these developments have inserted a heavy dose of uncertainty to a US stock market that recently was flirting with all-time highs. We’d note the tariff increase announced Friday exempts goods already in transit – providing an unofficial ‘window’ for negotiation before any economic impact is felt. Whether negotiators from both sides will take advantage of this is still unclear.

RIVERFRONT’S TAKEAWAYS FROM THIS WEEK

Market volatility should be expected for the foreseeable future. Tough negotiation with China is one of the rare actions by the Trump Administration that enjoys bi-partisan support, and Trump’s support for tariffs has been unwavering. Therefore, investors should not automatically assume this issue will go away quickly, though the political calculus gets trickier should the dispute drag out long enough to damage the trajectory of the US economy. Going into the President’s unexpected announcement investor sentiment was elevated, and stocks were close to all-time highs. Without a margin of safety, it’s understandable that the calm may be temporarily shattered until investors get more clarity.

We still believe that US has more negotiation leverage than China. The US imports roughly three times as many goods from China as they import from us, and the US economy is strong.

China is also experiencing increasing export competition from areas like Vietnam and Cambodia.

If China was trying to ‘run out the clock’ assuming they’d be negotiating with a different administration in 2020, we would note that the Trump administration’s approval ratings are at its highest level since right after the 2016 elections, on the back of the lowest unemployment figure in almost five decades.

We still believe it’s in both countries’ interests to eventually agree to a ‘cease-fire.’ Both nations have much to lose by a protracted trade war with each other’s largest trading partner, so we believe we’ll eventually see something like a cease-fire; it just now appears it will require a more circuitous path. At risk for the Trump administration is its strong economy heading into the 2020 election. The sentiment of US consumers, farmers and manufacturers could be damaged by the tariffs, especially if the US makes good on its threat to levy additional tariffs on up to $300b of primarily consumer facing goods. The risk to China and President Xi is its recent and fragile economic turnaround that is just now starting to experience ‘green shoots’ after an 18-month slump (see Weekly View from 4/23). We believe that President Xi is acutely aware that non-democratic regimes can become destabilized during periods of economic distress.

HOW THIS AFFECTS OUR PORTFOLIO POSITIONING

We remain modestly overweight stocks versus bonds in our portfolios. Given fixed income’s poor long-term return profile with interest rates at current levels, we believe this is prudent. However, our portfolios entered 2019 with lower structural risk levels than in past years in part due to trade uncertainty. While we believe this risk will eventually resolve itself positively (see page 2), our tactical and risk teams are monitoring indicators closely for signs of further contagion and are willing to take action if deemed necessary.

WHERE MAY THE STOCK MARKET GO FROM HERE?

Stock market returns are generally influenced by two separate components: the direction of corporate earnings, and the price investors are willing to pay to access those earnings (‘the multiple’). The likelihood that these new developments dramatically affect US corporate earnings in the near-term is relatively slim. Research house Cornerstone Macro predicts that the additional tariffs levied by the US will amount to only a 0.15% drag on US GDP over the next year, probably not enough to dramatically affect the economy. It’s also worth noting that according to the Wall Street Journal, many large US exporters had already been expecting an increase in tariffs and had incorporated such an increase into their forward earnings guidance.

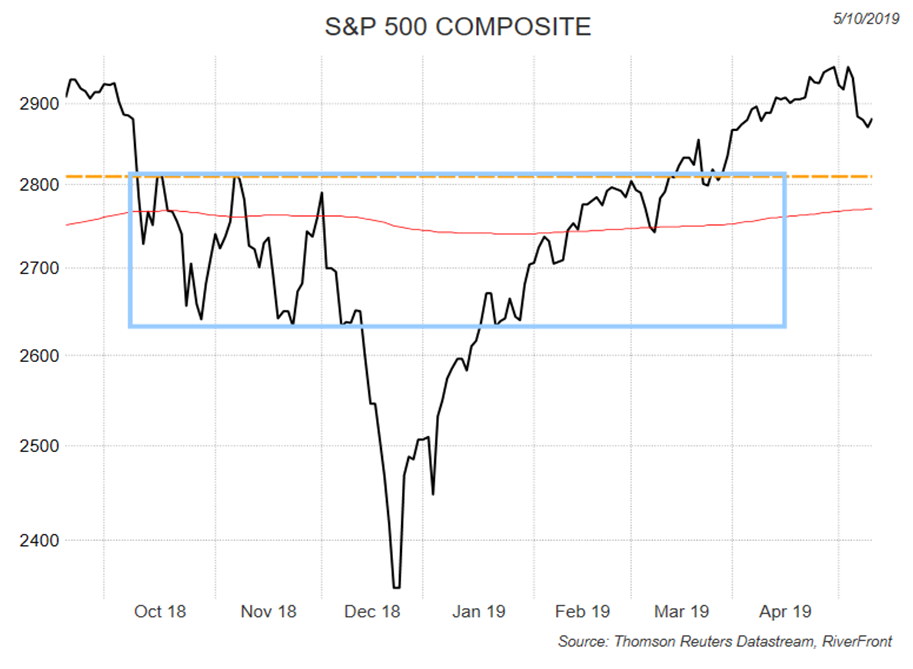

However, uncertain geopolitical events tend to affect near-term investor sentiment – the multiple – more dramatically than earnings. Applying a S&P 500 price-to-earnings multiple range of 15 to 15.5 times to the current $181 consensus earnings estimate for 2020 suggests a range of 2700-2800 for the S&P 500, with possible downside risk to 2600 if analysts also reduce earnings estimates by 2-3%. In our view, this implies a worst-case scenario of another 5% to 7% downside from current levels as of Monday morning. We do not wish to sound too sanguine about such a fluid situation, but we view this level of downside as very much in the ‘garden variety’ type pullback that stocks often experience within the broader context of an intact structural bull market. This incident is also likely to deflate the levels of excessive optimism in the market (see our Weekly View on 4/29 for more on sentiment) and may create opportunities for longer-term focused investors with higher risk tolerance.

KEY RISK INDICATORS GOING FORWARD

Our tactical and risk teams have not yet seen technical deterioration that suggests this will be a pullback (i.e., a pullback that an investor could reasonably get out of and back in with a high probability of a profitable trade). However, here is what we will be watching for clues for whether the trade conflict will metastasize further:

Technical levels: From a tactical perspective, we expect technical support for the S&P 500 to be around 2810, the 23% Fibonacci retracement of the 2945 high. This is the top of our old ‘decision box’ (see blue box, left).The next level of technical support is the 200-day moving average at 2766 (red line).

Beyond that, we would expect the S&P to find ultimate support at the bottom of our decision box at 2640 if market sentiment continues to sour.

US business confidence surveys: The resilience of US business confidence is crucial, because confidence can affect hiring and capital expenditure plans, and thus the economy and corporate earnings. Currently the US manufacturing ISM survey is still in expansionary territory and the NFIB Small Business Optimism survey has stabilized at high levels. Neither surveys are flashing a red flag currently, in our opinion, but will bear watching going forward.

The Chinese Yuan: The Chinese appear poised to retaliate against the US. According to the Chinese State Council, China will raise tariffs on up to $60b of US goods beginning June 1st. We believe that tools other likely counter-measures include lower purchases and outright boycotts of US goods and additional red-tape for US exporters. Another weapon the Chinese may employ is to allow the yuan, a heavily managed currency, to depreciate. This would counterbalance the effect of US tariffs to a certain extent but also strengthen the US dollar, increasing pressures on everything from US corporate earnings to debt servicing in certain emerging markets countries. Thus, we will be watching the movement of the yuan closely.

Important Disclosure Information

The comments above refer generally to financial markets and not RiverFront portfolios or any related performance. Past results are no guarantee of future results and no representation is made that a client will or is likely to achieve positive returns, avoid losses, or experience returns similar to those shown or experienced in the past.

Information or data shown or used in this material is for illustrative purposes only and was received from sources believed to be reliable, but accuracy is not guaranteed.

When referring to being “overweight” or “underweight” relative to a market or asset class, RiverFront is referring to our current portfolios’ weightings compared with the portfolios’ composite benchmarks. For information on our portfolio’s current holdings and benchmark definitions, please visit our website: www.riverfrontig.com.

In a rising interest rate environment, the value of fixed-income securities generally declines.

Investing in foreign companies poses additional risks since political and economic events unique to a country or region may affect those markets and their issuers. In addition to such general international risks, the portfolio may also be exposed to currency fluctuation risks and emerging markets risks as described further below.

Changes in the value of foreign currencies compared to the U.S. dollar may affect (positively or negatively) the value of the portfolio’s investments. Such currency movements may occur separately from, and/or in response to, events that do not otherwise affect the value of the security in the issuer’s home country. Also, the value of the portfolio may be influenced by currency exchange control regulations. The currencies of emerging market countries may experience significant declines against the U.S. dollar, and devaluation may occur subsequent to investments in these currencies by the portfolio.

Foreign investments, especially investments in emerging markets, can be riskier and more volatile than investments in the U.S. and are considered speculative and subject to heightened risks in addition to the general risks of investing in non-U.S. securities. Also, inflation and rapid fluctuations in inflation rates have had, and may continue to have, negative effects on the economies and securities markets of certain emerging market countries.

Stocks represent partial ownership of a corporation. If the corporation does well, its value increases, and investors share in the appreciation. However, if it goes bankrupt, or performs poorly, investors can lose their entire initial investment (i.e., the stock price can go to zero). Bonds represent a loan made by an investor to a corporation or government. As such, the investor gets a guaranteed interest rate for a specific period of time and expects to get their original investment back at the end of that time period, along with the interest earned. Investment risk is repayment of the principal (amount invested). In the event of a bankruptcy or other corporate disruption, bonds are senior to stocks. Investors should be aware of these differences prior to investing. It is not possible to invest directly in an index.

RiverFront Investment Group, LLC, is an investment adviser registered with the Securities Exchange Commission under the Investment Advisers Act of 1940.

Registration does not imply any level of skill or expertise. The company manages a variety of portfolios utilizing stocks, bonds, and exchange-traded funds (ETFs). RiverFront also serves as sub-advisor to a series of mutual funds and ETFs. Opinions expressed are current as of the date shown and are subject to change. They are not intended as investment recommendations.

RiverFront is owned primarily by its employees through RiverFront Investment Holding Group, LLC, the holding company for RiverFront. Baird Financial Corporation (BFC) is a minority owner of RiverFront Investment Holding Group, LLC and therefore an indirect owner of RiverFront. BFC is the parent company of Robert W. Baird & Co. Incorporated (“Baird”), a registered broker/dealer and investment adviser.

Copyright ©2019 RiverFront Investment Group. All Rights Reserved. 847274