(Source: Visualcapitalist)

The iShares Core US Aggregate Bond ETF (AGG) returned -0.05% for the year after returning 1.62% for the 4th quarter. Longer term treasuries, measured by the iShares 20+ Year Treasury Bond ETF (TLT) returned, -2.07% for the year after gaining 4.16% for the quarter. High yield, measured by the iShares iBOXX $ High Yield Corp Bd ETF (HYG) was down -1.93% for the year, giving up -4.34% in the fourth quarter.

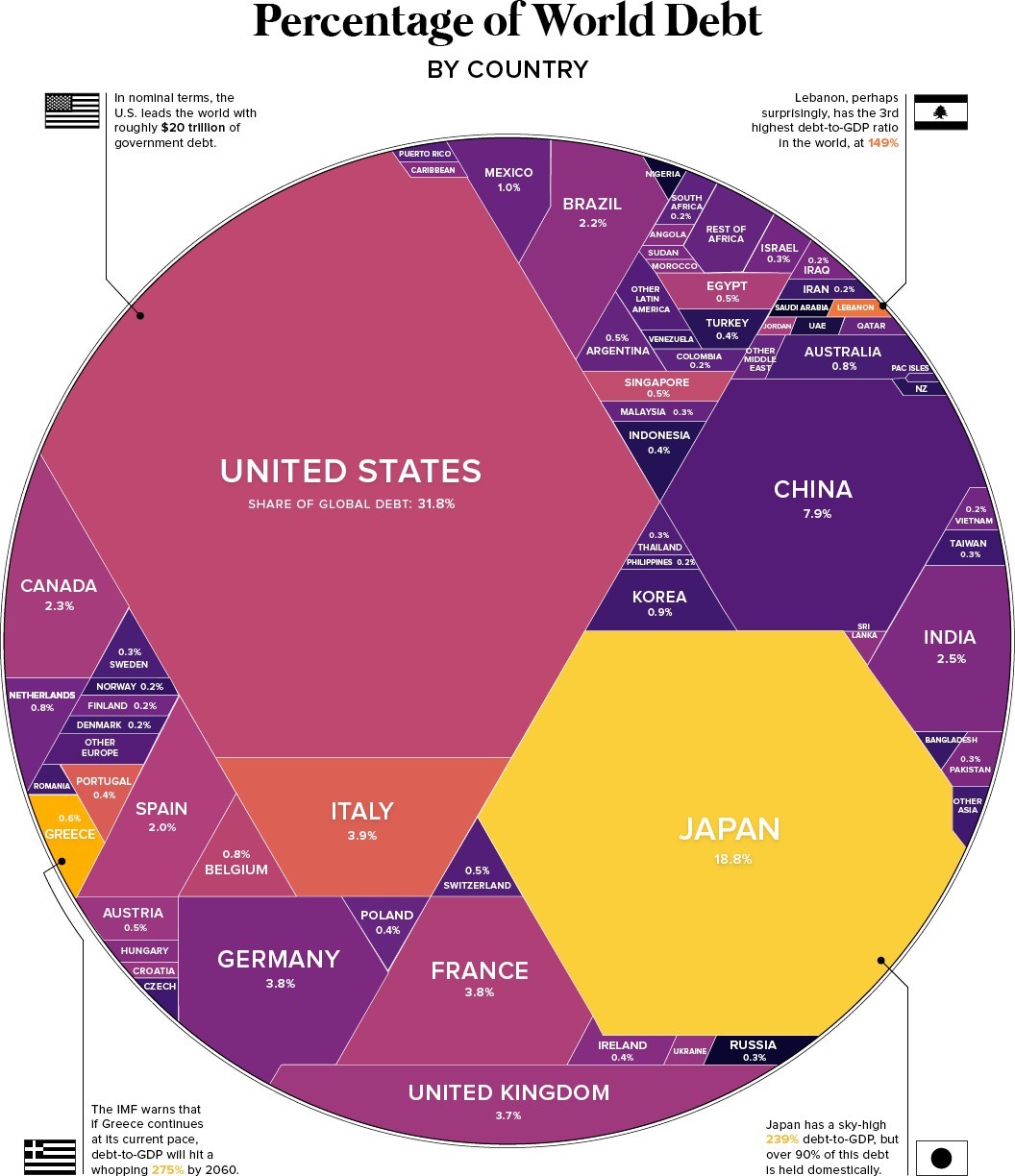

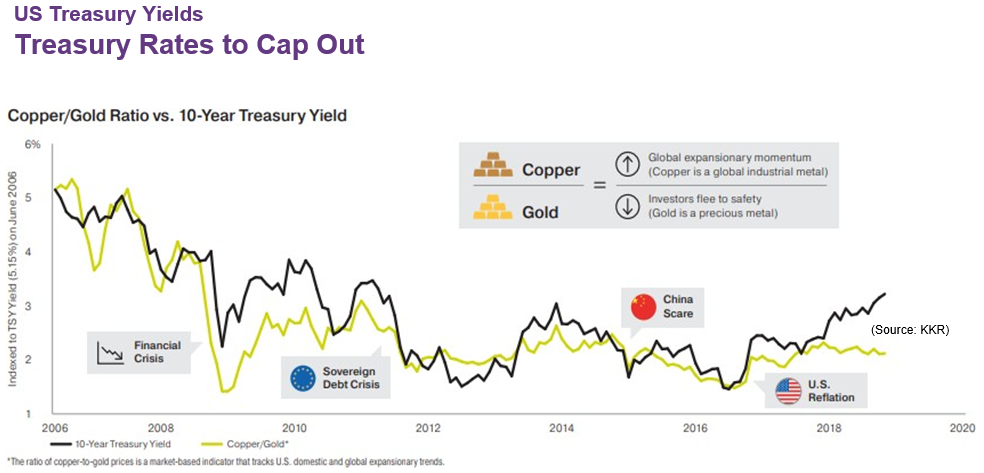

Treasuries started to perform somewhat differently than they have in recent past. Some have been selling by foreign nations (Russia all but removed all Treasuries from their reserves in exchange for gold and other currencies). We see short term potential for US treasuries as treasury yields have somewhat broken out from their typical historical ratio to the cooper/gold ratio, but long term, we don’t like the prospects of the only developed nation with plans to significantly increase their annual deficit over the next 5 years. Interestingly, US Savers became the largest owners of treasuries, which leaves us questioning, are we becoming Japan?

US Treasury Yields

Treasury Rates to Cap Out

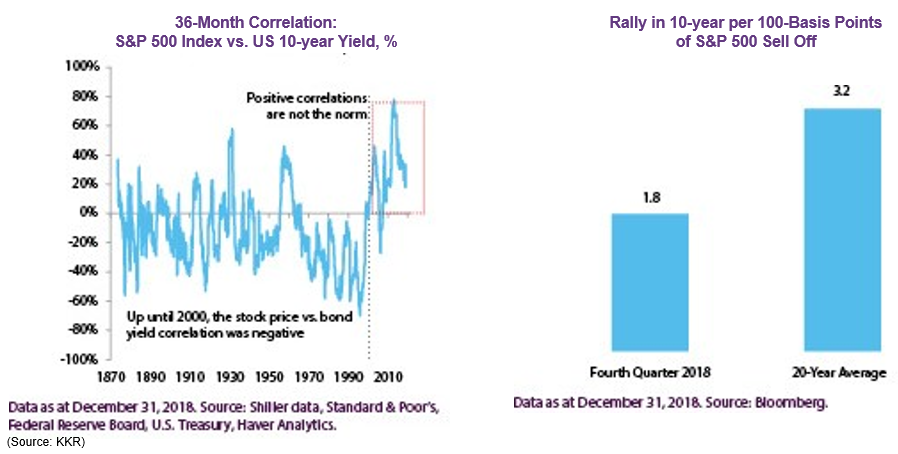

Before we transition to alternatives, we thought it interesting to note the changing dynamics occurring between equities and treasuries. Diversification benefits of treasuries appear to be diminishing:

Alternatives

Commodities, measured by Invesco DB Commodity Tracking ETF (DBC), returned -12.02% on the year, after giving back all gains and then some in the fourth quarter, returning -18.47%. Alternatively, Gold, measured by SPDR Gold Shares (GLD), ended the year down just -1.54%, after recovering 7.84% in the fourth quarter. The Bloomberg Galaxy Cyrpto Index (BGCI) was down -81% for the year and -65.4% for the fourth quarter. We have been using a specific market neutral ETF for quite some time that finally showed its true colors in the most recent market volatility; the AGFiQ US Market Neutral Anti-Beta ETF (BTAL) returned 4.7% for the fourth quarter, and 14.7% for the year. Treasuries will no longer be as impactful of a diversifier as they once were and its extremely important to analyze your alts at time like this to make sure they are at least somewhat alternative in nature.

Conclusion

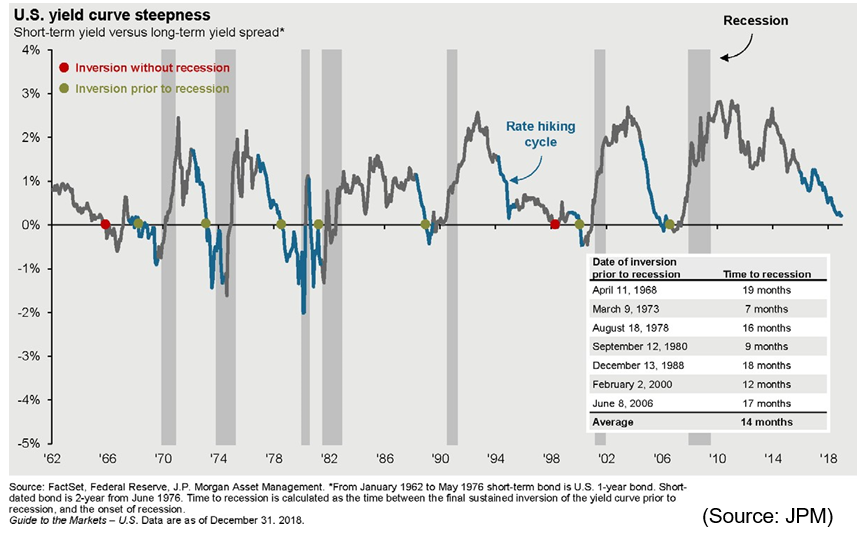

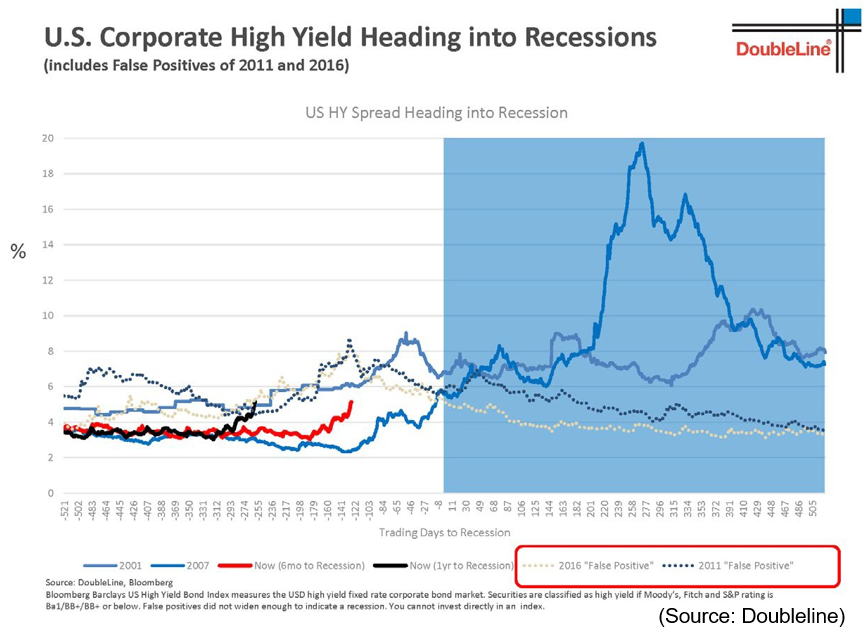

Two occurrences we mentioned as potential signals of an upcoming recession in our last commentary continue to show signs of breakdown. Traditional recessions are preceeded by inverted yield curves and expanding high yield credit spreads. Despite this information, trying to time such an occurrence is unlikey to result in a benefit. Credit spreads have begun to expand two other times over the course of this recovery, only to revert back to historical lows. Even when they do continue, determining the time in which it may occur is challenging in the face of market volatility. Historically, these trends would imply market disruptions in the next 6 to 24 months, but in a world where a tweet can significantly distort global markets, we caution over taking action according to emotions due to these signals. Extreme positions in volatile markets requires optimal timing and hindsight in a forward journey where we simply don’t always have a clear path.

This article was written by the team at Toroso Asset Management, a participant in the ETF Strategist Channel.

Click here to see disclosures.

Disclaimer: This commentary is distributed for informational and educational purposes only and is not intended to constitute legal, tax, accounting or investment advice. Nothing in this commentary constitutes an offer to sell or a solicitation of an offer to buy any security or service and any securities discussed are presented for illustration purposes only. It should not be assumed that any securities discussed herein were or will prove to be profitable, or that investment recommendations made by Toroso Investments, LLC will be profitable or will equal the investment performance of any securities discussed. Furthermore, investments or strategies discussed may not be suitable for all investors and nothing herein should be considered a recommendation to purchase or sell any particular security.

Investors should make their own investment decisions based on their specific investment objectives and financial circumstances and are encouraged to seek professional advice before making any decisions. While Toroso Investments, LLC has gathered the information presented from sources that it believes to be reliable, Toroso cannot guarantee the accuracy or completeness of the information presented and the information presented should not be relied upon as such. Any opinions expressed in this commentary are Toroso’s current opinions and do not reflect the opinions of any affiliates. Furthermore, all opinions are current only as of the time made and are subject to change without notice. Toroso does not have any obligation to provide revised opinions in the event of changed circumstances. All investment strategies and investments involve risk of loss and nothing within this commentary should be construed as a guarantee of any specific outcome or profit. Securities discussed in this commentary and the accompanying charts, if any, were selected for presentation because they serve as relevant examples of the respective points being made throughout the commentary. Some, but not all, of the securities presented are currently or were previously held in advisory client accounts of Toroso and the securities presented do not represent all of the securities previously or currently purchased, sold or recommended to Toroso’s advisory clients. Upon request, Toroso will furnish a list of all recommendations made by Toroso within the immediately preceding period of one year.