![]()

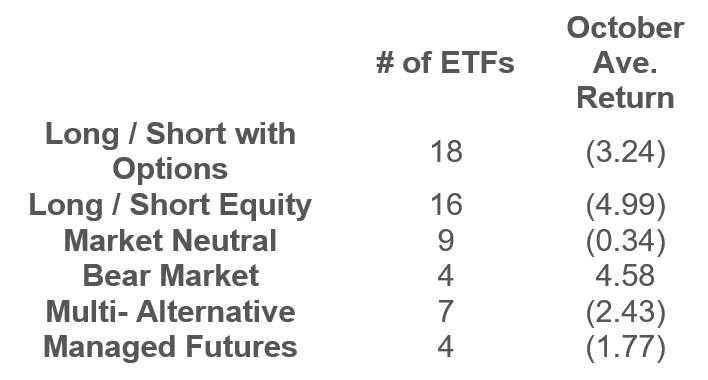

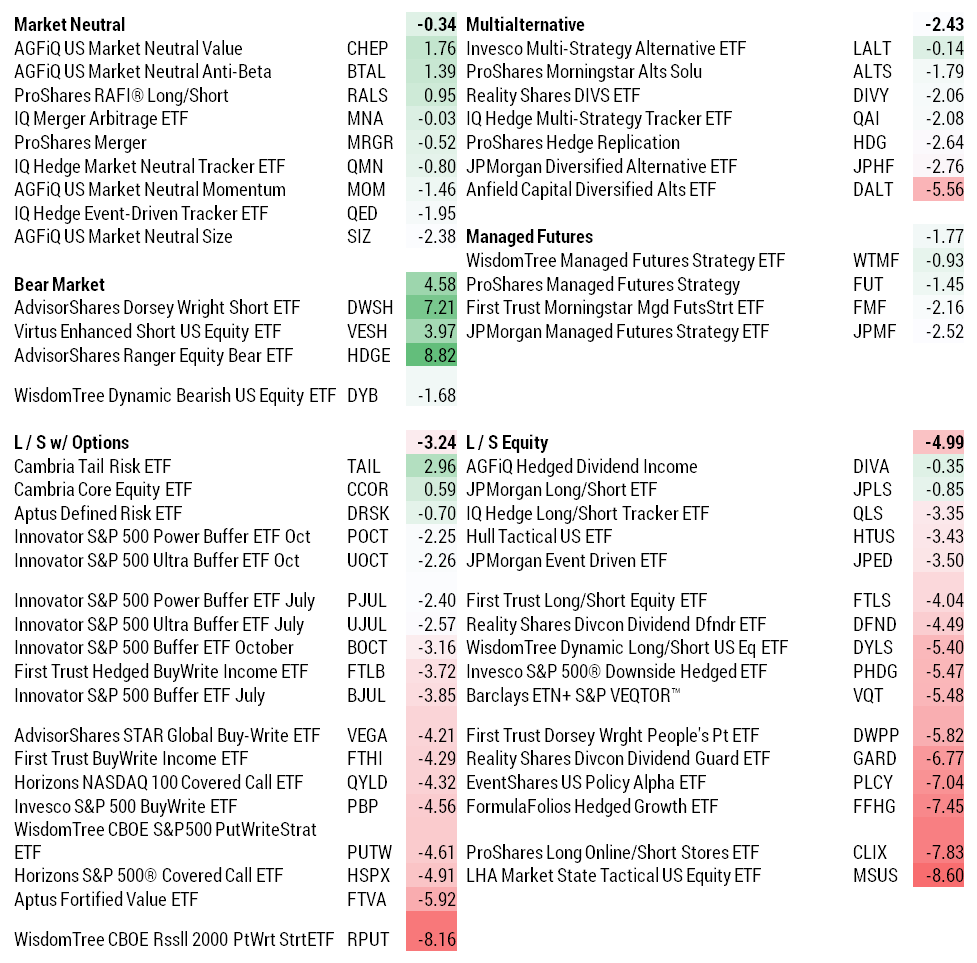

Complete Table of Alternative ETFs Studied with October Performance:

Alternatives of Note:

Alternatives of Note:

Based not just on their October performance but more so on their construction, some of our favorite alternatives within this group are:

- Market Neutral: AGFiQ US Market Neutral Anti-Beta (BTAL)

- Provides exposure to the spread between low and high beta stocks in a market neutral & sector neutral approach. See our original paper on BTAL.

- Long / Short with Options: Cambria Core Equity (CCOR)

- At least 80% of the fund’s value will be invested in equities under normal market conditions, with the remainder in options where pricing provides favorable risk/reward models using call and put option spreads

- Long / Short Equity: JPMorgan Long / Short (JPLS)

- Long and short exposure to equity factors (value, quality, and momentum) with a dynamic market beta.

Many of these positions have been the unloved child of one’s portfolio, causing pain and reducing overall portfolio returns. The last two weeks were a reminder of why alternatives are necessary in your portfolio and why digging under the hood is more important than ever! Understanding these ETFs that go up when the markets go down is another great example of an innovation growth factor for the ETF ecosystem.

Find out more at www.etfthinktank.com.

This article was written by the team at Toroso Asset Management, a participant in the ETF Strategist Channel.

Click here to see disclosures.