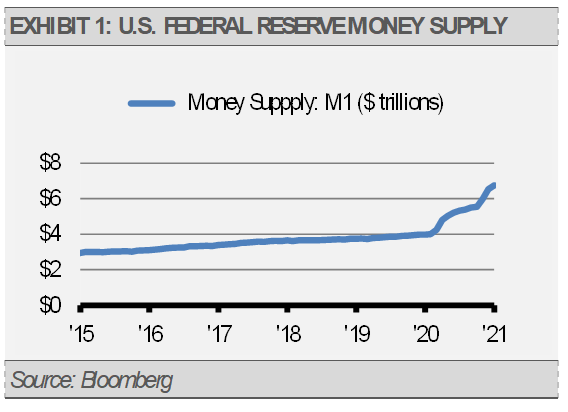

There are three broad reasons why our outlook for U.S. economic growth and the equity market continues to brighten. First, the U.S. Federal Reserve’s (the Fed) massive monetary support keeps increasing liquidity in the financial system. As exhibit 1 shows, M1 (currency, checking accounts, etc.) is growing quickly. While the Fed’s initial massive intervention was designed to mitigate the liquidity crash we saw in the financial system last spring, this ongoing support helps grease the skids of economic activity. With time, this liquidity should make its way into the broader economy in the form of more business investment and consumer spending.

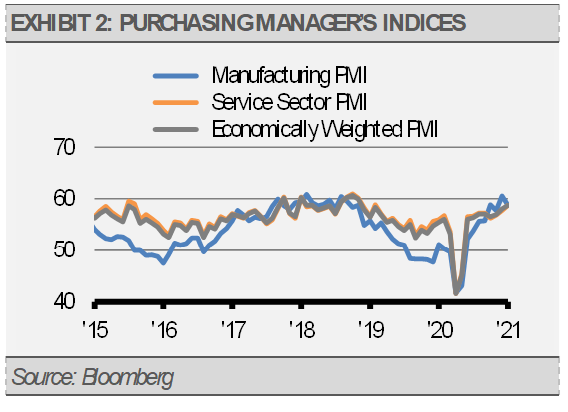

Meanwhile, the ISM Purchasing Manager Index (PMI) reports suggest that economic activity both accelerated and broadened in January. In fact, the service sector had its strongest showing since February 2019.

To date, the U.S. economic recovery has largely been led by increases in the manufacturing sector and, more recently, we have seen an uptick in the service sector as well. This is important not only in that the recovery is broadening, but also in that the service sector makes up approximately 70% of the U.S. economy. As a result, we think that the recovery is becoming more robust as time goes on.

While the areas most directly and negatively impacted by COVID related restrictions continue to struggle, the finances of U.S. households in aggregate are in great shape. In fact, the level of outstanding credit card balances and other revolving debts are falling while personal savings remains high.

Credit card and revolving debt has fallen by about $100 billion from nearly $850 billion a year ago to less than $750 billion at the end of December. Meanwhile, personal savings has grown by over $1 trillion from $1.3 trillion to $2.4 trillion, though savings is down from its peak during the lockdowns. This situation should improve even more with the $900 billion of fiscal stimulus enacted in December and any further fiscal support. In addition, any jobs market recovery should help household finances.

We expect excess savings to migrate into the real economy with the eventual lifting of COVID restrictions. Despite bouts of volatility, we think that broad equity markets will move higher over the coming year. Furthermore, we think that cyclical and value sectors will outperform the broad equity market as the reopening trade continues.

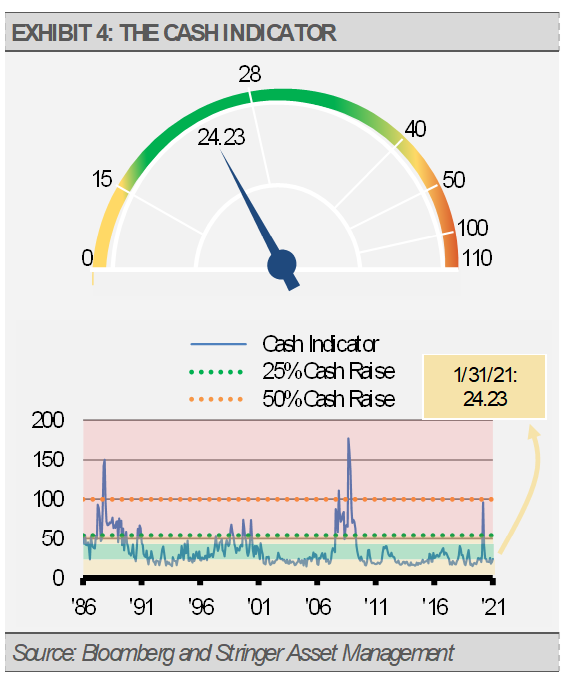

THE CASH INDICATOR

The Cash Indicator (CI) is holding at a healthy level. Currently, the CI reflects global financial market stability. As a result of this stability and our fundamental economic outlook, we view a market selloff as a buying opportunity.

Originally published by Stringer Asset Management

DISCLOSURES

Any forecasts, figures, opinions or investment techniques and strategies explained are Stringer Asset Management, LLC’s as of the date of publication. They are considered to be accurate at the time of writing, but no warranty of accuracy is given and no liability in respect to error or omission is accepted. They are subject to change without reference or notification. The views contained herein are not to be taken as advice or a recommendation to buy or sell any investment and the material should not be relied upon as containing sufficient information to support an investment decision. It should be noted that the value of investments and the income from them may fluctuate in accordance with market conditions and taxation agreements and investors may not get back the full amount invested.

Past performance and yield may not be a reliable guide to future performance. Current performance may be higher or lower than the performance quoted.

The securities identified and described may not represent all of the securities purchased, sold or recommended for client accounts. The reader should not assume that an investment in the securities identified was or will be profitable.

Data is provided by various sources and prepared by Stringer Asset Management, LLC and has not been verified or audited by an independent accountant.