By RiverFront Investment Management

‘Drinking water’ means:

- Avoiding highly valued stocks

- Avoiding highly indebted companies

- Lowering portfolio risk

- Ensuring risk management plans are in place

The world got a little scarier last week. This is why we’ve been ‘drinking water.’

We don’t know how US/China trade negotiations are going to end. This is why we’ve been ‘drinking water.’

What we do know is that an extended trade war between the two sides poses a significant and imminent threat to the already fragile global economy, which could end the bull market. This is why we’ve been ‘drinking water.’

In case you don’t recognize the phrase, we are referring to two past editions of the Weekly View: “Don’t leave the Party, Just Start Drinking Water” (6/12/18), and “Still at the Party, Still Drinking Water” (7/23/19). In those pieces we described our current portfolio management philosophy as ‘drinking water’ in the midst of a late-night party. From a portfolio management perspective, ‘drinking water’ means avoiding highly valued stocks, avoiding highly-indebted companies, lowering portfolio risk, and making sure risk management plans are in place.

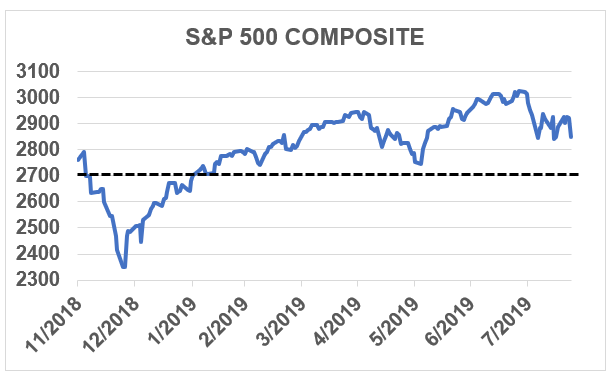

Ultimately, it is too early to handicap the impact of last week’s events and not the time to panic. From a technical perspective, the US bull market is still intact. We think a break below 2700 (dotted-line, right chart) would call this into question.

Lost in the fog of Friday’s trade rhetoric (8/23/19) was an interview with Jerome Powell in which the Fed chair noted that they will continue to act in the face of trade uncertainty. Another important observation from Friday was that bond investors did not panic, which is important because the bond market can often act as an early warning indicator for the stock market.

Over the remainder of this piece we review how the ‘drinking water’ philosophy was enacted in different areas of our portfolios since the trade tensions were first announced in early 2018. As we wait for additional clarity and the ultimate resolution, we will stay vigilant, adjust our portfolios accordingly, and continue ‘drinking water.’

Source: Refinitiv Datastream, RiverFront. Disclosures: Past performance is no guarantee of future results. Shown for illustrative purposes. Not indicative of RiverFront portfolio performance. Index definitions are available in the disclosures.

ASSET ALLOCATION: Prior to the beginning of the trade war (March 2018), RiverFront’s asset allocation was tilted toward stocks and favored international markets. As the trade war escalated, we felt this allocation was no longer appropriate. Across our balanced portfolios, our current stock weighting is roughly 8 percentage points lower than it was at the beginning of 2018. Importantly, the composition of the equities we own has also changed over this time. We have progressively reduced our international stock weighting between 18-22 percentage points since that time depending on the portfolio, in keeping with our view that a trade war has a larger negative impact on international economies than it does in the US (See the Weekly View from 8/5/19). The trade war escalation has our team prepared to make further adjustments if necessary, but currently we believe that the portfolios are positioned properly for the uncertainty of trade.

EQUITIES: In addition to geography, we have also shifted our thematic focus over this period. We have placed a greater emphasis on stable growth companies that we believe can generate earnings in more challenging economic times, including software and services, US consumer-oriented companies, and international growth companies.

FIXED INCOME: In a mature bull market, we believe it is critical that investors do not put too much emphasis on yield at the expense of safety. Currently, we own bonds in our portfolios to generate income and to act as a counter balance to equities. For this reason, we have improved the quality of our fixed income allocation. For example, in the last year we’ve eliminated our high yield bond and bank loan exposure from all of our balanced portfolios. More recently, we reduced longer maturity credit exposure and shifted to corporate bonds maturing in 5 years and less.

RISK MANAGEMENT: There are a variety of lenses through which our portfolios are assessed from a risk management perspective. These include asset class and regional exposures, sector and industry exposures, and overall risk levels. Since the beginning of 2018, we have not only lowered or eliminated exposures to developed and emerging markets equities, we have also reduced exposure to the semiconductor industry across all portfolios as revenues from China are significant for these companies. Further, we reviewed our conviction in sector level exposures against the backdrop of slower global economic growth and decelerating corporate earnings. Our monitoring tools allow us to “look under the hood” of the individual ETFs that are in the portfolios to see exactly how much revenue exposure we have from a country standpoint. We estimate at this time, depending on the time horizons for the various strategies, revenues from China range from approximately 3-7.5%. Given the challenges of predicting the future, our objective risk management tools allow us to understand our portfolio exposures as we navigate through uncertain times.

BOTTOM LINE: Lightening can strike out of the clear blue sky, so as the Boy Scouts say, “Be Prepared.” To us, being prepared means: 1. Know what you own, 2. Know how it will respond to good and bad outcomes, and 3. Know what you are going to do if ‘lightning strikes.’ In our view, unmanaged investment strategies don’t always provide a good or clear answer to these questions. This is why we believe the role of advice and guidance is so important. We are prepared, we can help if you are not.

This article was written by the team at RiverFront Investment Group, a participant in the ETF Strategist Channel.

Important Disclosure Information

The comments above refer generally to financial markets and not RiverFront portfolios’ related performance. Past results are no guarantee of future results and no representation is made that a client will or is likely to achieve positive returns, avoid losses, or experience returns similar to those shown or experienced in the past.

Information or data shown or used in this material is for illustrative purposes only and was received from sources believed to be reliable, but accuracy is not guaranteed.

In a rising interest rate environment, the value of fixed-income securities generally declines.

When referring to being “overweight” or “underweight” relative to a market or asset class, RiverFront is referring to our current portfolios’ weightings compared to the composite benchmarks for each portfolio. Asset class weighting discussion refers to our Advantage portfolios. For more information on our other portfolios, please visit www.riverfrontig.com or contact your Financial Advisor.

Investing in foreign companies poses additional risks since political and economic events unique to a country or region may affect those markets and their issuers. In addition to such general international risks, the portfolio may also be exposed to currency fluctuation risks and emerging markets risks as described further below.

Changes in the value of foreign currencies compared to the U.S. dollar may affect (positively or negatively) the value of the portfolio’s investments. Such currency movements may occur separately from, and/or in response to, events that do not otherwise affect the value of the security in the issuer’s home country. Also, the value of the portfolio may be influenced by currency exchange control regulations. The currencies of emerging market countries may experience significant declines against the U.S. dollar, and devaluation may occur subsequent to investments in these currencies by the portfolio.

Foreign investments, especially investments in emerging markets, can be riskier and more volatile than investments in the U.S. and are considered speculative and subject to heightened risks in addition to the general risks of investing in non-U.S. securities. Also, inflation and rapid fluctuations in inflation rates have had, and may continue to have, negative effects on the economies and securities markets of certain emerging market countries.

Stocks represent partial ownership of a corporation. If the corporation does well, its value increases, and investors share in the appreciation. However, if it goes bankrupt, or performs poorly, investors can lose their entire initial investment (i.e., the stock price can go to zero). Bonds represent a loan made by an investor to a corporation or government. As such, the investor gets a guaranteed interest rate for a specific period of time and expects to get their original investment back at the end of that time period, along with the interest earned. Investment risk is repayment of the principal (amount invested). In the event of a bankruptcy or other corporate disruption, bonds are senior to stocks. Investors should be aware of these differences prior to investing.

Index Definitions: You cannot invest directly in an index

Standard & Poor’s (S&P) 500 Index measures the performance of 500 large cap stocks, which together represent about 80% of the total US equities market.

RiverFront Investment Group, LLC, is an investment adviser registered with the Securities Exchange Commission under the Investment Advisers Act of 1940. Registration as an investment adviser does not imply any level of skill or expertise. The company manages a variety of portfolios utilizing stocks, bonds, and exchange-traded funds (ETFs). RiverFront also serves as sub-advisor to a series of mutual funds and ETFs. Opinions expressed are current as of the date shown and are subject to change. They are not intended as investment recommendations.

RiverFront is owned primarily by its employees through RiverFront Investment Holding Group, LLC, the holding company for RiverFront. Baird Financial Corporation (BFC) is a minority owner of RiverFront Investment Holding Group, LLC and therefore an indirect owner of RiverFront. BFC is the parent company of Robert W. Baird & Co. Incorporated (“Baird”), a registered broker/dealer and investment adviser.

Copyright ©2019 RiverFront Investment Group. All Rights Reserved. 937173