By Joseph Hosler, Auour Investments

Markets have been exceptionally volatile this year as trade rhetoric between China and the U.S. hits new highs. Recent actions taken by President Trump appear at odds with the goal of reaching a trade deal. Specifically, labeling the country a currency manipulator. If one wanted to work towards a middle ground, this would not have been a suggested move. However, it may make sense if it is more to do with lessening China’s global stature and pushing our historical allies away from them.

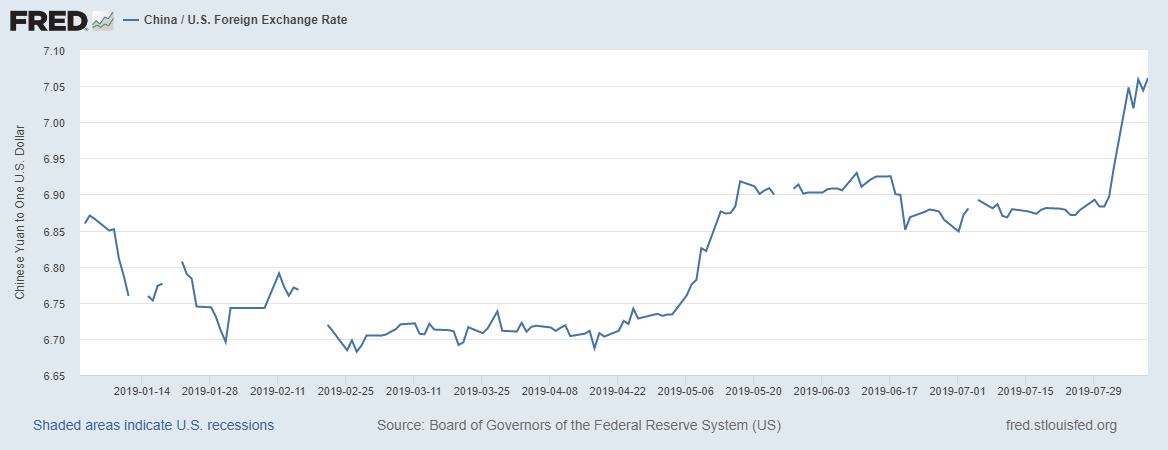

First, there should be little doubt that China manipulates their currency. They do not allow free float of their currency and restrict capital flows in and out of the country. In the true sense of the word, those attributes define manipulation.To be labelled a ‘currency manipulator’ though is to be found guilty of working towards a weaker currency. In the case of China, they have been trying to strengthen it. This is the exact opposite action expected of an export-driven country if the intent was to improve its competitive stance.

However, if the desire of the U.S. is not a trade deal but instead to destabilize the Chinese economy, then it may make sense. The belief among some economists is that if no capital restrictions were in place, Chinese citizens would flee, moving their savings to safer currencies such as the U.S. dollar. We see this already with the amount of money finding its way out of China and into real estate in the U.S., Canada, and Europe. Another anecdote is the move in bitcoin whenever the yuan gets hit or their government restricts capital outflows further.

The labeling of China a currency manipulator will highlight actions by the People’s Bank of China (PBOC) to strength the yuan. The spotlight may cause them to lessen yuan support, allowing the currency to weaken further. The continued weakness will be viewed as PBOC being backed into corner, solidifying the future direction and adding pressure for increased capital flight.

As the yuan falls against the dollar, it will also fall against the overall basket, including the Euro. As the Eurozone economy suffers from a manufacturing contraction, the cheaper yuan will provide EU politicians additional ammunition in their fight to lessen the influence of China products on their soil, bringing the EU more in line with the U.S. as it pertains to China trade.

All of this places China’s leaders in an increasingly tough spot. With an economy that has seen a doubling in their leverage over the past 10 years and still very dependent on exports, a weakening economic environment will be harder to control. And with well over $1 trillion in dollar denominated debt needing to be refinanced over the next 18 months, the increasing weakness in their currency will make it much more expensive to refinance.

With increasing economic pressure comes an increase in political pressure – something China’s government may not want as it celebrates the 70’s anniversary of communist rule in October. Time will tell if the actions taken by U.S. trade negotiators were a tactic to bring about a better deal or an attempt to destabilize an authoritarian regime. No matter the intent, the result may be the same.

This article was written Joseph Hosler, Managing Principal at Auour Investments, a participant in the ETF Strategist Channel.