By Gary Stringer, Kim Escue and Chad Keller, Stringer Asset Management

Though we believe long-term fundamentals look attractive for oil and energy stocks, we expect near-term volatility to continue in the wake of geopolitical tensions. Risks from trade wars and sanctions linger and the potential upside for the broad oil and energy sectors in the near-term does not outweigh the downside risk in our opinion.

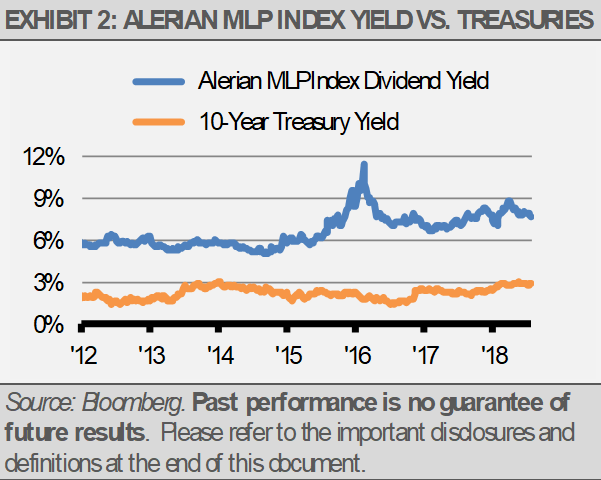

However, we do find value in energy Master Limited Partnerships (MLPs), which are traded on national exchanges like equity securities, but offer some tax benefits due to their limited partnership structure. With a recent decoupling from oil prices, depressed valuations, and stable interest rates, we think MLPs are attractive, especially for income investors seeking high dividends and diversification from traditional income products.

FERC CHANGES TO MLP SPACE

In March of this year, the Federal Energy Regulatory Commission (FERC) came out with a change that would take away an important income tax allowance used by cost of service pipeline MLPs. This rule adjustment threatened the profitability and dividends of a specific subset of MLPs, along with heightening the risk of a shrinking universe as more MLPs would find converting to a C-corp structure more appealing without the tax allowance. As is often typical, investors threw the baby out with the bathwater and the broad MLP sector was affected. While the ruling only impacted a small number of interstate pipelines and was not expected to have an impact for some years, the news was met with a large selloff within the MLP universe.

In July, FERC announced the new tax allowance rule would not impact certain MLPs that have a corporate parent company. This has eased some of the strain in the MLP market and prices have moved back up from their lows, but prices remain attractive in our opinion, especially for income investors that benefit from the high dividend yield.

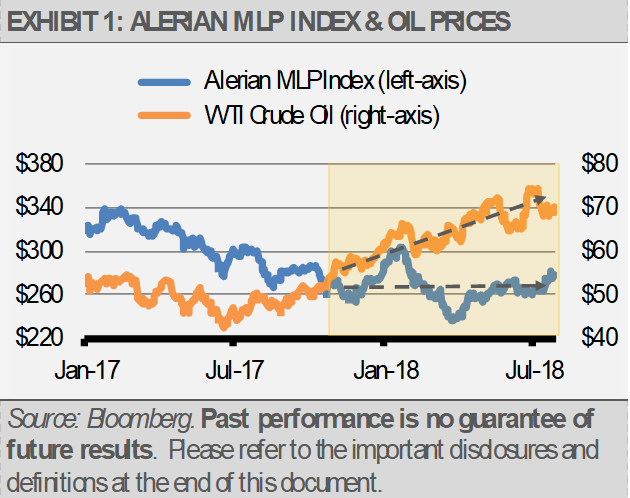

RECENT DIVERGENCE FROM OIL PRICES

Over the past several months, the MLP sector has decoupled and correlations to oil prices have fallen. If this trend continues, we would expect to see less volatility in the shorter-term from geopolitical risks, as well as from stabilized interest rates and more favorable tax rulings.

![]()

THE OUTLOOK IS GOOD FOR MLPS

All together, we think this is a positive backdrop for the MLP space. The MLP sector can be interest rate sensitive, and with our current view that longer term interest rates will not move up significantly from here, this is a favorable environment for the sector. Additionally, MLPs can provide a nice income stream for those investors looking to diversify their sources of income.

However, we are concerned about the longer-term trend of MLPs switching to C-corps that began years back when Kinder Morgan converted. While the latest FERC ruling takes some of the pressure off, the tax spread between the MLP structure and the C-Corp will remain wider and advantageous for most MLPs. In general, there are other factors driving the decision to convert to a C-Corp or not, such as the access and the cost of capital, and how the MLP would value as a C-Corp. Despite recent developments with the FERC ruling, this conversion trend should be watched as dedicated MLP ETFs would become more concentrated with fewer holdings.