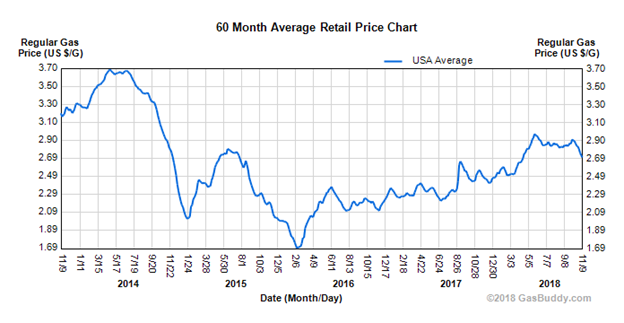

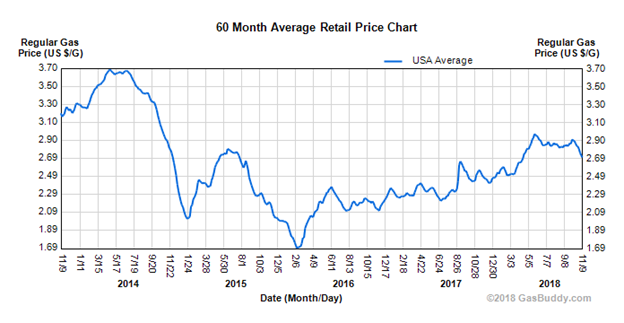

The impact of extra dollars in the hands of consumers can result in additional travel volume for both the roadways and airports, helping strengthen debt coverage ratios within the sector. While the latest drop in oil prices has not yet resulted in a decline in either of these fuel prices, we believe the potential for declines is expected over time.

Lower oil should prove to be supportive for transportation backed revenue bonds; however, the larger challenge the sector may face could come in the form of a renewed interest in infrastructure legislation. One piece of legislation being discussed by congress would increase the passenger facility charge to help pay for airport improvement projects.

Related: Top 34 Oil ETFs

Additional fees that would be folded into airline ticket prices would serve to offset any traction made from declining fuel prices. Any increase in the national gas tax would also serve to offset declines from sustained lower crude oil prices.

Impact on Today’s Markets

At Clark Capital Management, we continually monitor these types of macro-economic trends and events to help us determine portfolio diversification, credit positioning and sector selection within our Tax-Free Municipal Bond Strategy.

As always, we believe it’s important for investors to stay focused on their long-term goals and objectives and not short-term fluctuations in the market—including oil prices.

Disclosure Information

This is not a recommendation to buy or sell a particular security.

This information should not be considered to be a recommendation to buy or sell a security or to adopt a particular investment strategy. Clark Capital Management Group, Inc. (“Clark Capital”) is an investment adviser registered with the U.S. Securities and Exchange Commission. Registration does not imply a certain level of skill or training. More information about Clark Capital’s advisory services can be found in its Form ADV, which is available upon request.

Past performance is not indicative of future results. The opinions expressed are those of the Clark Capital Management Investment Team and are subject to change without notice. The opinions referenced are as of the date of publication and may not necessarily come to pass. This material is not financial advice or an offer to buy or sell any product. Clark Capital reserves the right to modify its current investment strategies based on changing market dynamics or client needs. The material in this report has been derived from sources considered to be reliable, but Clark Capital cannot guarantee its completeness or accuracy.Clark Capital does not provide accounting, tax, or legal advice. Economic and market forecasts presented herein reflect a series of assumptions and judgments as of the date of this presentation and are subject to change without notice. These forecasts do not take into account the specific investment objectives, restrictions, tax and financial situation or other needs of any specific client. Actual data will vary and may not be reflected here. These forecasts are subject to high levels of uncertainty that may affect actual performance. Accordingly, these forecasts should be viewed as merely representative of a broad range of possible outcomes. These forecasts are estimated, based on assumptions, and are subject to significant revision and may change materially as economic and market conditions change. Clark Capital has no obligation to provide updates or changes to these forecasts.CCM-910