Our Cash Indicator methodology acts as a plan in case of an emergency. This is analogous to the multiple safety systems in a modern automobile, which includes an airbag. Importantly, each of these systems work together to potentially help smooth the ride.

We manage risk within our strategic, long-term allocations based on diversification across equity, fixed income, and alternative assets and a focus on more attractive relative values.

We manage risk tactically over the short-term by investing across a broad array of themes and asset classes including cash. We can either invest opportunistically or defensively depending on the environment.

Cash Indicator: Markets are functioning properly but we expect continued volatility.

Our proprietary Cash Indicator (CI) provides insight into the health of the market by monitoring the level of fear using equity and fixed income indicators. This warning system is designed to signal us to either a 25% or 50% cash position to potentially protect principle and provide liquidity to reinvest at lower and more attractive valuations.

The CI remains above its long-term median level. While our fundamental work suggests that we should expect more market volatility ahead, the CI suggests a low risk of a big market crash over the near-term.

Strategic View: Equity and fixed income valuations remain attractive, which increases our long-term expectations.

Equity Valuations: Equity valuations by different measures have fallen below their longer-term averages. Attractive valuations improve our long-term outlook for the equity market.

Equity Favorability: We continue to favor defensive equities as we expect global, economic, and market challenges ahead. That said, we have upgraded our foreign outlook as the Eurozone has done a tremendous job in dealing with their energy issues related to the war in Ukraine, reducing the risk of a deeper recession in our opinion. Our Strategies are close to their long-term target weight allocation to foreign equities.

Fixed Income Valuations: With the yield curve persistently inverted and broad money growth falling, we expect headline inflation and long-term interest rates to decline over the next year. The 10-year Treasury yield looks attractive when over 3% while short-term interest rates should stabilize.

Fixed Income Favorability: We remain overweight U.S. Treasuries including floating rate at the short end of the yield curve, and interest rate sensitivity. We are underweight credit risks as we expect those areas to underperform in a challenging economic environment.

Tactical View: We favor defensive equity, fixed income, and alternative investments.

While our global economic outlook remains cautious, we are seeing signs that the most acute risks of an energy shock in the Eurozone will likely be avoided. As a result, we have increased our allocation to developed market foreign equities with a focus on quality and lower volatility.

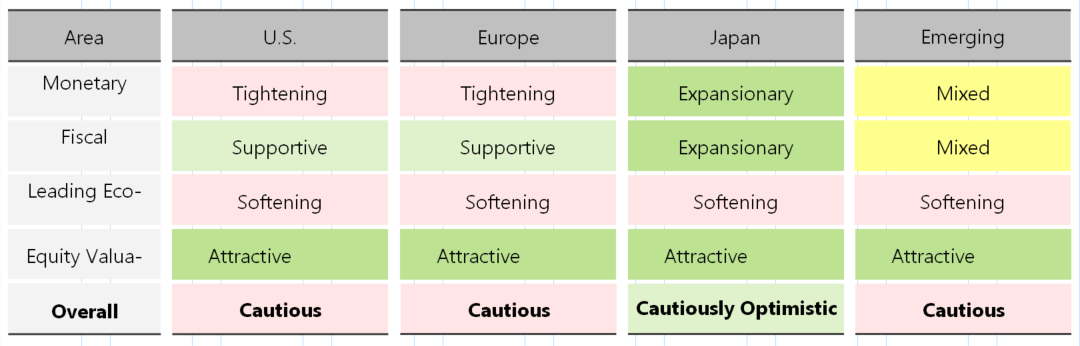

Global Broad Outlook: We remain cautious about the global economy and markets as economic weaknesses persist.

For more news, information, and analysis, visit the ETF Strategist Channel.

Any forecasts, figures, opinions, or investment techniques and strategies explained are Stringer Asset Management LLC’s as of the date of publication. They are considered to be accurate at the time of writing, but no warranty of accuracy is given and no liability in respect to error or omission is accepted. They are subject to change without reference or notification. The views contained herein are not be taken as an advice or a recommendation to buy or sell any investment and the material should not be relied upon as containing sufficient information to support an investment decision. The views and opinions expressed are soley those of the original authors and other contributors. This material is for informational purpose only. Investments discussed may not be suitable for all investors. No part of the authors’ compensation was, is, or will be directly or indirectly related to the specific views contained in this report. Information provided is obtained from sources deemed to be reliable; but is not represented as complete, and its accuracy is not guaranteed. Past performance is not indicative of future results. The securities identified and described may not represent all of the securities purchased, sold or recommended for client accounts. The reader should not assume that an investment in the securities identified was or will be profitable.