By RiverFront Investment Management

Market psychology is a fickle, fragile thing. Early this month it was all rainbows and unicorns after the S&P 500 closed at an all-time high. However, the mood turned darker after the Federal Reserve meeting. While the Fed cut interest rates 25 basis points (its first rate cut in a decade) and lowered the rates on excess bank reserves, the market chose to fret that this cut represented only a minor policy adjustment rather than the start of a new easing cycle.

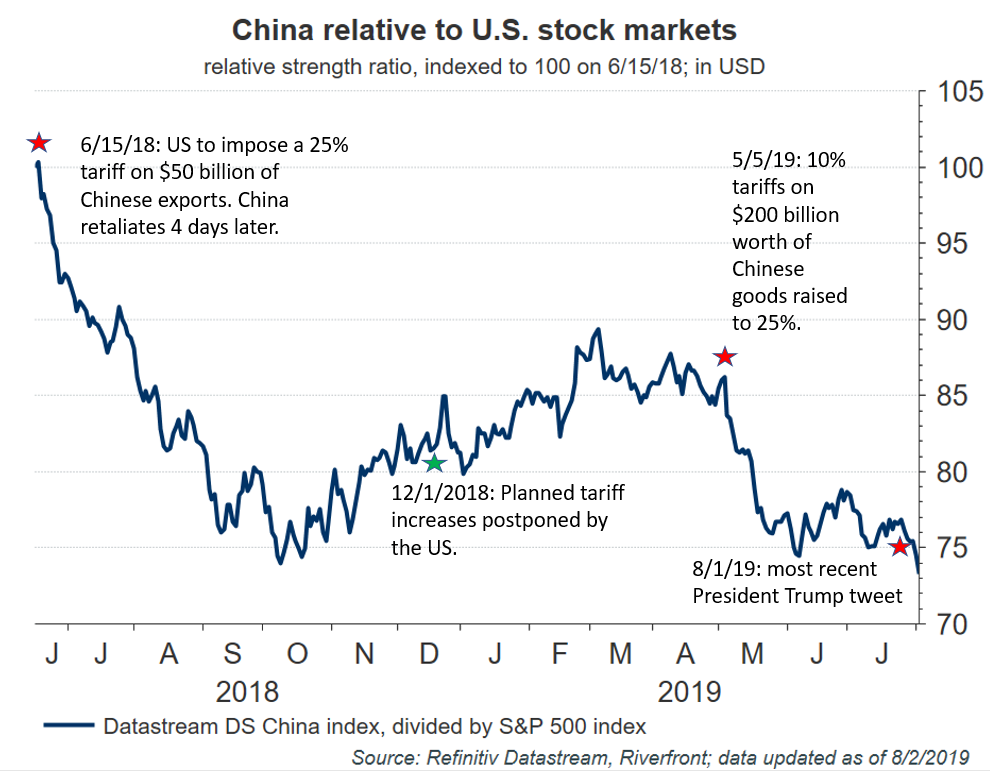

Wednesday’s fear of a complacent Fed was exacerbated by a tweet by President Donald Trump on Thursday outlining his intentions to impose a 10% tariff on the final $300 billion of imports from China on September 1st…apparently to the surprise of most of his administration. The end result was that US Treasury yields fell below 2%, the stock market experienced its worst week of the year, and yield curves further inverted as investors flocked to safety. The selloff appears to be continuing this week, with China allowing the yuan to fall below the support level of 7.00 yuan to the dollar. Given that a cheaper yuan makes Chinese exports more attractive to foreign buyers, this action suggests that China is retaliating to offset the impact of additional tariffs.

While this pullback in US markets may continue in the near-term, we believe there are reasons to remain calm and remember that many of the same factors that propelled the US equity market to new highs just a week ago remain in place today. Overseas, the news looks less encouraging and is the reason that we continue to prefer assets within the US to international ones in the near-term.

THREE REASONS FOR US INVESTORS TO STAY CALM

1. The Fed is still on investors’ side…particularly if the global economy deteriorates. In our 2019 Outlook and many times since, we have referred to the main drivers of stock market performance as the ‘3 Rs’: Rate strategy, Resolution of trade disputes, and Recession risk. Of these three, we think that rate strategy has been the main force driving the stock market since last fall.

The Powell-led Fed is far more concerned about international economies than past administrations. Last week, for example, the Fed outlined three main reasons for cutting rates: soft global growth, trade uncertainty, and lack of sustained inflation expectations. With the Fed clearly paying attention to the deteriorating economic data and political tail risks in Europe and Asia, it may continue to take preemptive action to minimize the risk of contagion despite the fact that the US economy appears to remain in sound shape. Essentially, if things get worse overseas, such as the Eurozone falling into recession, a ‘hard’ Brexit in the UK, or the trade war intensifying, we believe the Fed will continue to stimulate the US economy. China’s currency devaluation may even make it more likely that the Fed will act decisively.

2. A trade war is a real danger to the global economy – but it appears more damaging to international economies than to the US First, there is nearly a month for President Trump to rescind his threat regarding additional tariffs on Chinese goods. It appears the president is particularly upset about his perception of G20 promises reneged on by the Chinese, including large agricultural purchases and policing of illegal drug flow into the US. These shouldn’t be difficult for the Chinese to at least agree to in theory.

If these tariffs are enacted, there’s no denying they will directly impact prices of popular consumer-facing goods in the US, such as smartphones, clothes, and toys. Potentially offsetting higher tariffs are a number of tailwinds for US consumers, including strong job growth and wage gains, which has led to high levels of US consumer confidence. Not surprisingly, spending on discretionary goods like recreation and durable goods has been strong recently, a sign that US consumers feel good about the future. As long as US employment and wages continue on their current path, there is no reason to believe that higher prices on Chinese goods can’t be absorbed without triggering what is ultimately the most important ‘R’ for markets: Recession.

Past performance is no guarantee of future results. Shown for illustrative purposes. Not indicative of RiverFront portfolio performance. Index definitions are available in the disclosures.

We believe that the stock market itself tends to be the ultimate leading indicator of most economic data – and thus far has corroborated our view that the US is winning the trade war. Since the US first alarmed investors by openly discussing tariffs on China back in March of 2018, the S&P 500 is up over 6%, while Datastream DS China Index has lost over 25% of its value in US dollar terms (see chart above and on the next page). Most other international markets have also meaningfully underperformed the US over that time period.

3. The message from the bond market isn’t as alarming as it seems. While the inverted yield curve and low US treasury rates seem to be signaling heightened levels of stress in the economy, the credit market is not supporting that narrative. Credit spreads, which measure the additional premium investors demand for default risk, remain low by historical averages for investment grade corporates. As interest rates and credit spreads remain subdued, companies can refinance their debt at attractive levels, keeping interest expenses low. Therefore, despite the alarms about an increase in total debt outstanding, low rates and tight credit spreads have meaningfully lowered the cost of servicing that debt. We believe this will continue to support credit markets which have historically been a good indicator for economic strength.

Although it’s always dangerous to assume “it’s different this time,” we don’t believe investors should consider the 3m/10yr inversion of the yield curve as a signal for an imminent recession. There are a few reasons for this conclusion, including the fact that we’re still in a low interest rate environment with few signs of inflation, and that global central banks have depressed long term rates around the world (see our March 19, 2019 Weekly View).

WHAT WE’RE WATCHING GOING FORWARD

Déjà vu alert – we first published the following sentence back in May: “The market entered this unexpected announcement with elevated sentiment and stocks close to all-time highs; therefore, it’s understandable that the calm may be shattered until investors get more clarity.” The same is likely to hold true today. As in May, we expect the impact of this most recent Twitter bomb to eventually fizzle as investors realize that the US economy is unlikely to plunge into recession in the next 6-9 months.

But what if this view proves too sanguine? RiverFront adheres to a disciplined risk management process that utilizes technical analysis to harness the ‘wisdom of crowds’ and help strike an objective view towards portfolio opportunities and risk management. With the psychological barrier of 3000 breached on Wednesday July 31, 2019 and the market flirting with support around 2867 as we write this, we view the next important near-term support levels on the S&P 500 to include the 200-day moving average around 2790; this level is close to a 1/3 retracement of the 2019’s stock market rally (support lines in light blue, below). The next level of support beyond that is likely to be around 2700, in our view. Our team would note that, according to RiverFront’s proprietary tactical models, the historical probability for positive S&P 500 returns over the next three to still look above-average as of Friday’s close.

Past performance is no guarantee of future results. Shown for illustrative purposes. Not indicative of RiverFront portfolio performance. Index definitions are available in the disclosures.

This article was written by the team at RiverFront Investment Group, a participant in the ETF Strategist Channel.

Important Disclosure Information

The comments above refer generally to financial markets and not RiverFront portfolios or any related performance. Past results are no guarantee of future results and no representation is made that a client will or is likely to achieve positive returns, avoid losses, or experience returns similar to those shown or experienced in the past.

Information or data shown or used in this material is for illustrative purposes only and was received from sources believed to be reliable, but accuracy is not guaranteed.

In a rising interest rate environment, the value of fixed-income securities generally declines.

When referring to being “overweight” or “underweight” relative to a market or asset class, RiverFront is referring to our current portfolios’ weightings compared to the composite benchmarks for each portfolio. Asset class weighting discussion refers to our Advantage portfolios. For more information on our other portfolios, please visit www.riverfrontig.com or contact your Financial Advisor.

Investing in foreign companies poses additional risks since political and economic events unique to a country or region may affect those markets and their issuers. In addition to such general international risks, the portfolio may also be exposed to currency fluctuation risks and emerging markets risks as described further below.

Changes in the value of foreign currencies compared to the US dollar may affect (positively or negatively) the value of the portfolio’s investments. Such currency movements may occur separately from, and/or in response to, events that do not otherwise affect the value of the security in the issuer’s home country. Also, the value of the portfolio may be influenced by currency exchange control regulations. The currencies of emerging market countries may experience significant declines against the US dollar, and devaluation may occur subsequent to investments in these currencies by the portfolio.

Foreign investments, especially investments in emerging markets, can be riskier and more volatile than investments in the US and are considered speculative and subject to heightened risks in addition to the general risks of investing in non-US securities. Also, inflation and rapid fluctuations in inflation rates have had, and may continue to have, negative effects on the economies and securities markets of certain emerging market countries.

Stocks represent partial ownership of a corporation. If the corporation does well, its value increases, and investors share in the appreciation. However, if it goes bankrupt, or performs poorly, investors can lose their entire initial investment (i.e., the stock price can go to zero). Bonds represent a loan made by an investor to a corporation or government. As such, the investor gets a guaranteed interest rate for a specific period of time and expects to get their original investment back at the end of that time period, along with the interest earned. Investment risk is repayment of the principal (amount invested). In the event of a bankruptcy or other corporate disruption, bonds are senior to stocks. Investors should be aware of these differences prior to investing.

[Index Definitions]: You cannot invest directly in an index

Standard & Poor’s (S&P) 500 Index measures the performance of 500 large cap stocks, which together represent about 80% of the total US equities market.

Datastream Global Equity Indices draw on the wealth of the Thomson Datastream database to provide a range of equity indices. They form a comprehensive, independent standard for equity research and benchmarking. For each market, a representative sample of stocks covering a minimum 75 – 80% of total market capitalization enables market indices to be calculated. By aggregating market indices for regional groupings, regional and world indices are produced.

RiverFront Investment Group, LLC, is an investment adviser registered with the Securities Exchange Commission under the Investment Advisers Act of 1940. Registration as an investment adviser does not imply any level of skill or expertise. The company manages a variety of portfolios utilizing stocks, bonds, and exchange-traded funds (ETFs). RiverFront also serves as sub-advisor to a series of mutual funds and ETFs. Opinions expressed are current as of the date shown and are subject to change. They are not intended as investment recommendations.

RiverFront is owned primarily by its employees through RiverFront Investment Holding Group, LLC, the holding company for RiverFront. Baird Financial Corporation (BFC) is a minority owner of RiverFront Investment Holding Group, LLC and therefore an indirect owner of RiverFront. BFC is the parent company of Robert W. Baird & Co. Incorporated (“Baird”), a registered broker/dealer and investment adviser.

Copyright ©2019 RiverFront Investment Group. All Rights Reserved. 918797