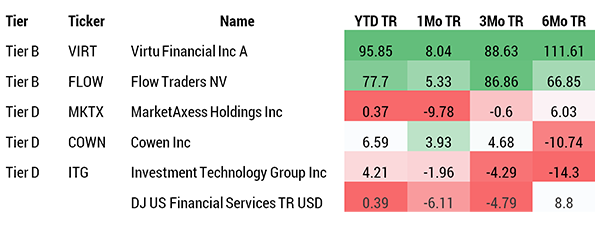

With the uptick in market volatility, ETF liquidity providers have outperformed most other financial stocks, which in turn has helped TETF.Index maintain its performance when compared to other indexes.

The VIX, a measure of volatility, has had an average close of 20.74 since February 2nd, and never closing below 15. To put that in perspective, the VIX closed above 15 on only 7 occasions in all of 2017, and only once crossing 16. The Toroso ETF Industry Index has a current 8.8% allocation to liquidity providers, which is comprised of 5 companies.

![]()

Source: Morningstar

These liquidity providers benefit from the fact that ETFs are now more than 60% of the overall daily trading volume of the market. Trading volume is derived from creations and redemptions of the ETFs themselves, as well as rebalances within each ETF. The charts and tables below help to illustrate the significant dollars being rebalanced in ETFs.For this analysis, we examined the readily available data from US equity ETFs, split between Traditional Beta, Smart Beta and Active. All in all, there were 809 ETFs included with $1.99 trillion.

![]()