Last week, we dissected sectors, and this week tackle themes. Within the ETF Security Master that powers the tools of the ETF Think Tank, we include themes in the sector search function. Many themes will be the sectors of the future that advisors need to access and provide value to clients. Let’s start by looking at how themes compare to sectors.

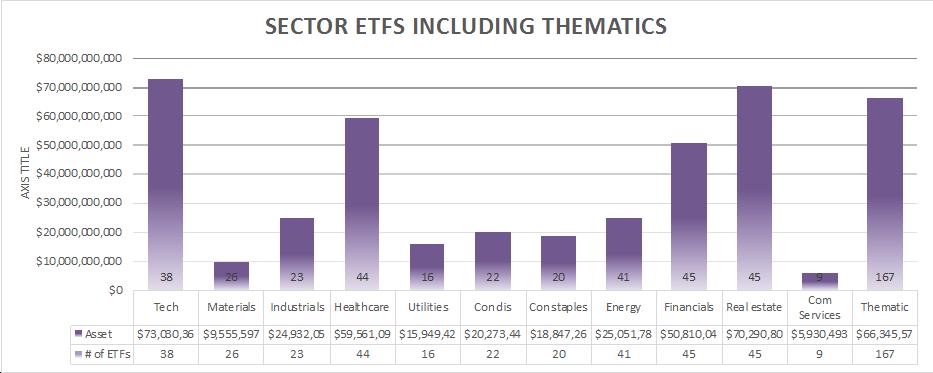

As depicted in the chart above, there are 167 thematic ETFs, excluding leveraged and inverse ETFs with $66 billion in assets. Thematic ETFs command more assets than every sector except Technology and Real Estate. Although thematic ETFs represent only 1.7% of ETF assets, they have been 13% of all ETF launches in the past 12 months.

What is a Thematic ETF?

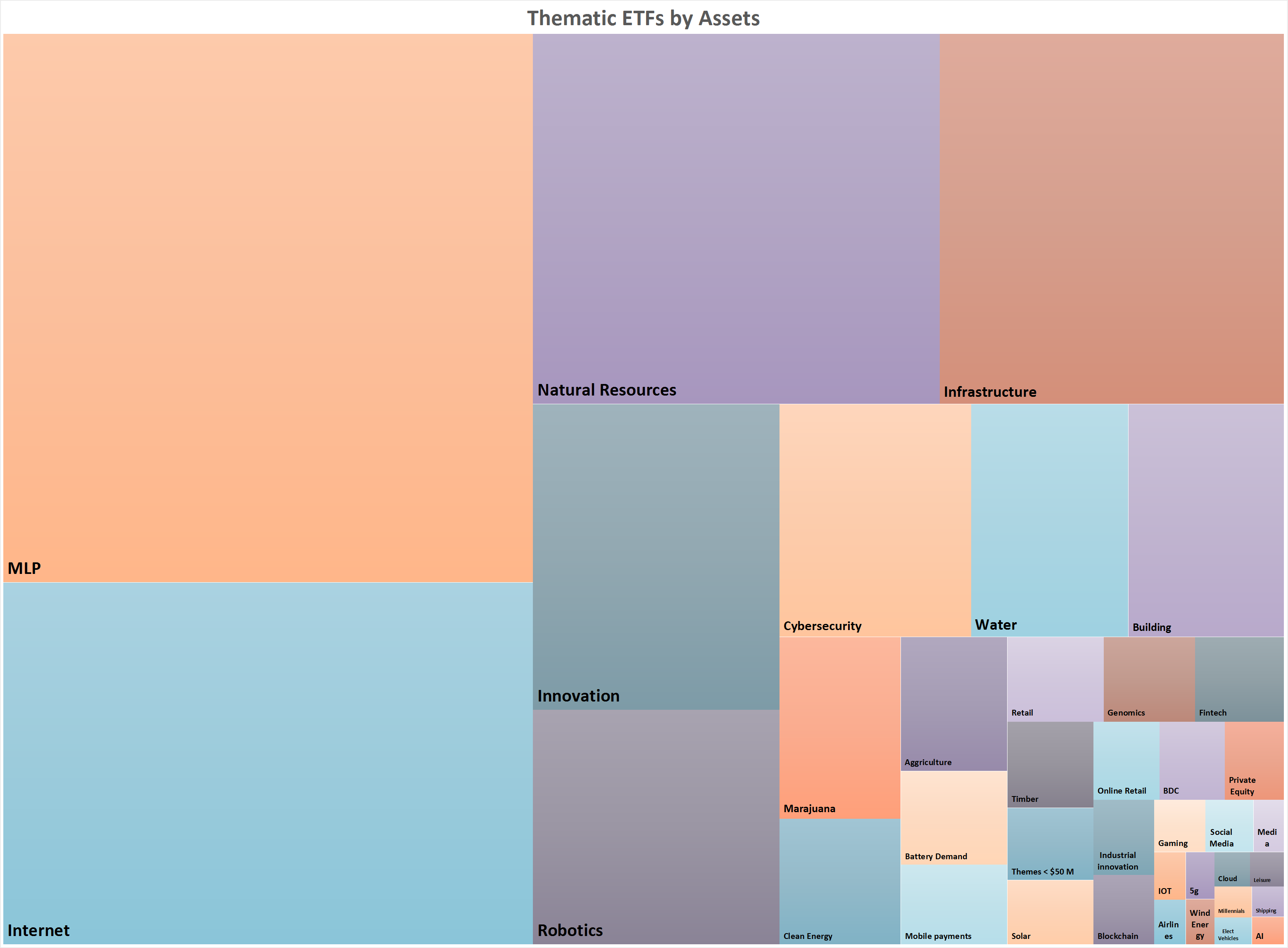

A thematic ETF seeks to provide exposure to a trend or developing business model through the compilation of securities from multiple sectors, market caps, and geographies. Thematic ETFs include specific corporate structures and often encompass multiple businesses within the supply chain supporting the global growth trend. They differ from industries in that they are not mandated to hold at least 80% in a single defined sub-sector. Below we provide a surface chart and a list of how thematic assets are allocated today.

Clearly the largest theme is MLPs, which falls under our structural definition of themes just like BDCs or Yieldco equities. Although most MLPs are in the energy or infrastructure sector, some are in Finance, Real Estate, or even amusement parks like Cedar Fair ($FUN). Additionally, within our ETF Think Tank Security Master, we categorized any MLP ETF that mandated 80% energy to the energy sector. To our surprise, only 25 out of 28 qualified as themes.

Next, we see over $10 billion allocated to the Internet, which clearly spans multiple sectors with the recategorization of many internet companies from Technology to Communication Services. Natural resources and infrastructure come next. Both of which are commonly used as inflation beneficiaries with decent yields. The transformational innovation trends like robotics, cybersecurity, marijuana, fintech, and blockchain have been some of the newer themes that have grown over the past few years. In 2019, we have seen some impressive thematic ETF launches like Defiance 5G Next Gen Connectivity ETF ($FIVG) and Global X Genomics & Biotechnology ETF ($GNOM).

How Can Advisors use Thematic ETFs?

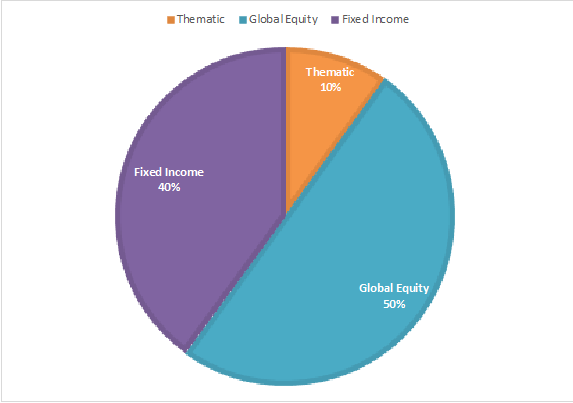

Thematic ETFs fall within the client alignment growth factors of transparency, liquidity, tax efficiency, and even lower cost, even though the average theme expense ratio is 0.65. Liquidity may be the most important attribute of thematic ETFs because they provide access in a liquid diversified way to global trends that are often difficult and expensive to trade. Additionally, in a previous research note, Thematic ETFs and Nursery Rhymes, we described how advisors can use the asset allocation model below to potentially enhance the outcomes of a traditionally balanced portfolio.

This article was contributed by the team at Toroso Investments, creators of the ETF Think Tank and a participant in the ETF Strategist Channel.

Click here to see disclosures.