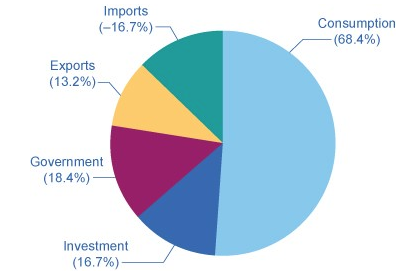

If all is well with the economy, why did the FED just turn so Dovish? According to the Bureau of Economic Analysis at the U.S. Department of Commerce, ~68% of the U.S. economy is based on the U.S. consumer’s spending and Fixed Investment accounts for another ~17%. The Fed just acknowledged that at least 75% of our economy is slowing!

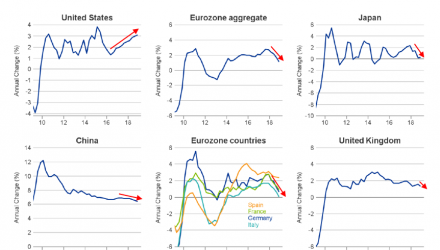

Whether it’s the trade war, the reversal of trillions of dollars of Quantitative Easing (QE) by the world’s Central Banks, the fact that this period of economic expansion is within months of becoming the longest ever, or some combination of global-macro factors, the data does not lie. Markets are up yet the fundamentals of market and economic growth are going down. Which one will ultimately be wrong?

This article was contributed by Dave Haviland, Portfolio Manager at Beaumont Capital Management, a participant in the ETF Strategist Channel.

For more insights like these, visit BCM’s blog at blog.investbcm.com.

Disclosure:

Copyright © 2019 Beaumont Financial Partners, LLC DBA Beaumont Capital Management (BCM). All rights reserved.

This material is for informational purposes only. It is not intended as an offer or solicitation for the purchase or sale of any security or financial instrument, nor should it be construed as financial or investment advice.

The information presented in this report is based on data obtained from third party sources. Although it is believed to be accurate, no representation or warranty is made as to its accuracy or completeness.

An investment cannot be made directly in an index. Past performance is no guarantee of future results.