![]()

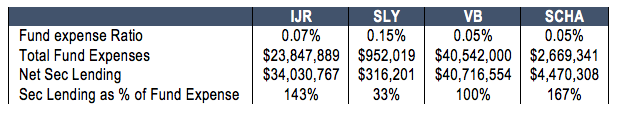

IJR expense information is for 1 year ending 3/31/2018. SLY information is for 1 year ending 06/30/2017. SCHA expense information is for 1 year ending 8/31/2017. VB expense information is for 1 year ending 12/31/2017.

What this data shows is that for each of the funds, with the exclusion of SLY, the fund company can completely cover their fund expense through securities lending revenue.

Summary

In summary, there are a lot of operational activities of fund management which can impact the expense ratio more than just the stated number in the prospectus. Depending upon the asset class, many funds can cover the entirety of their expenses just through securities lending. Some could even call that “free.”

The truest test of overall efficiency, however, can be measured by tracking error. All the income and expenses a fund generates will be netted and impact the overall efficiency of a fund tracking an index. The closer a fund tracks it’s benchmark, the better it is for the end investor.

This article was written by Tyler Denholm, CFA, who is Vice President – Investment & Research at TOPS ETF Portfolios, a participant in the ETF Strategist Channel.

Valmark Advisers, Inc. (“Valmark”) is a federally registered investment adviser located in Akron, Ohio. Valmark and its representatives are in compliance with the current registration and notice filing requirements imposed upon federally covered investment advisers by those states in which Valmark maintains clients. For registration or additional information about Valmark, including its services and fees, a copy of our Form ADV is available upon request by contacting Valmark at 1-800-765-5201.

This article provides commentary on current economic and market conditions and is not directly relevant to any particular client account. The information contained herein should not be construed as personalized investment advice or recommendations to buy or sell any security. There can be no assurance that the views and opinions expressed in this article will come to pass. Investing involves the risk of loss, including the loss of principal.

Diversification cannot assure gains or protect against losses.

Past performance is no guarantee of future results. Information contained herein is subject to change without notice and should not be considered as a solicitation to buy or sell any security. Indexes are unmanaged and cannot be directly invested in.

Source: Bloomberg for historic price and return references, as well as charts.

TOPS® is a registered trademark of Valmark Advisers, Inc.