By Kimberly Woody, Senior Portfolio Manager

The market is digesting a lot of bad news. Arguably it is well telegraphed. We all know what could go wrong. For instance, the Fed is committed to tightening financial conditions which historically triggers a recession. In addition, even if the U.S. economy manages to avoid a recession in 2023, earnings estimates are likely to be negatively revised as margins and demand suffer from the multi-faceted burdens of inflation. And the U.S. consumer is currently faced with meaningful changes in the affordability of housing, food, and fuel. That said, when sentiment is this negative, it only takes a little light at the end of the tunnel to get investors back in the game.

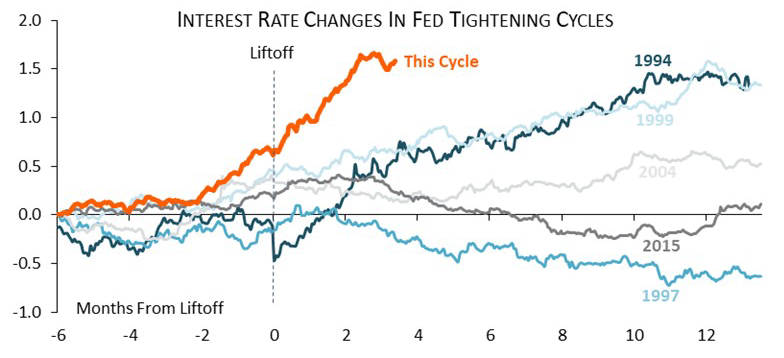

So, we start to look for silver linings. This tightening cycle seems very different from past cycles. The Fed is plainly hawkish and its plans to tighten monetary conditions via balance sheet reduction and rate hikes are included in their forward guidance. And because we have very little past experience with quantitative tightening, it is difficult to estimate the impact of Fed balance sheet reduction. While some lament the Fed’s slow reaction timing, and the move has been relatively modest thus far (75 basis points hike), the market has adjusted to expectations for future tightening. Our colleagues at Piper Sandler constructed the following:

“We constructed an index of various interest rates that affect the U.S. economy the most. In particular, we included government interest rates, corporate interest rates (commercial paper and bonds of various credit quality), and consumer interest rates (mortgages, auto, and personal loans). The conclusion is in the chart below: We are going through the fastest tightening cycle since 1994.”

In a sense, Powell achieves his intentions without actually doing much of anything so far. Consensus is that the Fed rarely achieves a soft landing. Perhaps this new way of tackling an economy with so many complicated crosscurrents may finally yield the intended outcome.

In a sense, Powell achieves his intentions without actually doing much of anything so far. Consensus is that the Fed rarely achieves a soft landing. Perhaps this new way of tackling an economy with so many complicated crosscurrents may finally yield the intended outcome.

The cure for higher prices may just be higher prices. Much like household debt levels, there is a point at which consumers alter their purchasing habits by substituting, cutting back or completely stopping consuming a given product. Anecdotally, gas demand in May was the lowest for the time period since 2013 (4 week rolling average). Retailers like Walmart, Target, and the Gap are reporting a glut of inventory as consumers eschew inflated prices and shift spending priorities away from pandemic related items. As supply chains resolve, we are already seeing evidence of excess ordering based on previously expected shortages. We are seeing wholesale inventories continuing to climb. The level of existing home sales has pushed lower but has yet to flow through to prices as median home prices remain elevated. That said, housing data is very lagged and so the data may not reflect current conditions.

While all this may not sound like good news, these anecdotes show that consumers are increasingly uncomfortable with higher prices and demand destruction may already be underway. We are seeing moderation in expectations for inflation at every debt maturity level as measured by the spread between the yield on a treasury inflation protected security and a straight treasury. The consumers reaction to inflation may just be part of the cure.

Much like the bear case is based on rates and inflation running out of control, conversely so is the bull case. With rates and inflation widely believed to be heading higher and untamed for a longer period of time, a bullish scenario relies on the consensus getting that wrong. Declining real income and consumer real net worth are cured by tamer inflation numbers and it also gets folks back to work which alleviates employment shortages and wage pressures. The Fed is walking a fine line. The interplay between all these factors determines how this situation unfolds. But with sentiment and positioning at historically bearish levels, it’s time to consider what may go well over the next few months and in to 2023.

Sources: Ned Davis Research, Energy Information Administration, Piper Sandler

GLOBALT is an SEC Registered Investment Adviser since 1991 and, effective July 10, 2013, remains a Registered Investment Adviser through a separately identifiable division of Synovus Trust N.A., a nationally chartered trust company. This information has been prepared for educational purposes only, as general information and should not be considered a solicitation for the purchase or sale of any security. This does not constitute legal or professional advice, and is not tailored to the investment needs of any specific investor. Registration of an investment adviser does not imply any certain level of skill or training. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information may be required to make informed investment decisions, based on your individual investment objectives and suitability specifications. Investors should seek tailored advice and should understand that statements regarding future prospects of the financial market may not be realized, as past performance does not guarantee and/or is not indicative of future results. Content may not be reproduced, distributed, or transmitted in whole or in part by any means without written permission from GLOBALT. Regarding permission, as well as to receive a copy of GLOBALT’s Form ADV Part 2 and Part 3, contact GLOBALT’s Chief Compliance Officer, 3400 Overton Park Drive, Suite 200, Atlanta GA 30339. You can obtain more information about GLOBALT Investments and its advisers via the Internet at adviserinfo.sec.gov, sponsored by the U.S. Securities and Exchange Commission.

The opinions and some comments contained herein reflect the judgment of the author, as of the date noted.

Investment products and services provided are offered through Synovus Securities, Inc. (SSI), a registered Broker-Dealer, member FINRA/SIPC and SEC Registered Investment Adviser, Synovus Trust Company, N.A. (STC), Creative Financial Group, a division of SSI. Trust services for Synovus are provided by STC.

Regarding the products and services provided by GLOBALT:

NOT A DEPOSIT. NOT FDIC INSURED. NOT GUARANTEED BY THE BANK. MAY LOSE VALUE. NOT INSURED BY ANY FEDERAL AGENCY