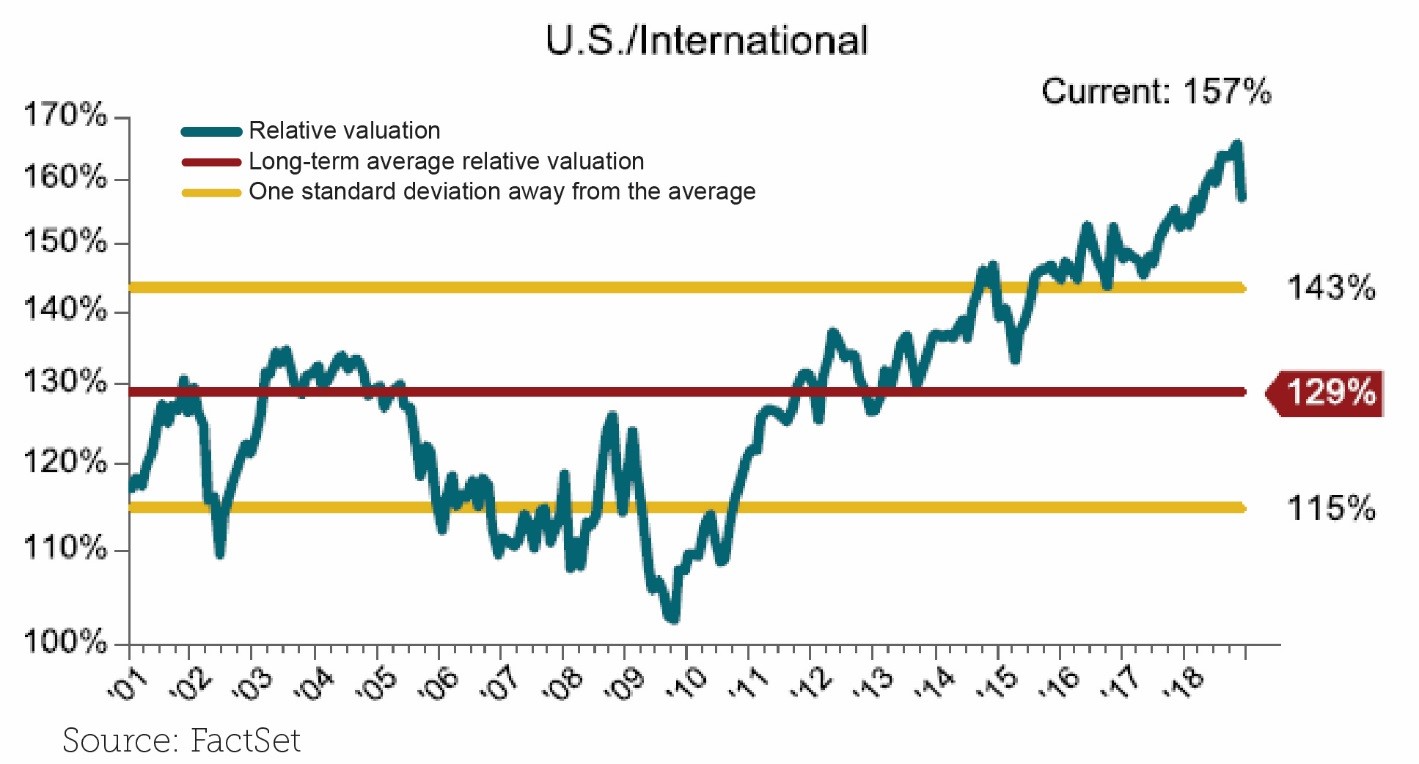

2. Valuations of U.S. equities relative to international are extremely high. Despite the recent drawback at the end of 2018, current relative valuations are still well above the historical average (two standard deviation points higher). While valuations may deviate from the mean in the short term, mean reversion is bound to happen over time.

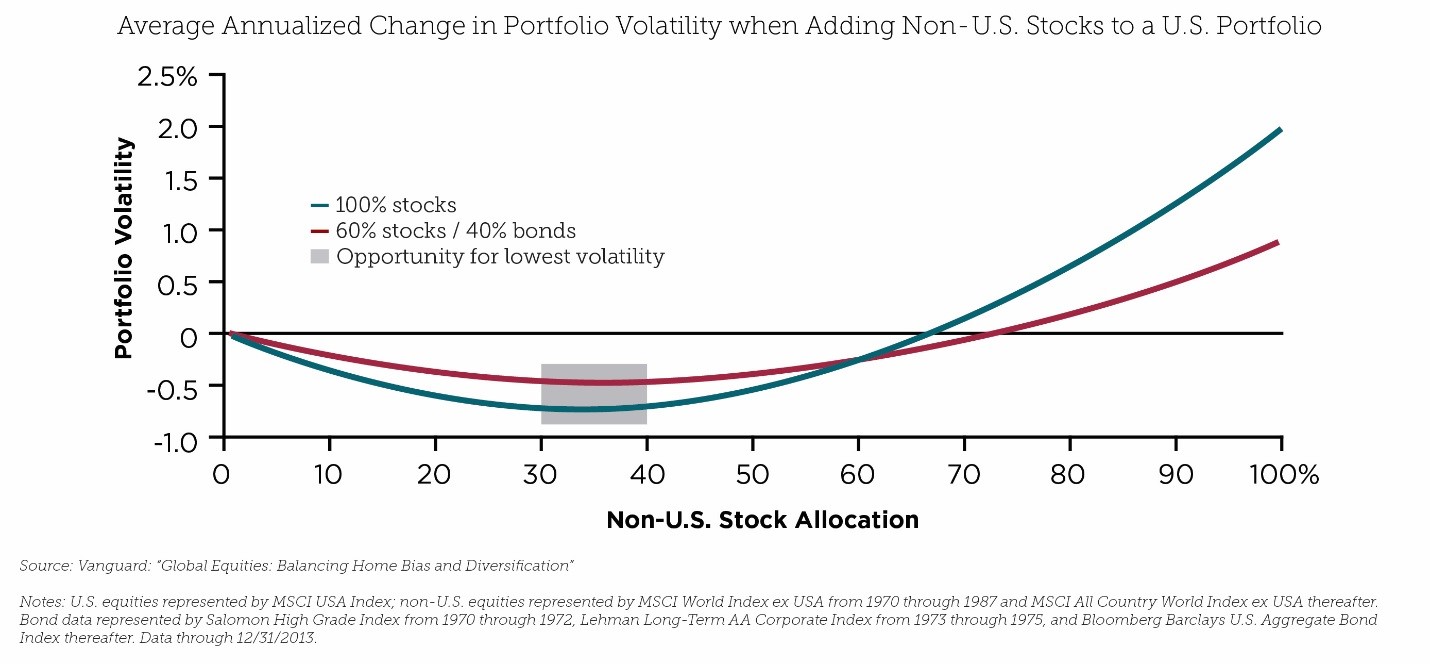

3. Based on the diversification benefits, we believe it’s always a good time to invest in international. Much research, like the chart below from Vanguard, has shown that the risk-reduction benefits of global diversification continue to grow until approximately 70% of the portfolio is allocated to international investments

While investors may have gotten away with a home-country bias over the past decade, it is a good time to reconsider those allocations. The current valuations and outlook suggest that international should have a higher expected return going forward. Of course, the U.S. market could continue to outperform, but history suggests the chances are slim. And, while I may occasionally give in on brand-name shopping to keep the peace at home, I’m not willing to give up the long-term benefits of a global portfolio.

Jackson Lee is Associate Quantitative Portfolio Manager at CLS Investments, a participant in the ETF Strategist Channel.

95-CLS-1/28/2019