Hindsight is 20/20 and the period between November 13, 2014 to July 13, 2018 is an isolated hypothetical illustration that was limited by the launch date of EMQQ; regardless, it does illustrate how wrongly focusing on fees can encumber an investor’s returns. Structure matters a lot more than the expense ratio. In fact, we argue that in using the SmartCost™ Calculator to highlight the diversification across the fee opens the door to the next generation of ETFs which may have a better engine.

A Simple Emerging Market Portfolio

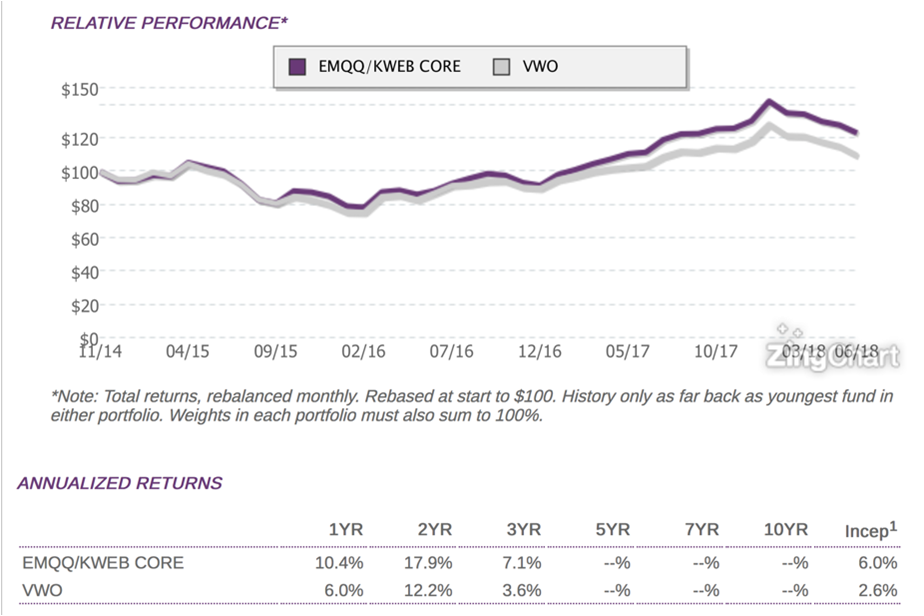

To illustrate that point, using the ETF Think Tank analyzer, we built a simple Emerging Market portfolio where cost was overall similar vs the Vanguard FTSE Emerging Markets ETF (VWO) and came out with a portfolio that had better returns and had very little overlap with the Vanguard fund (about 57%). Our point was that since we allocated 80% evenly between iShares Core MSCI Emerging Markets ETF (IEMG) and SPDR® Portfolio Emerging Markets ETF (SPEM) and then evenly between the Emerging Markets Internet & Ecommerce ETF (EMQQ) and KraneShares CSI China Internet ETF (KWEB), this kind of wrapped solution would not be difficult to maintain, but offer significantly more diversification. Lastly, assuming that a portfolio is only allocated to emerging markets of between 5-10% the excess return that might come from the incremental addition to the smaller funds could be significant.

![]()

The rapid growth of the ETF market place has been driven mostly from cheap, broad access to “markets”, but investors and fiduciaries should not be simply drawn to low cost solutions and ignore those funds with “special sauce.” In more challenging times, we think the next phase of growth will also be about diversification of solutions. We recommend that investors and fiduciaries look to the TETF.Index reports for ideas and solutions as the ETF industry will continue to evolve and grow.

To check out the SmartCost™ Calculator, please sign up for the ETF Think Tank at https://etfthinktank.com. It is complimentary to qualified advisors.

Additionally, this past weekend, France won the World Cup, and a few weeks back we had France winning the ETF World Cup!!

This article was written by the team at Toroso Asset Management, a participant in the ETF Strategist Channel.

Click here to see disclosures.