Client Alignment and Growth

Advisors who believe in ETFs and believe that implementing portfolios of ETFs helps achieve client alignment and growth are at the core of The ETF Think Tank! As we think about ETFs and advisor growth, we have highlighted four primary client alignment growth factors: lower cost, transparency, liquidity and tax efficiency. In our ETF Think Tank Security Master, built by advisors for advisors, we embrace the growth factor of transparency to help categorize and research ETFs in way that truly defines ETFs by their underlying holdings. To that end, we first covered the type of securities held in ETFs to define the asset category. Then we reviewed ETF corporate structure and the impact on tax efficiency. Today, we take the next step and evaluate the investment approach of active versus passive and beyond.

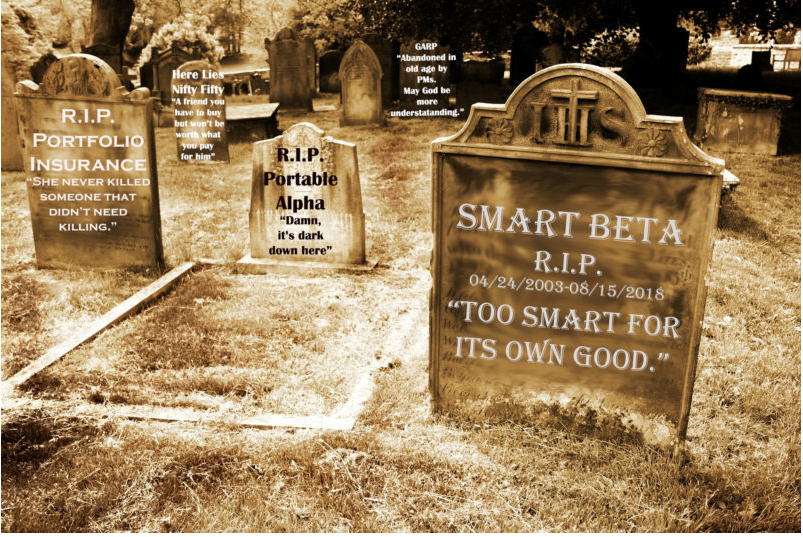

Is Smart Beta Dead?

ETFs were born over 25 years ago as trading vehicles that tracked a traditional market-cap weighted index. Due to unforeseen benefits like tax efficiency, the ETF structure expanded through innovations to fixed income, commodities, active, and non-traditional quasi-passive indexes. These non-traditional passive funds are commonly called “smart beta.” In the ETF Think Tank, we declared the term, “smart beta” dead, multiple times. We believe it to be a catchy marketing term that obscures the nature of ETFs through over-simplification. Other ETF nerds like Ryan Kirlin of Alpha Architect have also sought to obliterate the term.

Despite these efforts, “smart beta” lives on – primarily through inertia and a lack of a marketable alternative. In fact, Toroso’s CIO, @michael_venuto will be speaking on a Smart Beta panel at the ETP Experts Series on Wednesday April 30th.

Smart Beta is Undead

Although most advisors ignore the name, “smart beta” lives on like a zombie, mindlessly consuming the research and reporting on any ETF not following the most basic and established index. In the ETF Think Tank Security Master, we also choose to dismiss the term “smart” or rather “walking” beta; and define the investment approach of ETFs under three categories: Active, Traditional Index, and Non-Traditional Index.

Transparency in Naming

As we move past the jesting and misdirection of smart beta, we can define the investment approach of each ETF clearly, by embracing the transparency of the ETF structure. First, Active is clearly defined in each ETF’s prospectus, but active also comes in many flavors. Most active ETFs are still quite rigid in their process and sometimes follow an index. Active ETFs are often designed to implement strategies that are rules-based but include leverage, futures or can be enhanced through “active execution.”

Although active is easily defined in the prospectus, defining the two versions of passive (Traditional Index and Non-Traditional Index) is substantially more difficult. In the ETF Think Tank, we chose to define traditional indexing and consider all other passive tracking ETFs non-traditional indexing.

Here is our definition:

Traditional Indexing is any ETF that tracks an investable index solely based on market cap, geography, or sector.

This nomenclature allows advisors to distinguish between ETFs and evaluate the value propositions within clearly defined investment approaches. The importance of these distinctions becomes clear when reviewing the current use of ETFs in the charts below.

Source: ETF Think Tank Security Master as of April 18, 2019.

Although most ETF assets and revenue are allocated to traditional indexing, there are twice as many non-traditional ETFs listed in the US markets. Additionally, active ETFs are only 2% of ETF assets, but punch above their weight in ETF industry revenue with more than 5%.

Ignore the Walking Beta

The ETF Think Tank is committed to helping advisors grow through the use of ETFs. We believe having a clear and common language for researching and understanding ETFs is a necessary condition for growth. Misleading marketing terms like smart beta should be ignored so that concise evaluation of definable aspects of ETFs can be understood. Lastly for our ETF Nerds, stay nerdy!

This article was contributed by the team at Toroso Asset Management, a participant in the ETF Strategist Channel.

Click here to see disclosures.