On our last TETFindex weekly update, we covered the many applications of equal weighting and its impacts on future ETF growth. We noted that 73% of EW ETF assets are versions of “traditional” indexes, such as RSP which is an EW version of the S&P 500. A recent ETF ThinkTank discussion revealed that one of the most popular “traditional” indexes is actually unique. Unlike most traditional indexes that target a sector or a specific market capitalization, the Nasdaq 100 (QQQ) is an amalgamate of different sectors and market caps that are primarily linked by the exchange they chose to list on.

The Index includes 100 of the largest domestic and international nonfinancial companies listed on the Nasdaq Stock Market based on market capitalization. Because of its exclusion of financial firms, the index tends to focus more heavily on companies in the technology sector among others. Some of the most popular companies in the benchmark include Apple (AAPL), Amazon (AMZN) and Google (GOOG). The fund and the index are rebalanced quarterly and reconstituted annually. The index debuted on January 31, 1985. – Source ETFDB.COM

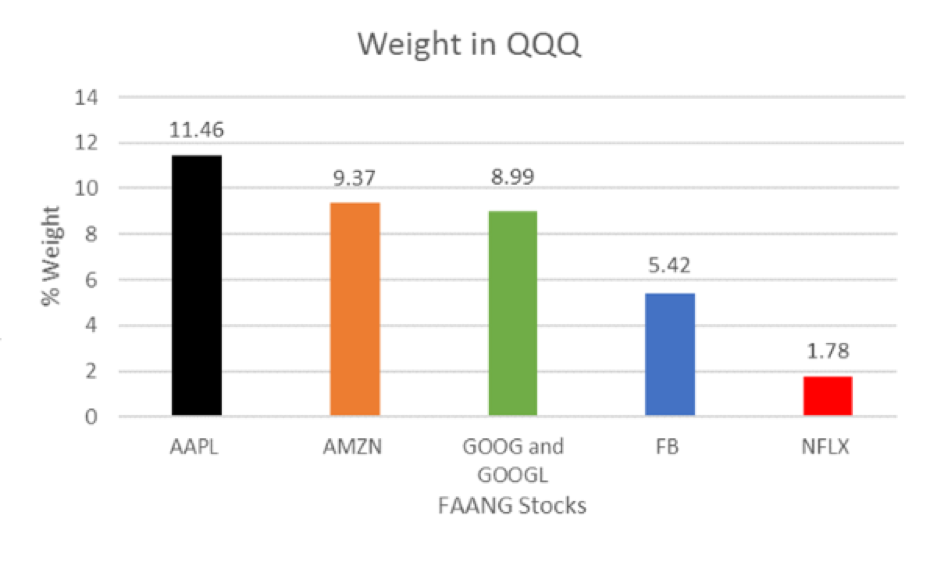

The QQQ ETF has been synonymous with growth and more specifically the FAANG phenomenon. In fact, QQQ has more exposure to the FAANG stocks than any other ETF at 37%.

![]()

This concentration in the largest growth and momentum stocks begs the question: Should the NASDAQ 100 be equally weighted? Not surprisingly, the ETF industry has already answered this question twice with two EW versions of the NASDAQ 100 index:

- QQQE from Direxion with an expense ratio of 0.35%

- QQEW from First Trust with an expense ratio of 0.60%

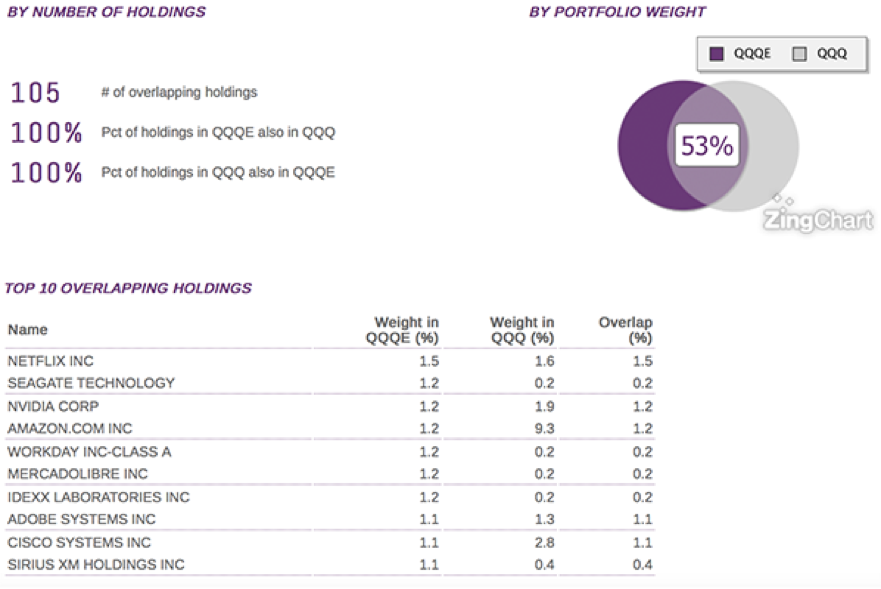

We focused on the lower cost option from Direxion to evaluate just how different the EW ETF is from the QQQ using our ETF Thinktank tools:

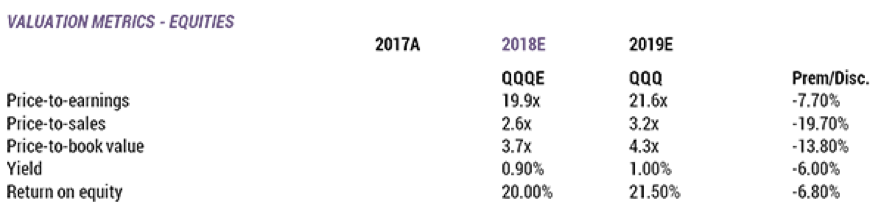

Source: Toroso Research

As you can see, even though they own the exact same stocks, the overlap by position weight is only 53%, which results in lower fundamentals and concentration.